The four largest commercial lenders have cut their prime lending rates, with a focus on the minimum retail rate (MRR), in a range of 25-50 basis points. The move is intended to alleviate pressure after Finance Minister Apisak Tantivorawong asked banks to narrow the wide interest gap between large and small borrowers.

The rate reductions take effect Tuesday.

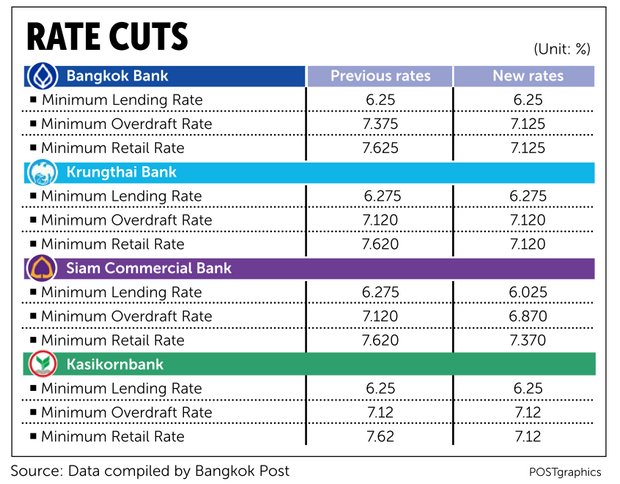

Bangkok Bank (BBL), Krungthai Bank (KTB) and Kasikornbank (KBANK) slashed their MRR -- a rate for individual and small-business borrowers -- by 50 basis points, while Siam Commercial Bank (SCB) trimmed its MRR by 25 basis points.

SCB also cut two other prime lending rates, the minimum lending rate (MLR) and the minimum overdraft rate (MOR), by 25 basis points.

- See also: Four banks cut lending rates

The bank's new lending rates will entail an MLR of 6.025%, an MOR of 6.87% and an MRR of 7.37%, according to an SCB statement.

The across-the-board rate cuts are aimed at alleviating financial burdens for customers, said SCB president and chief executive Arthid Nanthawithaya.

He said the rate reductions are only one part of a broader effort to assist customers, with the bank ready to launch other measures to sharpen the competitive edge of small-business operators and enhance the financial literacy of individual customers.

After the rate cuts, SCB's MLR and MOR will be the lowest in the industry, Mr Arthid said.

He said cutting the MLR and MRR will help small and medium-sized enterprises (SMEs) and retail borrowers, as their interest costs are largely based on those two rates.

The country's third-largest lender by assets is also ready to provide 20 billion baht in loans to small operators.

Mr Apisak said last week that the interest gap between large and small businesses was too large, with commercial banks charging large companies annual interest of just 1% while imposing 7-8% on small businesses and 11-12% for credit cards. The government has been working to help SMEs, which have been adversely hit by the uneven economy.

The last rate cuts were in April of last year.

BBL, the largest lender, also cut its MOR by 25 basis points but kept its MLR at 6.25%.

After the rate cut, the bank's MOR and MRR will be the same at 7.125%. Business operators, especially SMEs, will benefit from cutting both lending rates -- which are an important cost in running a business, said Suvarn Thansathit, BBL's senior executive vice-president.

"BBL is determined to support operators in boosting efficiency and competitiveness, which will drive the overall economy in line with the government's policy," he said.

Fourth-ranked KBank cut its MRR by 50 basis points to 7.12% but is maintaining its MLR and MOR at 6.25% and 7.12%, respectively.

The bank decided to slash MRR because it's the lending rate that affects SMEs and retail borrowers the most, said Predee Daochai, chairman of the Thai Bankers' Association and president of KBank.

KBank executive vice-president Surat Leelataviwat said the MRR cut would mainly benefit SMEs and mortgage borrowers because their borrowing costs are based on MRR.

KBank is the industry leader in SME loans, with outstanding loans totalling 660 billion baht. On average, the bank charges mid-sized and large SME customers in the range of MRR to MRR+2%, while small SMEs and startups are charged at MRR plus, depending on risk profile.

KTB also cut its MRR by 50 basis points to 7.12%.

Daranee Saeju, senior director of the Bank of Thailand's financial institutions strategy department, said the central bank will request more information from commercial banks to determine whether the lending rates for small borrowers are too high.

"The models used by commercial banks for interest rate calculations on lending, in our opinion, are in principle correct," she said. "But to determine on a case-by-base basis whether the loan rates are too high, the BoT will have to request more detailed information."

Ms Daranee said the Bank of Thailand will not impose specific rates on small borrowers, as this could affect other interest rates or fees.

Meanwhile, Ausanee Lewrat, an analyst at Asia Plus Securities, said the MRR cut from the big four banks would not significantly impact their earnings this year.

Interest-based income is largely garnered from MLR; KBank will be affected by SME loans and SCB will be hit by mortgage loans, he said.