Some people might still consider electric vehicles (EV) a novelty or a rich man's toy, and others including Donald Trump might believe that talk of climate change is alarmist, so they don't see reducing the environmental impact of fossil-fuel cars as a priority.

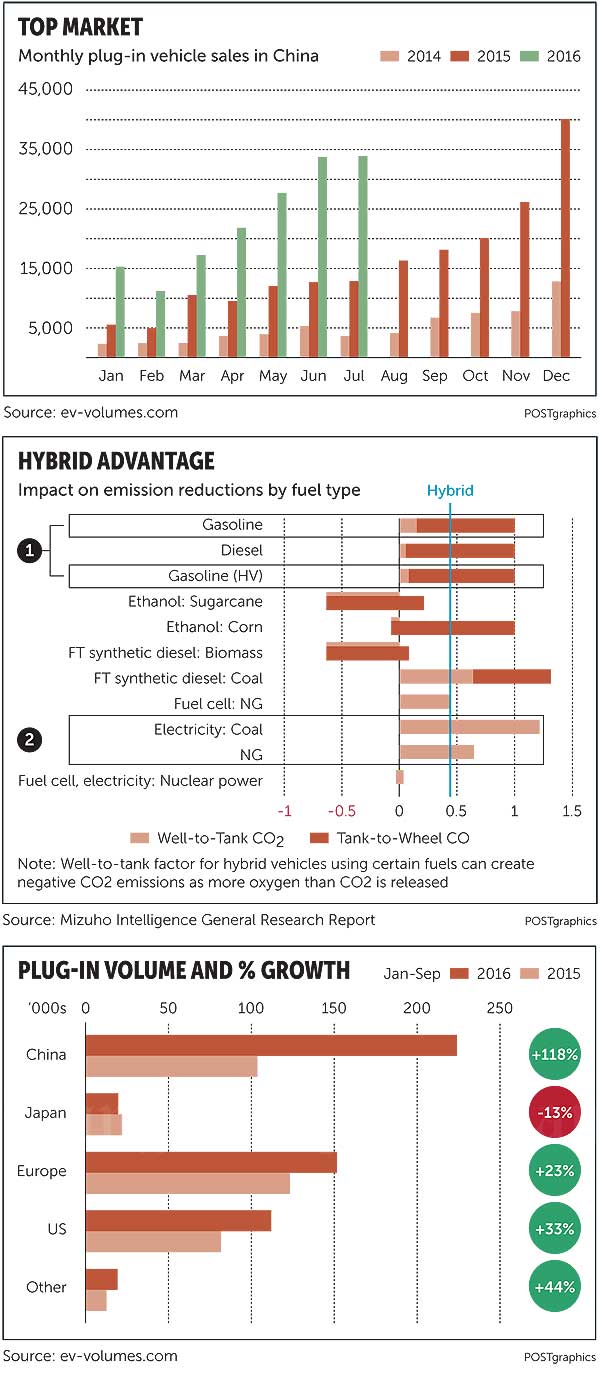

But scientific data proves that climate change impacts are real and 2016 is likely to be the warmest year since records began in the 19th century. And in China, the biggest polluter in the world, EV sales are soaring.

In Asia, where Japan, South Korea and Thailand are among the world's largest vehicle-producing countries, manufacturers hope to capture the growing opportunities in the new energy vehicle (NEV) market.

China, meanwhile, leads the world in NEV sales with 300,000 units sold last year. NEV sales in the United States totalled 64,000 units in the first half of this year, bringing sales to date to 520,000 units.

China's fleet of NEVs, which includes pure-electric and plug-in hybrid electric vehicles (PHEVs), totalled 730,000 units as of Sept 30. Sales in the first half of 2016 soared by 162% year-on-year to 170,000 units, including 134,000 pure EVs and around 36,000 plug-in hybrids.

"The fact, according to the IEA (International Energy Agency), is that from now until 2050, the global trend of energy usage is moving clearly toward hydrogen and batteries," said Piengjai Kaewsuwan, vice-president for government affairs at Nissan Motor (Thailand).

In Thailand, there are only around 50 electric sedans on the roads so far, Ms Piengjai told a seminar held recently by the Thailand Development Research Institute (TDRI). Prohibitive purchase costs -- an imported EV can cost nearly 3 million baht after taxes -- and limited charging infrastructure have stunted EV development locally.

