E-commerce business in Thailand is expected to scale up to another level this year with more creative activities to engage with potential customers, including live streaming, social commerce, direct-to-customer (DTC) strategies and immersive shopping experiences.

The battle of online merchants could also heighten in the wake of an influx of Chinese products into popular e-marketplaces.

According to experts, live-streaming activities in which presenters introduce products via e-marketplaces and social media platforms will become a crucial new strategy driving online sales, as Thailand is now one of the leading fronts for "conversational commerce".

The roll-out of 5G technology is anticipated to create a better presentation of products online and a smarter shopping experience among users.

The ultra-fast internet network will also be a boon to real-time interaction between sellers and buyers and take the shopping experience to another level with multi-platform sales channels using both online and offline approaches.

Chinese competition

Thanawat Malabuppha, president of the Thai E-Commerce Association, said 2020 should be a busy year for cross-border e-commerce with the explosion of Chinese products sold through giant e-marketplaces Lazada, Shopee and JD Central.

Chinese sellers will get a boost once e-commerce giant Alibaba sets up its distribution centre in the free-trade zone of the Eastern Economic Corridor, where products can be kept without paying import tax.

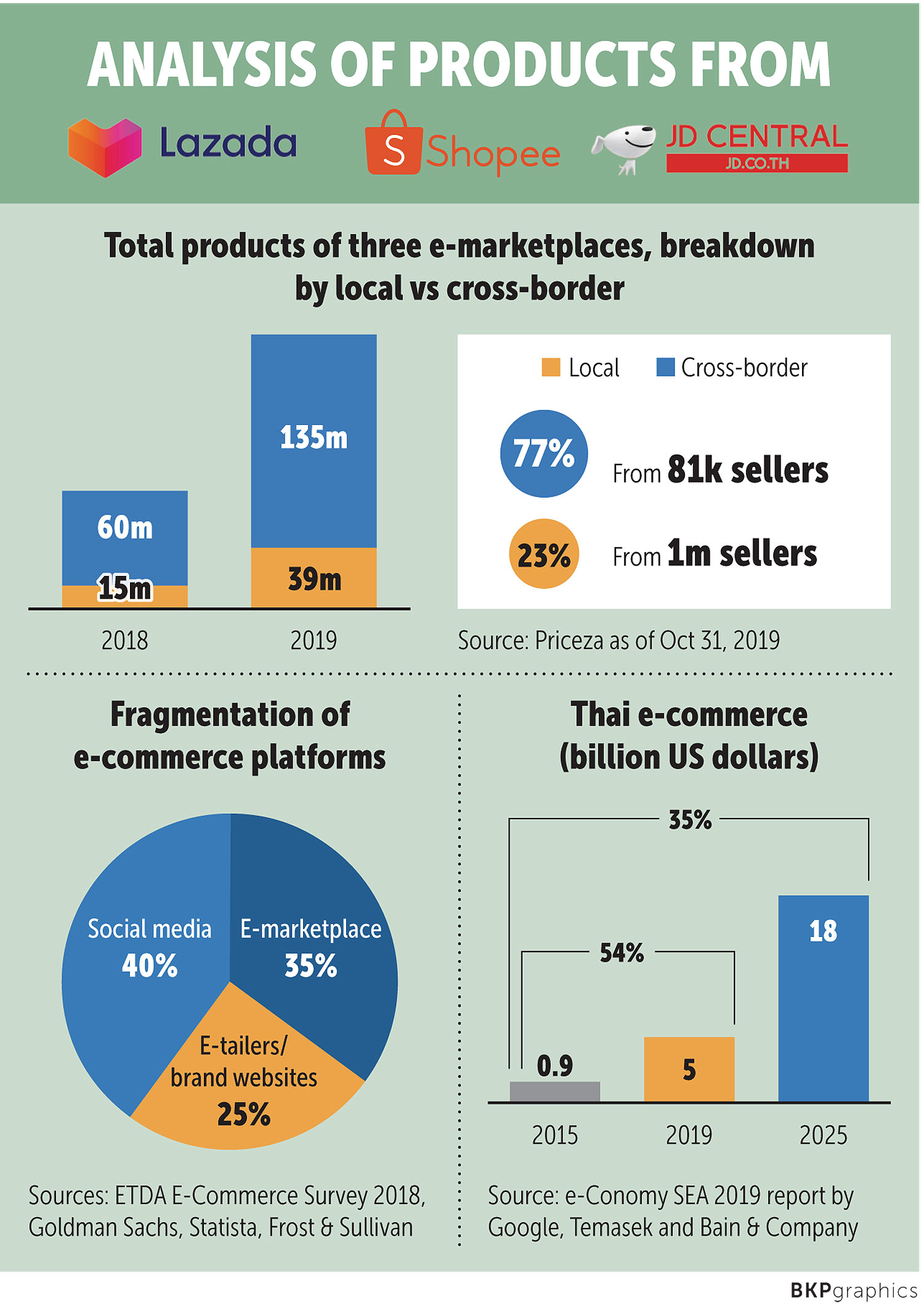

According to price comparison website Priceza, 60 million cross-border products were placed on Lazada, Shopee and JD Central in 2018.

