Long-term corporate bond issuance grew in popularity among private companies in the first quarter after numerous defaults in non-rated short-term bonds.

The overall picture of corporate bond issuance in the first quarter changed after many bill of exchange (B/E) issuers defaulted in the fourth quarter of 2016, said Tada Phutthitada, president of the Thai Bond Market Association (TBMA).

Long-term corporate bonds grew by 41% year-on-year to 183.4 billion baht in the first quarter.

"As a result of the effects of the B/E defaults, firms are avoiding refinancing risks by switching to long-term issuance,"said Mr Tada. "The amount of short-term issuance declined, while the non-investment grade bond market is emerging."

For the first three months, total short-term issuance was 453.6 billion baht, down 25.6% year-on-year.

Of the total, short-term issuance in the real sector fell by 13%, while issuance in the banking and finance sector fell 37% as a result of switching to long-term bonds.

The number of new short-term issuers in the real sector fell by 17.

Ariya Tiranaprakit, senior executive vice-president of the TBMA, said the issuance of short-term rated bonds declined by 11% and those of investment grade (rated BBB- to BBB+) dropped 22%, while those with high credit rating scores ranging from A- to AAA+ stayed unchanged from last year.

Meanwhile, other non-rated bonds released by issuers to use on their own without relating to other group businesses also fell in terms of issuer numbers and value, declining by 7.54 billion baht or 11% year-on-year, said Ms Ariya.

Mr Tada said that while the total value of short-term non-rated bonds has declined, transactions have become more secure under the Secured Transaction Act as issuances are collateralised by the major shareholders' stocks or by the companies' land asset collateral.

"We have also seen the emergence of non-investment grade long-term bond issuance by real sector companies after the B/E defaults," he said.

Earlier, companies that had planned to issue long-term bonds and were rated non-investment grade (below BBB-) would not reveal their grades. Those firms normally prefered to issue non-rated long-term bonds and raise funds from high-net-worth investors.

"The amount [of non-investment grade bonds] may not significant but this is just the beginning after the B/E defaults," he said.

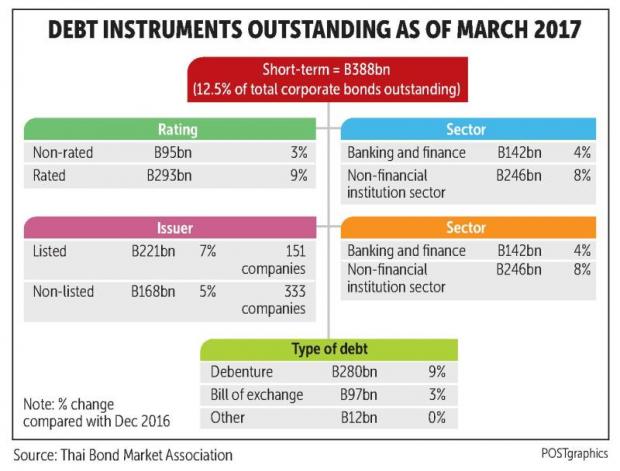

At the end of March, outstanding value for bonds was 11.3 trillion baht, up 3.4% year-on-year. Average daily trade in the secondary bond market was 92 billion baht, up 0.1%. Government and corporate bonds had higher liquidity, while the trade volume of Bank of Thailand bonds fell.

Outstanding foreign holdings of Thai bonds amounted to 696.1 billion baht, representing 6.2% of the Thai bond market. Net foreign fund flows to the bond market totalled 69.0 billion baht, 84% of which went to long-term bonds.