In China, heavy promotions and incentives from the central and local governments have given a jolt to EV adoption. Beijing now offers a maximum subsidy equivalent to US$6,740 per electric car, while at the local level, up to $7,500 is available, bringing the total subsidy to around $14,240. That would allow a Chinese driver to buy a new Tesla Model 3 battery electric vehicle (BEV) for 143,000 renminbi, compared with 151,900 renminbi for a Volkswagen Lavida, the best-selling petrol car on the mainland.

Different cities in China also offer additional incentives, such as free licence plates and reserved parking spaces. The Hong Kong government waives the first-year registration tax and is also installing EV charging facilities in government car parks. On the mainland, there are about 85,000 public charging stations, up 65% from the end of 2015.

The shift toward green mobility is being driven by the realisation that transport contributes around 23% of global energy-related greenhouse gas (GHG) emissions. The Paris Declaration on Electro-Mobility and Climate Change in 2015 forecast GHG emissions from transport would rise nearly 20% by 2030 and 50% by 2050 from today's levels unless everyone collectively does something about it.

To achieve the Paris goals of preventing catastrophic climate change by limiting the global temperature rise to below 2 degrees Celsius, at least 20% of all road transport vehicles would need to be electrically powered by 2030, according to the IEA. That means the number of EVs must increase from around 1 million in 2015 to 100 million in just 15 years.

That means that all EVs including battery-electric, plug-in hybrid and fuel-cell vehicles, including two- and three-wheelers, cars, light commercial vans, buses and trucks, need to represent 35% of global sales in 2030.

TAPPING THE SUPPLY CHAIN

Apart from China, Japan and South Korea are the major suppliers of EVs in Asia while Asean countries, particularly Thailand, Indonesia and Malaysia, want to tap into the global supply chain. Nissan of Japan is one of the first carmakers to introduce EVs to Asia with the Leaf.

If Asean really wants to attract such investment, governments will have to seriously think about creating awareness of EVs, providing subsidies for consumers to create domestic demand, and extra incentives for automakers to invest.

Asean governments are still deciding which EV platforms to focus on, while carmakers are betting on different horses based on their own expertise. Ms Piengjai says governments also will need to create a production hub for core EV components such as batteries and motors.

"We have to create awareness to let people know what EVs are and how beneficial they are to the environment and their wallet," she told Asia Focus.

But even with subsidies and good supporting facilities, she said, EV adoption will still rely on consumer trust and that takes a long time to build.

"Most countries in Asean have yet to get to even the first stage," she said. "The development of EVs will probably be the same as in the US and in Europe where it took some time to really penetrate the market.

"It probably will take around five years for EVs to really take off in Thailand and that can only happen if the government really pushes for local production of core components, but we have to start working on creating the awareness now."

Another issue for EVs, especially for developing economies, is high prices when compared with conventional and hybrid cars. In Thailand, excise taxes for eco-friendly and conventional vehicles still do not differ significantly. Subsidies would also help.

"Vietnam is already providing more subsides and incentives for EV production than Thailand, which is surprising since Thailand is the biggest carmaker in the Asean region," said Ms Piengjai.

Vietnam is still overwhelmingly a two-wheel market but electric bicycles and motorbikes have become increasingly popular there. More than 90% of the models are imported from China, Japan and Taiwan, while businesses have imported more than 1,300 electric vehicles for tourism.

The average import tariff for environmentally friendly cars in Vietnam is 70% but the government in July reduced the special consumption tax on passenger EVs with nine seats and below from 25% to 15%. In November this year, there were 1,086 three- and four-wheeled electric cars in northern and central Vietnam for personal use and tourism, compared with 621 two years earlier. Nissan is testing the Leaf in Vietnam and hopes to start selling it there soon.

The Vietnamese government aims to have 6 million eco-friendly vehicles in operation by 2020. The first phase (2013-16) focuses on hybrid cars with 15,000 to 20,000 taxis operated by Mai Linh Group taking the place of gasoline models. In April this year Mai Linh signed a contract to import Renault electric cars for passenger transport services. The second phase involves a plan to produce and commission 10,000 EVs this year, rising to 30,000 by 2020.

For drivers, the main hurdle to EV adoption is battery life that many still consider low, at around 120-160 kilometres on average after eight hours of charging for a Nissan vehicle for example.

Until charging stations become as ubiquitous as petrol stations, many drivers will be reluctant to buy an all-electric car, though hybrids with an internal combustion option may become more popular.

"[Public charging facilities] will support and allow mass usage of EVs," said Ms Piengjai.

"But EVs that will travel double the current average distance will be coming along soon, probably in the next five years, since battery quality will only get better and the size will get smaller in the near future."

