With 8.4 million visitors in 2017 alone, Phuket is Thailand's most popular island destination. Visitors numbers have broken records for the fourth straight year. Over the decades, the island has undergone significant developments before transforming into what it is today.

In the old days, Phuket was an isolated island that served foreign backpackers with only a handful of small resorts. Gradually, the number of tourists grew after the completion of the Sarasin bridge in 1967. In the 1980s, Phuket became more well-known, with key developments such as Amanpuri, the first luxury hotel and villa, which opened in 1987.

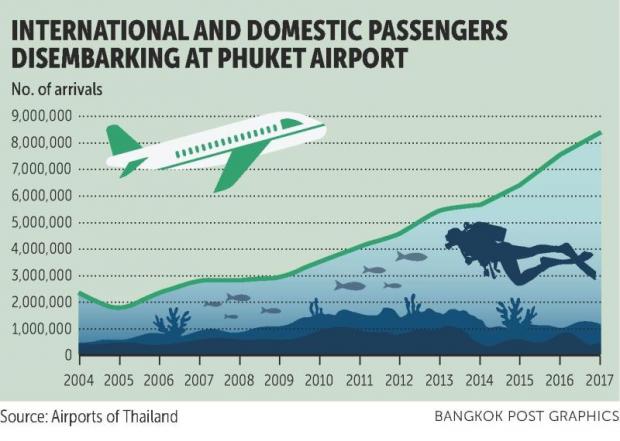

Phuket airport first began offering international flights in 1984; this made the island even more popular among tourists. In 1988, when the airport was taken over by Airports of Thailand, Phuket airport served 966,294 passengers. Since then, the airport has expanded tremendously, capitalising on its status as an international airport to continuously increase its capacity and passenger numbers.

Major development on the island began with Laguna Phuket, Asia's first integrated resort spanning over a thousand acres, on the site of a former tin mine in 1988. CBRE's first foray in Phuket was as the exclusive agent for Allamanda at Laguna, Phuket's first major resort condominium development, which was completed in 1993.

After a decade of prosperity, Phuket weathered the 1997 Asian financial crisis, then the devastating tsunami in 2004, which happened the same year CBRE established a permanent office in Phuket.

The island continued to grow -- both as a tourist destination and as a place to buy a second home, claiming its position in Forbes magazine's Top 5 Tourist Destinations in 2005.

Although the island endured another major hit during the 2008 global financial crisis, the number of foreign tourist arrivals doubled from 1 million in 2007 to 2 million in 2010.

The influx of tourists led to plans to expand the Phuket airport in 2014. The first phase of expansion was completed in 2016 and international arrivals reached 8.4 million in 2017, representing an 800% increase from 2007.

The Phuket tourist market has evolved from being driven by wealthy Asian and European feeder markets to 37% of its arrivals being Chinese tourists in 2017, a turn of events that was unthinkable in 1988.

There are 23,000 hotel rooms (excluding guest houses), 8,000 resort condominiums and 4,000 resort villas. The resort residential property market has changed. Today's resort property buyers not only want vacation homes, but they also want them to be income-producing properties. This has meant that developers have had to adapt their product to match purchasers' needs while acquiring hotel licences in order to offer properties on a daily rental basis.

Branded residences such as the Banyan Tree and the Sheraton, along with ultra-luxury villas with asking prices above 500 million baht per unit from Layan Residences by Anantara, Avadina Hills by Anantara and The Estates at MontAzure have been targeting the higher-end market.

Prakaipeth Meechoosarn, director of resort property sales at CBRE Phuket, has seen the market evolve since she first joined the company in 2004.

"Originally, most of the buyers were Asia-based expatriates looking for a second home," she said. "We have since seen the market expand to Russian buyers and Chinese and other Asians, including Thai buyers. Individual Thais are also looking to benefit from the robust tourism market by purchasing properties in projects that provide rental income."

Phuket's success has spread to neighbouring provinces, creating the "Greater Phuket Market" or "Andaman Coast Market" for hotels, which spill over into potential residential resort properties from Khao Lak to Krabi.

Over the past 30 years, Phuket has steadily transformed from an underdeveloped island that was dependent on tin mining and rubber to a top tourist destination. The future presents opportunities for growth through access to people who live within a four-hour flight who have started going on overseas holidays. This trend was prevalent in the Europe of the 1970s, and now it's Asia's turn -- further supported by the astounding growth of low-cost carriers that have increased access to affordable flights.

Both hotel and residential resort property developers can capitalise on the phenomenon. There are challenges on how to deal with the era of mass tourism, such as protecting the environment, limiting overcrowding and trying to balance the desire to grow a tourism industry while at the same time preserving the attractiveness of Phuket as a destination.