With substantial growth foreseen for online travel booking in the years to come, companies in related businesses have strengthened their presence by introducing new services and applications in order to reach potential customers.

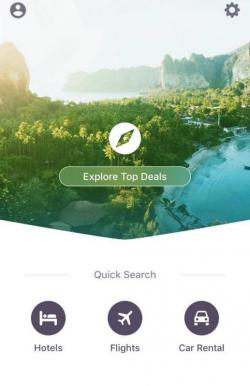

Skyscanner, a UK-based travel search site that previously offered flight searches only, has launched a 3-in-1 application for customers to search for flights, hotels and cars in one unified app, said Paul Whiteway, the company's Singapore-based commercial director for Asia Pacific.

"Especially in Asia, app usage is very high and users prefer to search on mobile devices versus desktop. So our app will make it easier for users to do everything on mobile. You can search for the flights, hotels and car hire in one experience," he said during an interview in Bangkok.

Photo courtesy of Skyscanner

Founded in 2003, Skyscanner is a privately owned company with 50 million users globally. It has 1,200 global partners including airlines, hotels and online travel agencies (OTAs) such as Agoda, with products available in 30 languages.

Globally, Skyscanner's business expanded 45% last year but the growth in Asia was much higher at 100%, he said, adding that business in Asia was expected to grow as much as tenfold in the coming years thanks to bright opportunities and the company's moves to capture that growth.

For example, Skyscanner does not take bookings itself but has been looking at ways to enable users who book after being directed from its app to make payments, especially on mobile devices.

"With a lot of partners across the region, we are in the process of rolling out booking payment. That would make it much easier to do it online. Especially for this part of the world where 56% of our users are on mobile devices, facilitating and making that process much easier will be fantastic for users and our partners as well," said Mr Whiteway.

Skyscanner has also invested heavily in resources in Asia, with 100 of its 770 worldwide staff at the Asian headquarters in Singapore.

"A little lower than 50% of our investment in Asia is on the technology side and roughly half of our employees in Singapore are engineers. We are pretty much an engineering and technology-led organisation," he told Asia Focus, stressing the need to understand the local market which is different from the US and Europe.

"Particularly in Asia, to complement technology, you need to be localised or locally relevant. The team made up of local nationals is important because they understand the market and can develop relevant products and marketing campaigns. From a product perspective, it has to be pretty much designed by local and for locals."

Skyscanner combines searches for flights, hotels and cars in a single application. Skyscanner.com

Skyscanner also stresses innovation, in keeping with the vision of founder Gareth Williams, an engineer who has worked with many technology startups. Globally, the company has made efforts to make its data and technology available for third parties including large organisations such as MSN and Lonely Planet to use.

"In this part of the world (Asia), there are huge opportunities for startups," said Mr Whiteway. "In Singapore, for instance, the startup ecosystem is very vibrant and supported by the government. Skyscanner loves to work with startups in terms of leading technology. We work a lot with startups to enable them to build really cool features and technologies on top of that data."

For the Amsterdam-based accommodation booking site Booking.com, Passion Search and Booking Experiences are among its recently launched products to support and enrich the consumer's journey from beginning to end, said CEO Gillian Tans.

Passion Search helps travellers easily search and discover special destinations based on their passions. This new way of searching, she said, is the most comprehensive of its kind in the travel industry, matching people's unique interests with the best destinations and accommodations to suit their needs.

Booking Experiences, meanwhile, helps take the friction out of the in-destination experience, and allows travellers to discover the best a destination has to offer, all through a mobile device. Once travellers have booked a stay in one of the first cities to offer Booking Experiences, via a single QR code in the Booking.com app, they can get instant booking access to a number of participating venues and attractions in that destination.

There is no need to book in advance or wait in lines to buy tickets. Customers just simply show up at the attraction they're interested in, and scan the code from their smartphone. The QR code is automatically linked to a credit card, she said.

"Another factor and one that is unique to Booking.com, is our flexible payment policies including free cancellation and book now, pay at the property," Ms Tans added. "This really gives our customers peace of mind, and we see great appreciation for this in our markets."

She acknowledged that Asean was an extremely fast-growing and important region for Booking.com, with many unique aspects and challenges.

"On the one hand you have markets such as Singapore and Thailand, with an extremely strong inbound booker market and a well-developed tourism industry. You also have markets that are just opening up to tourists, like Myanmar, that have massive growth potential and then markets that are extremely fragmented within themselves such as Indonesia. It is an extraordinary region with many complexities and many amazing destinations for visitors locally and globally to experience," she told Asia Focus.

In Asean, Thailand is the largest market for Booking.com with 14,000 properties available. It currently has 9,700 properties in Indonesia, 5,700 in Vietnam, 4,300 in Malaysia and anywhere from 2,000 or fewer properties in markets such as the Philippines, Cambodia, Laos and Myanmar.

At Bangkok-based Minor International Plc (MINT), which has 155 hotels and serviced residences in 23 countries, efforts are being made to strengthen brand awareness as a significant number of customers book rooms online through OTAs. Only 20% of the group's online bookings come from its own brand websites such as Anantara.com, Oakshotelsandresorts.com and Tivolihotels.com.

"Given the importance of the online channels in today's digital age, MINT has placed great efforts to enhance our 'Brand.com' websites to drive brand awareness and increase market exposure in the global arena," Dillip Rajakarier, CEO of Minor Hotels and COO of MINT, told Asia Focus by email.

The website of the group's flagship brand, Anantara.com, is now available in seven languages to cater to international travellers. The real-time reservation system has also been upgraded to make the online booking portal more user-friendly, he pointed out.

"Furthermore, as mobile devices continue become increasingly ingrained in people's daily lives, MINT will ensure that our Brand.com strategy is optimised for mobile viewing in order to create a seamless online experience across different platforms. MINT expects the online distribution channel will become its essential strategic enabler to grow sales and enhance hotel profitability in the future."

Online channels, noted Mr Rajakarier, have gradually become the source of inspiration, research and planning for travellers and are expected to become even more prominent as travellers get more accustomed to the usage of online portals.

"Rising internet and mobile phone penetration, especially from emerging markets where such rates are still lagging behind the developed world, will continue to change the way consumers interact, communicate, research and travel," he said.

In Asia, increasing urbanisation and economic advancement are expected to increase consumers' disposable income. Additionally, increasing air connectivity, particularly a rising number of flights from low-cost airlines, are expected to make travel more accessible and affordable. Those have led to rapid growth in tourism and related industries.

At the same time, a new generation is shifting its spending priority from owning things toward buying experiences. The "experience economy" is expected to drive up demand for tourism and hospitality services, he added.