Recap: Emerging market stocks fell yesterday on worries that a new US law backing Hong Kong protesters could hinder progress in resolving the Sino-US trade war.

The SET index moved in a range of 1,580.08 and 1,620.60 points before closing at 1,590.59, down 0.45% from the previous week, in turnover averaging 56.32 billion baht a day.

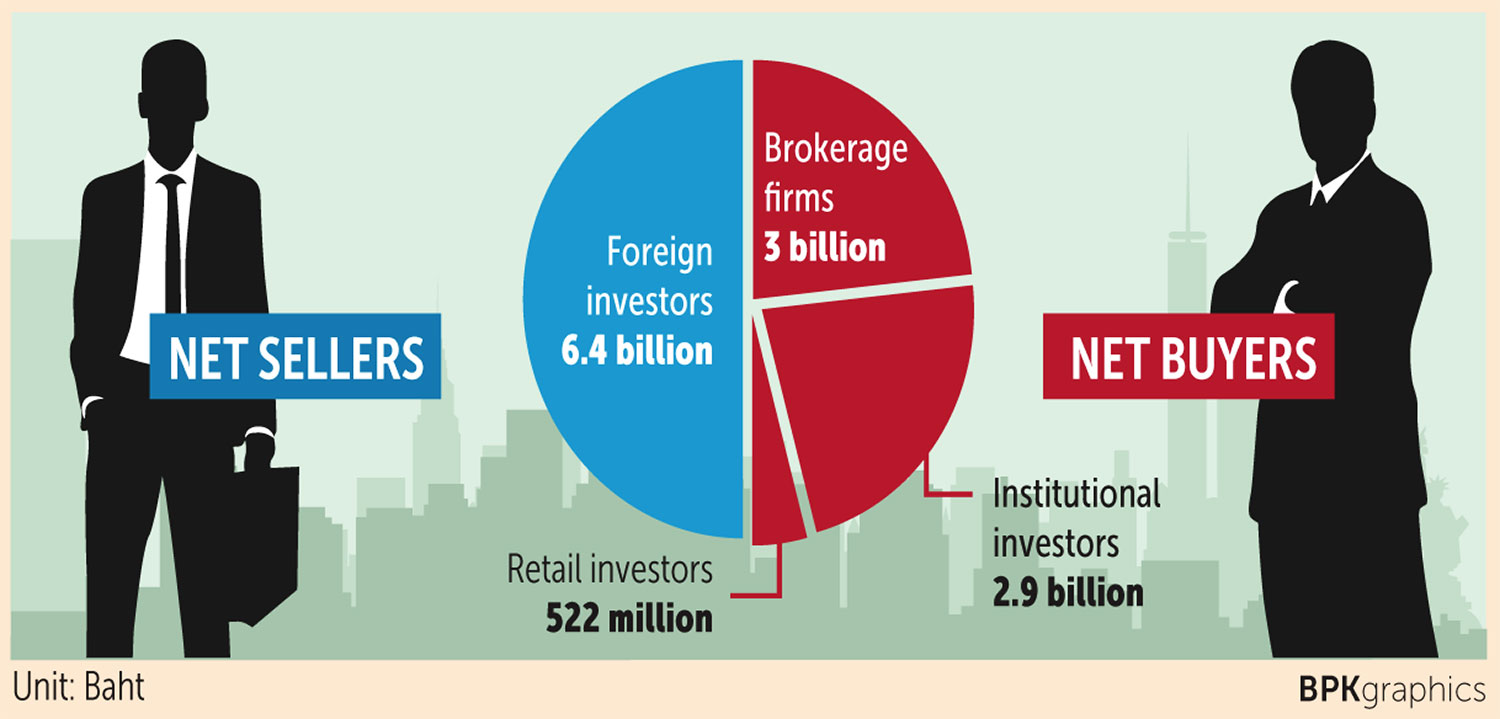

Brokerage firms were net buyers of 3 billion baht, institutional investors bought 2.9 billion and retail investors purchased 522 million worth of shares. Foreign investors were net sellers of 6.4 billion baht.

Newsmakers: China said on Thursday that the passage of US bills on Hong Kong human rights, signed on Wednesday by President Donald Trump, would undermine cooperation in "important areas". It did not say whether this would extend to trade talks. The bills call for annual reviews of US trade preferences if it is felt that Hong Kong's freedoms are being eroded.

- Mr Trump has been invited by Congress to its first impeachment hearing on Dec 4. If he does attend, the president would be able to question witnesses.

- Hong Kong's deeply unpopular leader Carrie Lam acknowledged that public dissatisfaction with her government fuelled a landslide win by pro-democracy candidates in local elections, but offered no new concessions to resolve months of violent protests.

- Not a single drop of Japanese beer was exported to South Korea last month as a boycott campaign against Japan over a historical dispute dries up demand.

- Shares of Alibaba surged Tuesday as it drew back the curtain on a Hong Kong listing that it described as a vote of confidence in the embattled city. The e-commerce giant raised about $11 billion in the largest IPO in Hong Kong since 2010, with about one-third taken up by mainland Chinese fund managers.