Over the first 10 months of last year, the number of cross-border products soared to 135 million items, accounting for 77% of total products put on the three platforms.

Average order value was 738 baht for local products, as opposed to 350 baht for cross-border products.

Alibaba's distribution facility is expected to speed delivery times for Chinese products to Thai customers.

Once the facility is completed, Chinese products could possibly be delivered from the centre to Thai customers on the same day the order is made, according to Lazada.

Pisut Ngamvijitvong, senior analyst at Kasikorn Securities, said local small and medium-sized enterprises (SMEs) must fine-tune their business models in the face of tougher competition from Chinese products.

"Local enterprises may have to create unique products and services to grab the niche market, something that could not be found in general product catalogues shown on giant e-marketplaces," Mr Pisut said.

Social network platforms are working towards people convenience in shopping on their platforms, including payment services.

New regulations

Under the new e-payment law, each financial institution will be required to report transactions of customer accounts that receive either more than 3,000 money transfers a year or at least 400 money transfers with a total value of at least 2 million baht a year to the Revenue Department.

The law will be the department's tool for preventing local online vendors, particularly those not in the tax system, from avoiding income tax payment.

Pawoot Pongvitayapanu, former head of the Thai E-Commerce Association, said the legislation will affect the e-commerce community.

A draft bill on e-business tax, a levy on foreign-based online platform operators, is also in the pipeline.

Under the bill, overseas digital platform operators providing services that generate annual sales of more than 1.8 million baht from Thais are required to register for VAT payment and are subject to sales tax.

Accordingly, Thai customers would have to pay a 7% VAT when they purchase overseas digital services.

"Malaysia already started a 6% tax collection from Facebook, Netflix, Google and many more," Mr Pawoot said.

The tax collection, he said, also lets the government obtain data that can shed light on how much the country spends on foreign digital services.

The three major e-marketplaces have begun collecting commission fees from online merchants running premium malls on their platforms, as well as seeking other revenue sources.

Mr Pawoot said data fetched from the platforms can be used to consider providing loans to online merchants. Banks are also seeking to partner with these e-commerce platforms, as well as ride-hailing service operators, to provide lending services.

Sales strategies

Meanwhile, the DTC strategy in which brands seek to reach out buyers directly is expected to gather steam this year.

To accommodate these merchants, the e-marketplaces rolled out platforms -- LazMall, ShopeeMall and JD Mall -- on which brands can set up their official shops.

In 2019, 1,700 brands had official shops on these three platforms, or 4% of the total 44,000 brands selling their products through these channels.

"We expect the number of shops and products to rise by three times on these platforms in 2020," Mr Thanawat said. "Traders and distributors need to proceed with more value-added services to create difference before they falter and disappear."

The DTC approach, he said, will enable brands to obtain necessary customer data and foster customer loyalty towards brands. The approach is an imperative for data-driven marketing activities undertaken by brands.

Social commerce is also gathering steam as an alternative channel for reaching potential customers.

According to a report titled "Conversational Commerce: The Next Gen of E-com" by Boston Consulting Group, 40% of respondents said they shopped via social commerce platforms.

Facebook, Instagram and Line are gearing up efforts to provide convenience in shopping through their platforms, including payment channels.

Facebook provides Facebook Pay services, while Instagram has the Instagram Shopping feature to accommodate online sales. Line enables merchants to open official accounts to interact with customers through the platform.

Norasit Sitivechvichit, chief commercial officer of Line Thailand, said Line this year will focus more on synergising its various services to accommodate product sales.

Line TV will be developed to let viewers buy products shown on programmes in real time, with delivery carried out by the Line Man courier service.

The 5G roll-out will improve the online shopping experience with faster loading of product displays, giving users instant access to sales services, according to Mr Thanawat.

Citing an Amazon report, he said one-second-faster loading of e-commerce websites could increase sales opportunity by 25%.

Meanwhile, brands and sellers are seeking to engage more with shoppers through what is called "shoppertainment".

For example, customers can try on lipstick using their phone screen and augmented reality (AR) technology, or see actual products via live stream. They can play in-app games that convert coins into vouchers or product discounts.

Lazada, which has become the largest e-marketplace in Asean with more than 50 million users, said visitors can come to its platform to shop, watch live streaming, play games or hunt for deals.

Lazada plans to add mobile wallet as a service this year.

Chinese celebrity and store owner Zhang Dayi, wearing glasses, promotes clothing during a live-streaming session. Reuters

Future trends

Terence Pang, chief operating officer of Shopee, predicts a more personalised online shopping experience this year, driven by data analytics and artificial intelligence.

He said Shopee will deepen its use of AI and big data to curate a more personalised shopping journey for users.

The Thai e-commerce market is set to continue its tremendous growth in 2020 in light of improving infrastructure such as high-speed internet, access to smartphones, payment innovations and logistics, Mr Pang said.

"Thais are now more confident and familiar with shopping online," he said, adding that men, the elderly and consumers in secondary cities appeared to shop online more often in 2019 than before.

Brands, including traditional businesses like property developers and insurance firms, are paying more attention to e-commerce platforms as a channel for reaching out to consumers.

"Intensifying competition will continue in 2020, which will encourage players to constantly upgrade the online shopping experience," Mr Pang said.