The ever-growing, diverse consumer market of Asean with a combined GDP of $2.4 trillion will be the fourth largest economic region in the world by 2050, according to research conducted by McKinsey & Company.

The growth of the region’s various economies and its rising middle class speaks volumes for the future as companies can tap into the expanding opportunities.

The report said that about 54% of the region’s GDP is generated from 142 cities, which will be home to about 54 million more people by 2025, creating an even larger consumer market.

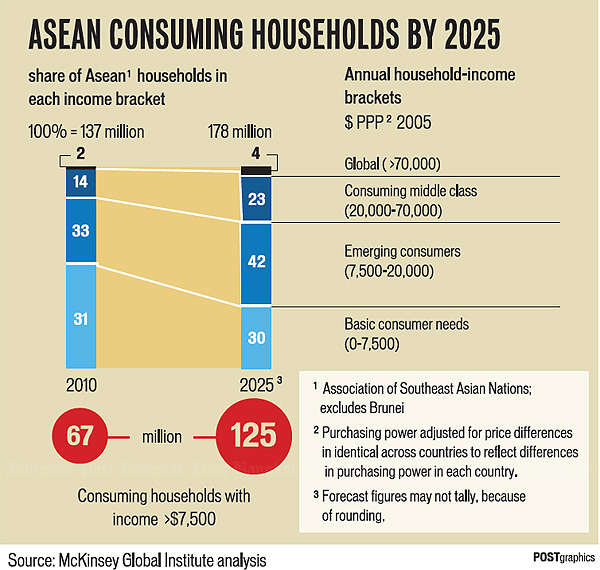

The economic expansion of the region has also helped lower the extreme poverty level from 13% to just 4% since 2000, with 67 million households in Asean now enjoying income levels that allow them to make discretionary purchases.

By 2025, McKinsey expects the size of this consumer-driven market to almost double to 125 million households.

Asean already has the third-largest labour force in the world following China and India, it added. With the rise of the younger generations, labour productivity is sure to increase, with a positive impact on GDP growth.

Apart from regional growth, Asean countries also continue to attract multinational corporations. Foreign direct investment last year in the five largest Asean economies — Indonesia, Malaysia, the Philippines, Singapore and Thailand — totalled $128 billion, exceeding China’s figure of $117 billion.

The low fees for setting up a new company in Singapore gave the city-state the fifth highest corporate-headquarters density in the world and it ranked first for foreign subsidiaries, according to McKinsey.

The report also noted that Asean suffered minimal impact from the 2008 global financial crisis, which dealt a severe blow to many economies in the developed world.

When compared with the European Union, Asean has had less volatile economic growth since 2000, and government debt ratios are below 50% of GDP, against 90% in the United Kingdom and 105% in the United States.

However, McKinsey cautioned that investors as well as analysts need to take into account the differing characteristics of each country in the 10-member group, including culture, language and religion, as well as economic output, GDP per capita, and the crucial weapon needed to compete in the modern world: internet access.

As of 2013, Singapore’s GDP per capita exceeded that of Canada and the US, while Laos, Cambodia and Myanmar were nowhere near such levels. Indonesia, the region’s largest economy accounting for 40% of Asean GDP, is a member of G20, while Myanmar has just started to open its doors to foreign investment.

Asean as a region is relatively tech-savvy and has the world’s second-largest number of Facebook users after the United States, with mobile penetration of 110% and internet penetration of 25% across the region.

With the fourth-highest smartphone penetration rate in the world, almost 75% of Singaporeans are online. And by 2016, Indonesian internet users are likely to reach 100 million, but in comparison only 1% of people in Myanmar have access to internet.

Given the great range in average incomes, investors have the option to choose the country where they see the best opportunities and apply appropriate market strategies to meet their goals.

GDP growth is also affected by the trading system, which has not been developed to its full potential but has the ability to flourish in the future, said McKinsey.

As for exports, from automobiles and parts to natural resources, the variety and quality of products and services traded has made Asean the fourth largest export region in the world. Even more so, the launch of export processing zones across Asean has increased interaction internally and externally.

Further advances are expected once the Asean Economic Community allows for freer movement of goods, services, skilled labour, and investment. However, improvements are still needed to help intraregional trade reach its full potential, since some countries still have some tariff and non-tariff barriers.

The trading system is expected to get a further boost from the Regional Comprehensive Economic Partnership (RCEP), now under negotiation between Asean and six partners: China, India, Japan, South Korea, Australia and New Zealand. Once in place, the RCEP would cover around 30% of world trade, with a combined GDP of about $21 trillion and involving more than 3 billion people.

According to McKinsey Global Institute’s Connectedness Index, Singapore ranked fourth worldwide in cross-border exchange of goods, services, communication, financial services and people. Malaysia ranked 18th and Thailand 36th.

It is projected that by 2025, emerging Myanmar will be a central hub with more than half of the world’s consumer market living within a five-hour flight from the country.

The 10 states of Asean have more to offer than many investors realise, the report said. With the emergence of a newly affluent population, the Asean market is now embracing more leisure activities, modern retail formats, and higher brand awareness. Investors should take advantage of the distinct differences that each economy has, it concluded.