Thailand's financial conditions were tighter than the historical average in the third quarter this year despite a policy rate cut by the Monetary Policy Committee (MPC) in August. This reflected persistent baht appreciation, an increase in corporate spreads and a slowdown in corporate borrowing and commercial bank loan growth.

When compared with the impact of two rate cuts in 2015, when the economy was similarly sluggish, the two latest reductions (in August and November 2019) may have more limited effect because other financial indicators are weak.

With slow and precarious growth in 2020 forecast, together with tightened financial conditions, we expect further monetary and fiscal policy easing. However, the central bank may not be able to cut rates much more due to potential financial stability risk.

We expect the policy rate to remain unchanged at 1.25% in the December MPC meeting, but now see the probability of another cut by the first quarter of 2020 rising to 40%.

In the third quarter, the overall Financial Conditions Index (FCI) slimmed to -1.33, tighter than the historical average between 2002 and 2019, as a result of the following developments.

Persistent baht appreciation: Although the August policy rate cut was a surprise, it did not lead to a significantly weaker baht. The baht against the US dollar remained rangebound between 30.8 and 30.9, before turning stronger. By the end of August, the nominal effective exchange rate (NEER) had risen 1.3% from the previous month, and as much as 6.84% from the beginning of the year.

Corporate spreads rise: With rising external and domestic risks, corporate bond investors demanded higher returns above sovereign yields to compensate for heightened default risks. The subsequent surge in corporate spreads raised funding costs.