- LVMH agreed to buy Tiffany & Co for $16.2 billion in the largest luxury-goods deal ever, raising the French conglomerate's profile in jewellery and giving it access to more shoppers in the US and Asia.

- London's transport authority on Monday refused to renew an operating licence for the ride-hailing giant Uber because of safety and security concerns. Regulators said vulnerabilities in the app let drivers fake their identities on thousands of rides.

- Thailand's unemployment rate in the third quarter edged up to 1.04%, from 0.96% in the same period last year because of a slowing economy, floods in the Northeast and drought in some parts of the country.

- The slowing economy has triggered a surge in household debt of 7.4% this year, says the University of the Thai Chamber of Commerce.

- Thai millennials' spending on "must-have items" amounts to 1.37 trillion baht a year, representing 13% of the country's GDP, and half of them owe debts, while one-fifth of debtors have defaulted, according to TMB Analytics.

- Thailand's cross-border trade dropped 1.94% year-on-year in the first 10 months of this year, with the strong baht, global economic slowdown, continued trade war and an volatile foreign exchange listed as key threats.

- Thailand's manufacturing production index in October fell 8.45% from a year earlier, dragged down by lower production of cars, petroleum and steel.

- The hotel business in Pattaya has begun to feel the pinch of the strong baht and the economic slowdown, with reports of declining occupancy rates. High-season occupancy rates, normally close to 100%, are running at 80% this year, say industry executives.

- The recently approved Baan Dee Mee Down, a 50,000-baht cash rebate programme, is unlikely to help stimulate the country's property market much because the impact will be limited and fleeting, says the Thailand Development Research Institute.

- The SEC is in the process of issuing regulations to improve capital market funding access for small and medium-sized enterprises, aiming to initially allow SME share offerings and convertible debentures without document submission.

- Companies planning to issue perpetual bonds next year must comply with the new Thai Accounting Standards (TAS 32) because such securities will be booked as liabilities, a deviation from their current status as equities, says the SEC.

- The Fiscal Policy Office is optimistic that spending from the cash rebate of up to 20% in the Taste-Shop-Spend scheme will reach 10 billion baht by the time the programme lapses at the end of January.

- The Bank of Thailand plans to pool the phone numbers of commercial banks, their subsidiaries and outsource units used for telemarketing and debt collection with the National Broadcasting and Telecommunications Commission to develop the Gun Guan app, enabling consumers to better block unwanted calls from next year.

- China is expected to dominate the CLMV market, with Thailand estimated to lose as much as 187 billion baht by 2022 as Cambodia, Laos, Myanmar and Vietnam are inundated with Chinese goods, says the Center for International Trade Studies at the University of the Thai Chamber of Commerce.

- Local car distributors remain optimistic that unit sales locally will reach 1 million for a third straight year in 2020, with an economic recovery predicted in next year's second half.

- The Electricity Generating Authority of Thailand has chosen Petronas LNG of Malaysia as the winning bidder to supply two shipments of liquefied natural gas, totalling 130,000 tonnes.

- PTT Plc forecasts the average Dubai crude oil price will range from US$55 to $65 a barrel in 2020, with global demand for crude growing by between one million and 1.3 million barrels per day.

- Central Pattana (CPN), the SET-listed retail and property developer under Central Group, has teamed up with Mitsubishi Estate, one of Japan's leading developers, to increase the competitiveness of Central Village luxury outlets in Southeast Asia.

- WHA Utilities and Power Plc (WHAUP), Glow Energy and Suez Asia have inaugurated a waste-to-energy power plant in Chon Buri worth 1.8 billion baht to sell electricity to the Provincial Electricity Authority (PEA) and other industrial buyers.

Coming up: China will release November Caixin manufacturing PMI on Monday, with Germany and the US releasing November manufacturing PMI the same day. Brazil will release third-quarter GDP data on Tuesday. Australia will release third-quarter GDP and the US will release November non-manufacturing PMI on Wednesday.

- Australia, Canada and the US will release November trade figures on Thursday. Elsewhere, the Reserve Bank of India will hold a policy meeting and the EC will release revised third-quarter GDP. On Friday, Canada will release November employment change, the US will release November non-farm payrolls and consumer confidence for December. China will release November trade figures on Saturday.

Stocks to watch: Capital Nomura Securities says the new Thai Accounting Standard TAS32 will give companies a three-year grace period to adjust their perpetual bond issuance, with likely beneficiaries identified as CPALL, CPF, MINT, PTTEP, IVL, ANAN, PF and TTCL. It also predicts more investment funds with flow into the energy and ICT sectors, potentially improving share prices of PTT, PTTEP, TOP, PTTGC, SCC, ADVANC and INTUCH.

- UOB Kay Hian Securities Thailand maintains a positive investment outlook for the next 3-6 months. It recommends infrastructure and hospitality stocks. Top pics include WHAUP, SSP, NNCL, AOT, MINT, ERW, ADVANC, INTUCH, MTC and SAWAD.

Technical view: Yuanta Securities Thailand sees support at 1,585 points and resistance at 1,625. Maybank Kim Eng Securities Thailand sees support at 1,588 and resistance at 1,630.