Hong Kong recently ranked third highest in the World Bank's 2020 "Ease of Doing Business" report, well ahead of much larger economies such as the United States (ranked 6th) and the United Kingdom (ranked 8th).

This is an important achievement, in our view and underscores Hong Kong's commitment to being open for business, irrespective of ongoing, sporadic civil unrest. The strength of regulatory and economic institutions plays an important role in attracting commerce, and the prevailing currency peg to the US dollar is one such important pillar of stability.

With the Linked Exchange Rate System (LERS), Hong Kong has pegged its currency to the US dollar since 1983. Also known as, a “currency board regime”, the LERS has withstood multiple episodes of macroeconomic stress, including the late-1990s Asian Financial Crisis, SARS of 2003 and the Global Financial Crisis of one decade ago. It does so, in our view, as it operates under clear, well-defined rules with the Hong Kong Monetary Authority maintaining FX reserves of US$439 billion against a monetary base equivalent to US$210 billion. Indeed, in its annual review of the Hong Kong SAR, the International Monetary Fund (IMF) praised the LERS as having "served as an anchor of stability, helping to ensure sustained growth, competitiveness, and the smooth functioning of the extensive financial services industry".(1)

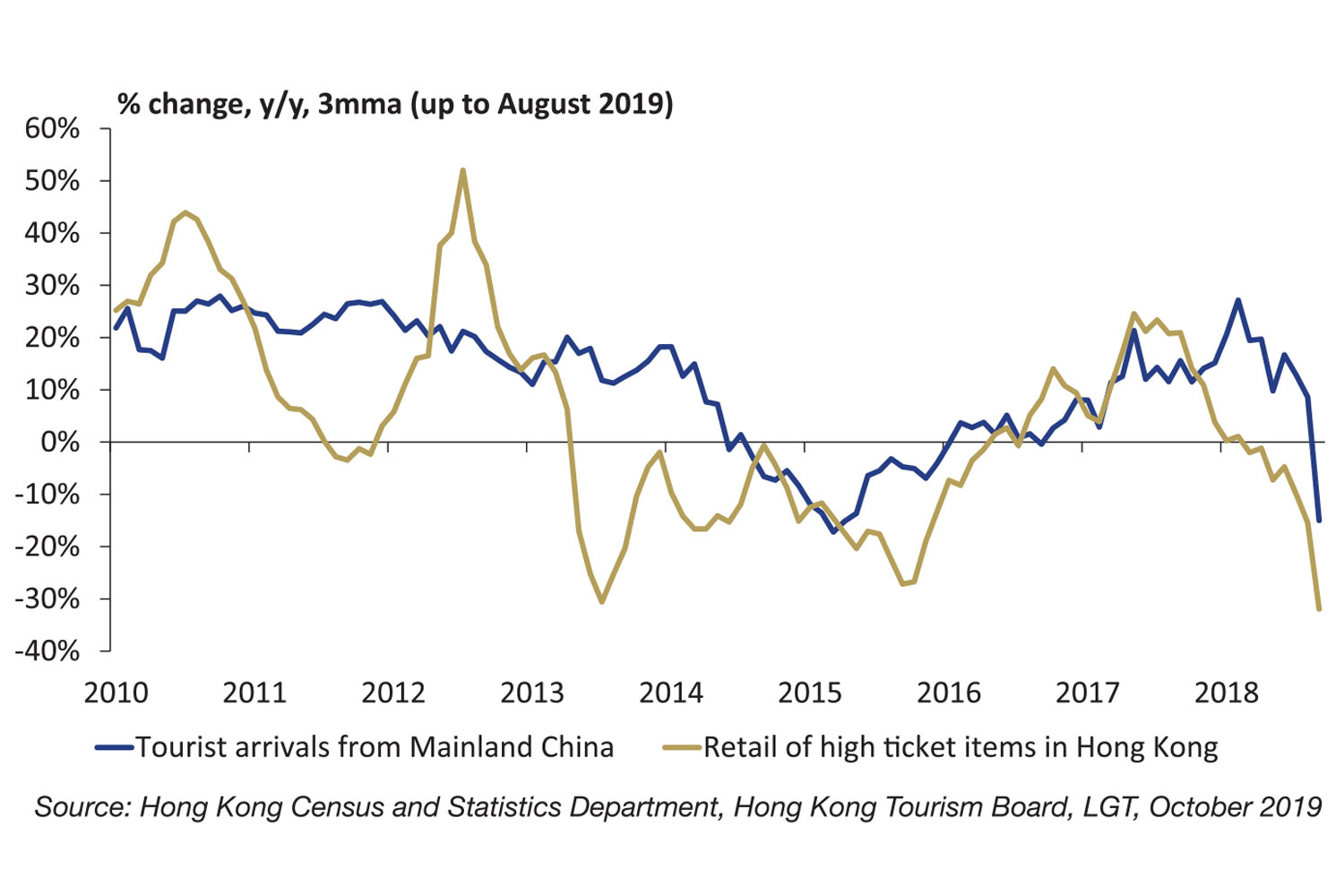

That said, it is self-evident in Hong Kong that the retail and hospitality sectors, in particular, are under duress, with tourist arrivals and high-ticket item sales down significantly, as shown below. Economic theory argues that macroeconomic shocks require policy tools (such as increased fiscal spending) and/or other flexible mechanisms to counter their negative impacts on the overall economy. In a January 2017(2) study written by IMF staff, the authors found that prices and wages in Hong Kong are even more flexible than particularly open economies such as the United States, echoing the World Bank's ranking mentioned above.

Put more directly, as Hong Kong cannot independently set interest rates and the currency is pegged to the US dollar, the adjustment process to absorb economic shocks occurs via changes in prices and/or the labour market. Official data suggests that this adjustment via lower employment (in the face of falling retail demand, and spill overs from the US-China trade war) is now taking place. It seems reasonable to assume that the severity and duration of wage and job losses may be commensurate with how much longer it takes the crisis to be resolved.

The local authorities have already announced a series of measures, including a HK$ 19.1 billion fiscal easing and property market supports. In our view, however, it would be remiss to think that the Hong Kong economy may not see a combination of lower salaries and employment levels over the coming quarters. That said, in our view the role of the LERS is even more important now, with the US dollar peg serving as a critical stability anchor for Hong Kong.

Stefan Hofer, Chief Investment Strategist, LGT

(1)International Monetary Fund, Article IV Consultation with the P.R.C - Hong Kong S.A.R, January 24, 2019

(2)IMF Working Paper "Price and Wage Stability in Hong Kong SAR", WP/17/9, Guo, January 2017

The information contained in this article has not been reviewed in the light of your individual circumstances and is for information purposes only. It does not purport to provide investment, legal, taxation, or other advice and should not be taken as such. No person should act or refrain from acting on the basis of the content of this article without seeking specific professional advice.