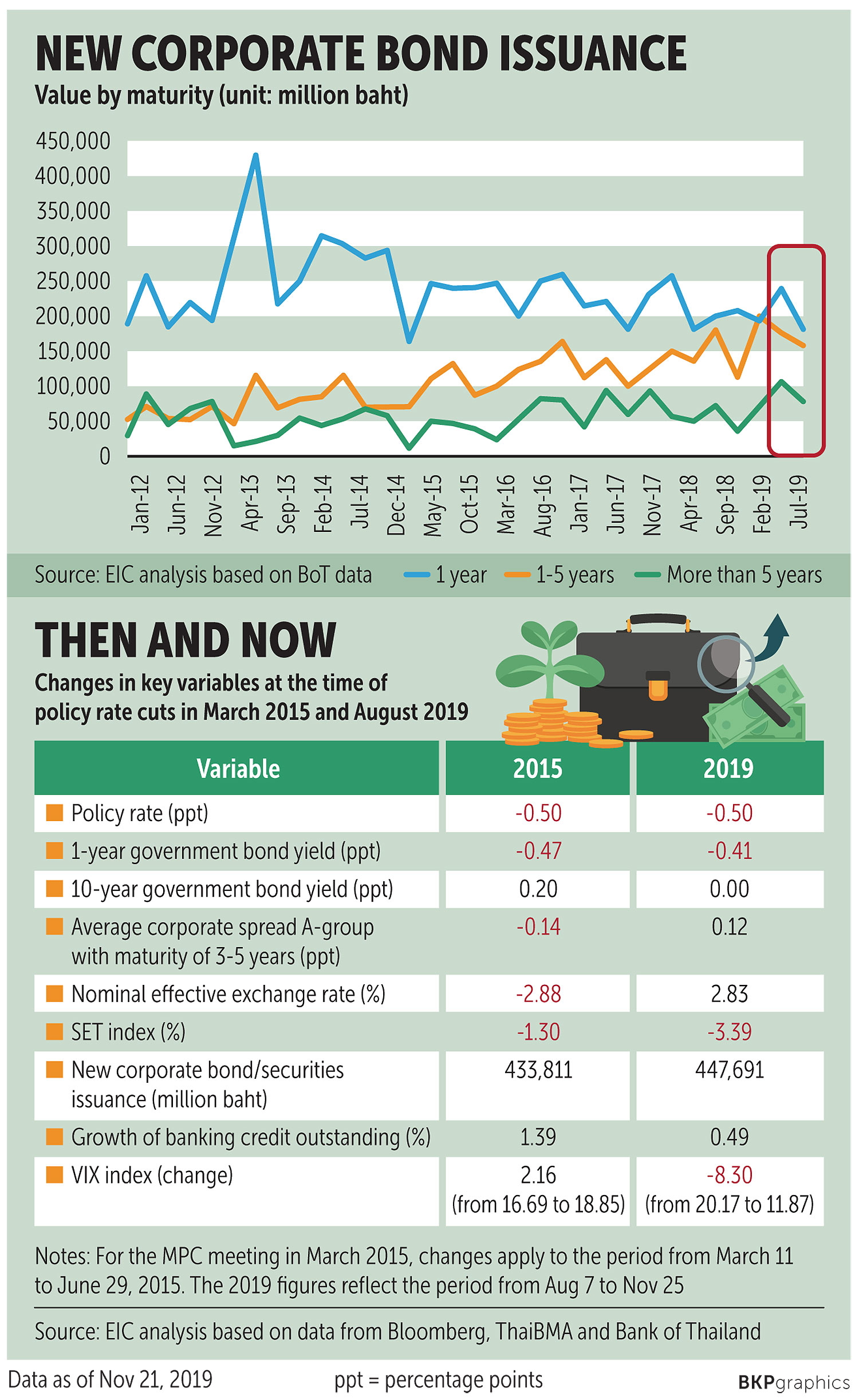

New corporate bond issuance drops: New corporate bond issuance fell across all maturities in the third quarter. Moreover, with falling yields over the past five years, businesses have been raising more funds via longer-term bonds (over one year maturity), while shifting away from short-term ones.

The low interest rate environment has been the major cause of this phenomenon, as it induced businesses to lock in their declining long-term funding cost.

As well, investors' search-for-yield behaviour has pushed up demand for long-term corporate bonds offering higher yields. However, new equity issuance remained largely unchanged from the second quarter.

Slower bank loan growth: Commercial bank loans expanded only 3.8% year-on-year in the third quarter, down from 4.2% in the previous quarter.

Non-performing loans (NPLs) continued to trend up, especially among small and medium-size enterprises and consumer loans, with the latter affected by deterioration in credit card and mortgage loans. Against this backdrop, banks grew more cautious in order to avoid default risks.

SET index falls: The US-China trade war, the worse than expected slowdown in the Thai economy, and disappointing earnings from Thai listed companies undermined investors' confidence in the stock market.

Global market confidence also deteriorated, as reflected in the elevated VIX index at the end of the quarter. This shift in sentiment affected capital flows to emerging markets, including Thailand. Thus, both the government bond market and the stock market in Thailand experienced net capital outflows.

Nevertheless, the lower policy rate helped ease financial conditions somewhat by lowering government bond yields. Short-term yields fell, but longer-term yields were influenced largely by US 10-year treasury yields, which fell amid heightened risks to global growth and trade tensions. These factors prompted greater demand for safe-haven assets such as treasuries.

As corporate spreads rose, falling short- and long-term Thai government bond yields helped alleviate pressure on funding costs (corporate yields) for Thai businesses somewhat.

But as other key financial variables have been tightening, the recent policy rate cuts did little to produce more accommodative financial conditions.

For example, when compared with the period prior to the policy rate cuts, the NEER has appreciated by almost 3%. Corporate spreads have risen by around 12 basis points. The SET index has declined by 3.4%. The NPL ratio rose from 2.95% in the second quarter to 3.01% in the third, leading to tightening bank credit. As a result, loan growth decelerated from 4.2% in the second quarter to 3.8% in the third.

DIFFERENCES FROM 2015

Comparing conditions in 2015 and 2019, we see a similar environment, including contracting exports and slowing private domestic demand (consumption and investment). But in 2015, after the MPC cut the policy rate in March and April by 50 bps in total, financial indicators responded more positively. In the three months following the cuts, the one-year Thai government bond yield decreased by 50 basis points, NEER depreciated by 3%, loan growth rose 1.4%, and Thai businesses raised more funds in the capital market.

In the second half of 2019, monetary and fiscal policy have been eased consistently through rate cuts and government stimulus. However, given widespread trade war effects (affecting exports, manufacturing employment and non-farm income), the strong baht, and the slowdown in real estate and car sales, private domestic demand continues to slow.

Although the policy rate is at a record low, the MPC has indicated that further monetary easing is possible if the economy slows further. We believe that data on private consumption and investment, employment and income (both farm and non-farm) will remain weak, leading to the rising probability of another rate cut by the first quarter of 2020.

However, more than one rate cut (25 basis points) in 2020 is unlikely as rates that are too low would threaten financial stability through heightened search-for-yield activity and underpricing of risk by investors. As well, more cuts might not increase consumption much as households could be induced to save more to compensate for lower interest income.

To address pressure on the baht, the Bank of Thailand in November eased capital flow and foreign-exchange regulations. Though they may have limited impact short term, they should ease appreciation pressure in 2020.

Meanwhile, we foresee fiscal easing to continue. Similar stimulus packages to those produced this year, including various types of subsidies and soft loans to SMEs and low-income households, could be extended to improve domestic demand in the coming year.

Kampon Adireksombat is head of economic and financial market research, Wachirawat Banchuen is senior economist and Pongsakorn Srisakawkul is an analyst with the Economic Intelligence Center (EIC) of Siam Commercial Bank.