The Chevrolet Bolt EV and Tesla Model S are currently the only battery-electric cars in existence that claim more than 320km on one normal charge. The Model S now costs $76,000 but Tesla is expected to start making its $35,000 Model 3 electric car next year. The 2017 Chevrolet Bolt EV is expected to cost $37,495. Mercedes-Benz last month showed off an electric sport utility vehicle (SUV) concept with a range of 480km, which could hit the road in 2019.

ANOTHER PATH

Toyota Motor, meanwhile, is banking more on hybrid electric vehicles (HEVs) and PHEVs for Asean, saying they are easier to develop and market based on the facilities and infrastructure that currently exist.

"Toyota shares a similar view with Nissan but I have to say the IEA data are completely different from that of Shell and Exxon. The IEA believes that oil will be gone in the next 50 years but the discovery of US shale oil has changed that picture and with the introduction of EVs, crude oil might now be more than abundant in the future," said Suparat Sirisuwanangkura, senior vice-president of Toyota Motor Thailand.

"Tesla can come up with the numbers [for battery life] but these numbers are calculated in a lab. Real driving experience is different than in a lab. The more lights you use in the car or the faster you go will significantly reduce how far you can go with your EV. Also, a 'quick charge' means 20-30 minutes of charging which is still inconvenient for most drivers, and the more you use a battery, the faster it deteriorates," he added.

Not only could an abundance of oil in the future keep transport costs relatively low, said Mr Suparat, but pure EVs might end up emitting more CO2 than hybrids if the power stations they use for charging use electricity from fossil fuels. This is reflected in "well-to-tank" data, an emissions factor averaging all GHG emissions released into the atmosphere from the production of a fuel or energy vector.

"Electric vehicles might have zero emissions if the electricity that powered the car came from a nuclear power station, but that is not the case today since we are still mainly using natural gas and coal to fuel power stations, meaning that the well-to-tank factor for EVs still emits a CO2 level that continues to be alarming for the climate," he said.

"If there are going to be around 1.2 million more EVs in Thailand, we will require three more power plants and then there will be more CO2-related problems in the future," he said, referring to a Thai government plan to increase the number of EVs to 1.2 million in the next two decades, with a focus on industrial adoption and the first charging stations to be available by the end of this year.

Mr Suparat said that when measuring the well-to-tank factor for hybrid vehicles, those using ethanol fuel extracted from sugarcane and corn actually create negative CO2 emissions as they create more oxygen than releasing CO2 from the production process.

"If we use a hybrid with ethanol fuel, it will be the best solution for CO2 emission reductions because it actually gives out more oxygen than CO2. If you want zero emissions, you have to look all the way back to the beginning, especially at the power plants that produce electricity for that vehicle," he said.

"Future technology will not be any further away than the current four EV platforms and even many countries in Europe are already banning diesel engine cars, but a diesel engine is actually really efficient, especially for pickups."

Mr Suparat said plug-in hybrids were especially suited to Thailand, Malaysia and Indonesia, which produce ethanol fuel and biodiesel. He still sees the hybrid car as an "interim technology" between conventional and pure electric cars in the next five to 10 years.

Mr Suparat also called on the Thai government to reconsider its decision not to include hybrid vehicles in the special investment package for EVs proposed by the Industry Ministry.

As of October, no applicant had sought eco-friendly vehicle privileges from the Board of Investment (BoI).

The BoI now allows carmakers to import EVs with tariff waivers but tax incentives are available only for investment in PHEVs and BEVs, while other platforms are subject to 10% excise tax for vehicles releasing CO2 of less than 100 grammes per kilometre. HEVs release over 100g/km and will be taxed as high as 20-30%.

Even though two carmakers have expressed interest in investing in EV and battery manufacturing, they have yet to apply. Japan's FOMM Corp is considering an assembly plant for compact EVs in Thailand after forming a partnership with two Thai partners -- Trinex Assets Co and Kusumoto Chavalit & Partners Co (KCP) -- to establish FOMM Asia.

Surapong Paisitpattanapong, a spokesman for the Automobile Industry Club at the Federation of Thai Industries (FTI), said prospective investors were still studying EV demand in Asean to decide whether to import or assemble models locally in Thailand.

"They are waiting to see what governments are going to do next in terms of incentives for the production of core components such as batteries," he said. "The Thai government should waive import taxes on these core components if it really wants investors to make electric cars here," he said.

Investors initially would enter the region to make EVs for export but domestic demand in each country would be vital for them to achieve their goals, he added.