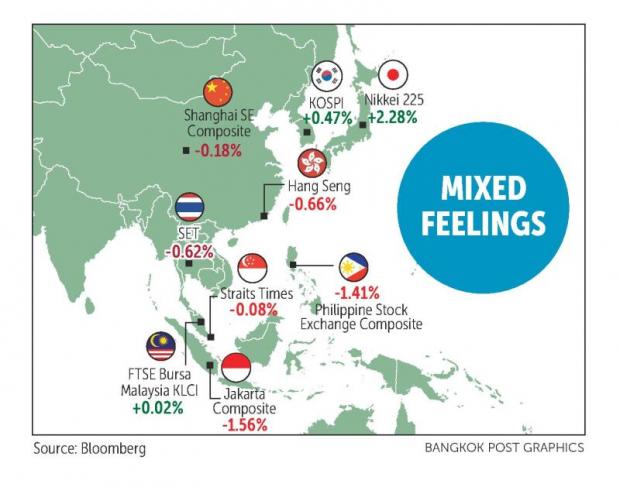

The Stock Exchange of Thailand (SET) suffered some losses on Tuesday as panic selling over Turkey's currency crisis drove the bourse lower.

The SET index closed at 1,695.35 points, down 10.61 or 0.6%, in moderate turnover worth 54.25 billion baht.

Foreign and institutional investors were net sellers of domestic shares worth 2.15 billion and 2 billion baht, respectively.

A sharp depreciation in the Turkish lira ensued after the US last week imposed sanctions on Turkey over its refusal to extradite a US preacher imprisoned in the country.

"In our view, although Thailand may not be directly impacted by the Turkish crisis, the baht's renewed weakness could also weigh somewhat on foreign fund flows," said Phillip Securities Research.

Visit Ongpipattanakul, managing director of Trinity Securities, said the SET experienced minimal impact thanks to strong earnings per share and seasonal dividend payments, but the baht's value was heavily affected, as evidenced by similar depreciation in other major currencies.

Sorapol Tulyasatien, director of the macroeconomics bureau at the Fiscal Policy Office, said the weakening lira could affect fund flows and Thailand's stock market in the short run because of investors' panic selling.

But the impact is expected to be short-lived because the problem is within Turkey, Mr Sorapol said.

He said heavy fund inflows were previously channelled into Turkey and capital outflows have been growing recently because the Turkish president declared that the country's policy interest rate will not be raised and spurned financial assistance from the International Monetary Fund, causing investor confidence to tumble and the lira to depreciate significantly.

Thailand's overall economic conditions will not be affected by Turkey's currency crisis because of the country's high foreign reserves and low foreign debts, Mr Sorapol said.

The capital outflows from Thailand are deemed to be a domino effect, he said, since investors are worried that other emerging countries will face similar problems as Turkey and have been pulling their investment capital from emerging markets.

Apart from Turkey's currency crisis, further assessment has to be made on the Sino-US trade row because China is set to incur losses from the US tariffs worth US$200 billion (6.66 trillion baht) at the end of this month, Mr Sorapol said.

Total investment of Thai mutual funds in Turkey is valued at 7 billion or 0.15% of total net assets of Thai mutual funds, therefore Turkey's currency crisis has not affected the overall domestic mutual funds industry, according to the Securities and Exchange Commission.

Chantavarn Sucharitakul, assistant governor for the corporate strategy and relations group at the Bank of Thailand, said the central bank has been monitoring the global financial markets with respect to Turkey's economic situation.

Trade linkage and bilateral investment between Thailand and Turkey are not substantial and the impact on Thailand's financial market remains limited, Mrs Chantavarn said.

Pimchanok Vonkorpon, director-general of the Trade Policy and Strategy Office under the Commerce Ministry, said Thai exports may be at risk of seeing a drop due to Turkey's anticipated economic slowdown and the drastic fall of the lira, which will make imports more expensive and eventually lower import demand.

However, she remains upbeat that Thai exports going to Turkey are unlikely to be affected much, saying shipments are expected to grow 8% this year, as earlier projected.

Turkey was ranked 36th among Thailand's international trading partners in 2017. Two-way trade totalled $1.52 billion last year, up 10.4% from a year earlier, with Thai exports making up $1.266 billion.