Planning a trip abroad for the coming New Year holiday? In the old days, if you were a holidaymaker or a business traveller, you probably would have booked a trip through a travel agent and when you got to your destination, bought a map and rented a car to get yourself around.

Nowadays, many consumers turn to online booking applications such as Skyscanner or Booking.com and search for everything they need, from an air ticket and a car to a room, whether it be a five-star hotel in Tokyo, a vacation home in Phuket or a cosy apartment in another corner of the world.

"The move to internet-enable travel booking is creating massive convenience, efficiency and savings for consumers," Gillian Tans, CEO of the online accommodation booking website Booking.com, told Asia Focus by email from her office in Amsterdam.

"Both business and leisure travellers are enjoying unprecedented levels of choice. They can access destinations around the world, even in some places that we consider new destinations for global tourism today."

Digitisation of commerce, she says, has brought new opportunities, efficiency, savings and transparency for businesses. Individuals who own accommodations can also benefit.

"We have many accommodation owners, people who own small hotels, villas and bungalows, and the digital economy has opened up a world of possibility for these business owners. Now, they can sell to and communicate with people around the world, and where Booking.com comes in is to help these accommodation owners adapt to the digital world.

"In recent years, we've seen the demand for vacation rentals, homes and apartments steadily grow," she said, adding that the site now had some 500,000 vacation rentals among its total inventory of 1 million properties worldwide. More than 70% of the accommodation options on its website are something other than a traditional hotel.

Asia, and especially Southeast Asia, is one of the fastest growing regions for Booking.com. "There are more and more properties joining us to benefit from and leverage our global online marketing expertise," said Ms Tans. "Meanwhile, consumers are very quickly adapting to the mobile marketplace and even broadband penetration is growing at a rapid pace in most markets."

According to the Thai unit of Agoda, an online travel agency (OTA), the online booking market globally has been expanding at around 20% a year with rapid development of financial technology (fintech) a key driver.

"In Asia, the growth is higher -- 30-40% is the number that many people quote," John Wroughton Brown, chief operating officer of Agoda Services Co Ltd, told Asia Focus.

"Fintech is obviously important, and will continue to be so in our industry and in most other industries for that matter."

Ms Tans agreed, saying that fintech gives more people the opportunity to make digital payments and that benefits society and the economy.

"There are still significant numbers of people in the Asean region who are unbanked, and we believe giving more people access to banking and banking technology is going to give people more flexibility, more convenience and ultimately more choice and a better life."

We have many accommodation owners, people who own small hotels, villas and bungalows, and the digital economy has opened up a world of possibility for these business owners" GILLIAN TANS CEO, Booking.com booking.com

GROWTH FACTORS

For Skyscanner, a global travel search site based in the UK, Asia offers tremendous growth opportunities for many reasons, apart from the fact that the internet makes travel easier to plan trips.

Globally, Skyscanner posted 49% year-on-year growth in 2015 and in Asia the figure was close to 100%, according to Paul Whiteway, Skyscanner's Singapore-based commercial director for Asia Pacific.

"A bunch of things are play in Asia. Obviously, you've got a huge population, burgeoning middle class, more income spent on travel, and the rise of low-cost carriers that makes travel much more affordable for everybody," he said in an interview with Asia Focus.

Airlines -- for example, Jetstar, AirAsia, Thai Smile, Nok Air, and Thai Airways International -- make Thailand a very competitive landscape, while travel is much easier and affordable for people.

What makes Skyscanner unique is that all the travel options -- airlines, hotels, car rental -- are available on one platform. "For instance, if you want to go to Singapore, there are a number of airlines, a number of different OTAs, we can put that through and we show you all the options for you to make a choice."

Millennials, in particular, have a strong desire to travel, especially in Asia, he notes.

"Online travel is a common place that mirrors the profile of the users, which in Thailand is skewed slightly toward female, and slightly younger," said Mr Whiteway. "Thailand is where travel online, mobile and smartphone penetration are high, so users of online booking are growing at a significant rate. It's convenient, easy, and you can find all the options [online] so it's easier to go online whether through a mobile phone or PC, research all the options and do all the booking. It's easier for users and that drives a lot more travel."

In Thailand, domestic trips are forecast to reach 704 million in 2016, an increase of 6% year-on-year. Skyscanner also sees tremendous growth in short-haul travel in Asia, from Thailand to popular destinations such as Singapore, Japan and Hong Kong, or between Singapore and Malaysia.

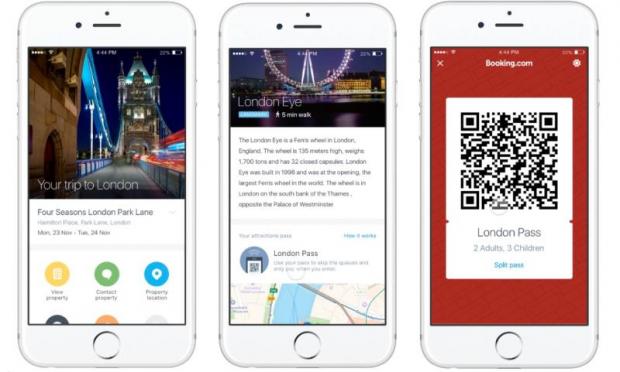

Booking.com now offers a Booking Experiences feature for some cities, where a single QR code allows instant booking access to participating venues and attractions. Photos courtesy of Booking.com

Online travel booking is just one of the disruptive technologies transforming the way people consume. A similar shakeup is occurring in fields such as shopping, music and transport, according to HSBC.

"We think the transformation will accelerate due to the demographic makeup of the world's consumers and further development in the digital technology space," HSBC's James Pomeroy wrote in a recent report about digital natives.

By 2030, the global number of digital natives, defined as those who have spent their entire secondary education in a country with an internet adoption rate above 50%, will rise from roughly 430 million today to 2.3 billion, and that excludes older people who adopt these technologies, according to the report.

"Today's young, digital native generation consumes differently. Having grown up at a time of rapid IT development, it is more likely to adopt disruptive technologies," Mr Pomeroy wrote, adding that digital natives account for 9% of the world's population today, and will rise to 30% by 2030 and more than 50% by 2050.

Greater use of technology should lead to downward pressure on prices. This may come via greater consumer information, including comparison websites, improved supply chains, increased access to alternative products or new technologies that are cheaper, he added.

"One thing is certain. Digital natives will become an even bigger part of the population and the rise of digital technologies will play a huge role in the way we consume. The patterns of day-to-day living keep changing. While we have seen a sea-change in consumer trends in the past few years, this is only just the start."

QUALITY CONTROL

At hotels across Asia, the ratio of online bookings is rising, and at a much faster rate than at their American and European counterparts.

Dillip Rajakarier, CEO of Minor Hotels and COO of Thailand-based Minor International Plc, said that about one-quarter of the company's total room nights sold came from online bookings. Of those, roughly 20% came from the websites of the company's own brands, such as Anantara.com, Oakshotelsandresorts.com and Tivolihotels.com, while the rest came through OTAs.

"Over the next few years, we expect the share of online bookings to grow even further thanks to various digital tools that provide travellers with convenience and price transparency when they research and book their journey," he told Asia Focus by email.

"The hotel industry has already witnessed consistent growth of hotel booking from online channels in Asia Pacific with some traditional wholesalers and travel agents moving their inventories online to keep up with the change in consumer behaviour and the increasing power of the big OTAs such as Expedia, Booking.com and Agoda.

"From our perspective, we expect the booming tourism industry, the emergence of the millennials and the rapidly advancing technology to contribute to the promising growth outlook of the online booking within the hotel industry in the years to come."

At Best Western Hotels & Resorts, the average online contribution for its Asian properties ranges from 38% to 45%, depending on brand and location.

"Based on the behaviour of customers nowadays, online bookings will most likely keep growing significantly in the future. It's easy, convenient and customers believe they will get cheaper rates when they book online," said Olivier Berrivin, managing director for international operations of Best Western Hotels & Resorts Asia.

For hotel operators, the main challenge is to motivate guests to book directly through their own "brand.com" rather than use OTAs who charge significant commissions.

"Some OTAs display a room-only rate or tax-exclusive rate, which make it cheap on first impression. In the end, the customers pay the same rate as we always control rate parity throughout all our online channels," he told Asia Focus.

Along with the rise in online booking, Mr Berrivin said the demand for affordable accommodations that still deliver expected international standards, has been growing steadily, especially in the mid-priced market. Many travellers are looking to the rental site Airbnb for such options.

"Modern travellers' lifestyle and behaviour drive this demand. They look for a hassle-free place to stay with a clear focus on value for money," he said. However, he cautions that the quality of these short-stay accommodations should be closely monitored.

"Definitely, especially in terms of service standards and security. Customers who book Airbnb will have to accept a potential risk when any emergency issues occur, such as an electricity blackout, fire, broken equipment, etc. There's basically no service provided and this happens at the expense of basic security and safety measures that would otherwise be properly addressed in a normal international hotel."

According to Internet Live Stats, 48.4% of global internet users are in Asia with China representing 22% of that number, said Erena Chan, vice-president for sales and marketing at the Bangkok-based hotel group Dusit International.

She estimates 35% of the group's hotel bookings are made online through Dusit.com and other booking sites, with 10% growth expected in 2017.

"Consumers are getting savvier and, even when choosing 'brick' over 'click', will more often than not research and compare rates online," she said. "Combined with online marketing initiatives such as sales recovery, use of internet user data and behaviour, which is constantly evolving and becoming increasingly sophisticated, online booking can keep growing."

Airbnb, according to Ms Chan, may have an impact on the hotel industry more in the leisure sector than the business sector. That said, it depends on the destination and stability of the surroundings. However, a recent study by CWT Solutions Group indicated that just 2.5% of business travellers whose company travel policies allow Airbnb bookings have actually used it.

Mr Rajakarier agreed, saying that while many argue that Airbnb promotes efficiencies in the hotel industry, lowering prices to consumers and enhancing the tourism market overall, the increasing geopolitical risks and threats globally still make hotels a preferred choice.

The hospitable home experience offered by Airbnb does not have the luxurious values that high-end hotels can offer, he said. Also, there are very few specific laws and regulations governing Airbnb at present while hotel operators must apply for licences and adhere to certain regulations, which ensure high standard of safety and security.

"Therefore, Mint believes some forms of regulatory framework for Airbnb should be developed to uplift their product standard for consumers," he said.