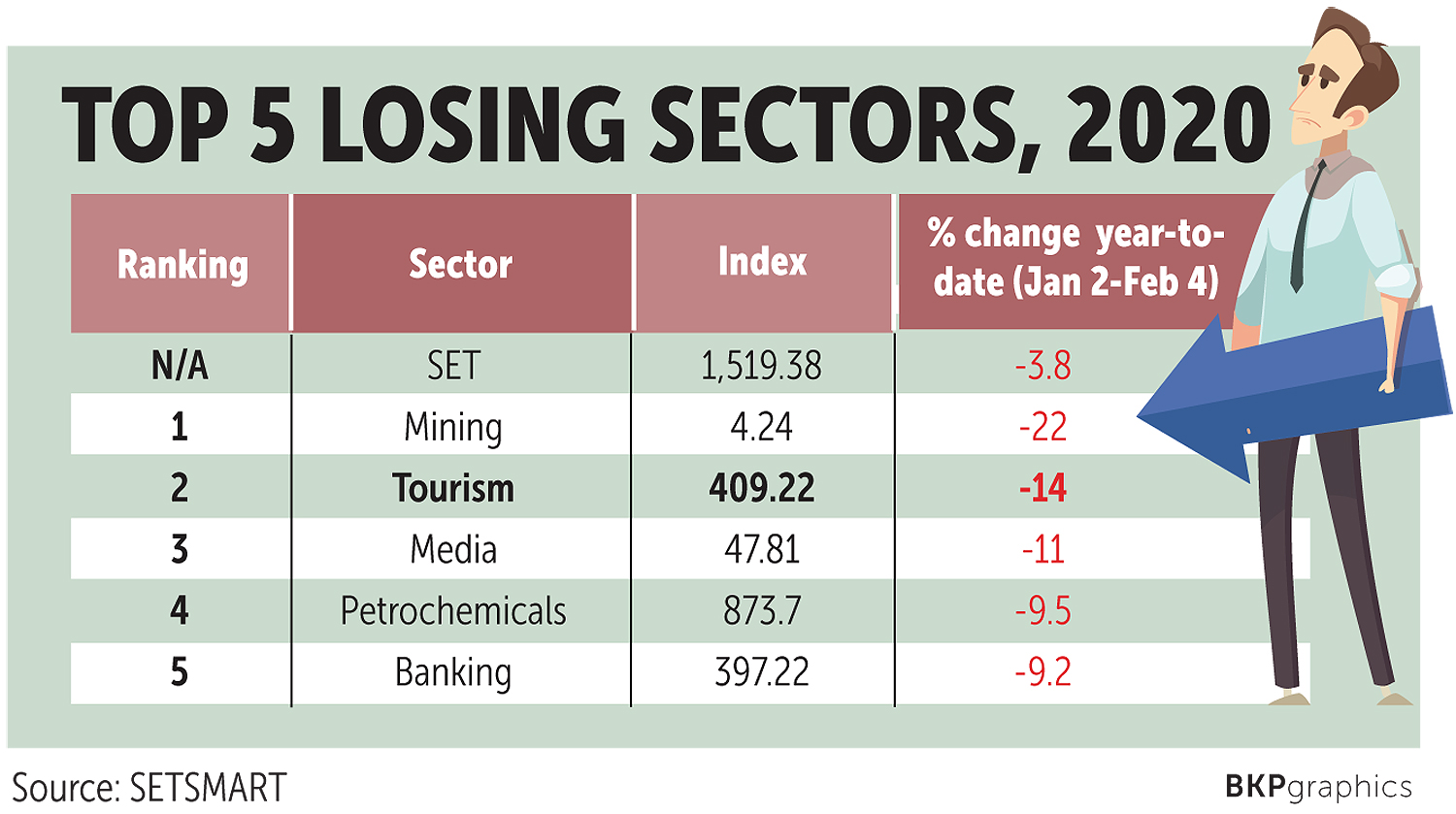

Tourism-related equities have become the second worst performer in the Stock Exchange of Thailand (SET) index after sliding by more than 14% year-to-date, with shattered first-quarter earnings projected as Chinese tourist arrivals plummet following the novel coronavirus outbreak.

Year-to-date share prices of all Thai equities clustered in the tourism segment, where most are operators of major hotel chains in Thailand, have been in the red since trading began on Jan 2.

The share price of S Hotels and Resorts Plc, a holding company that manages hotels and resorts in key tourist destinations, plunged the most among hospitality peers, down by 33.5% year-to-date as of Feb 4, according to SETSMART.

The Erawan Group Plc (ERW), the operator of luxury hotels such as Grand Hyatt Erawan Bangkok and JW Marriott Bangkok, also saw a 24.4% dip in share price, while Central Plaza Hotel Plc (CENTEL) suffered a 12% decline.

The virus pandemic is the latest string of bad news thwarting optimism for tourism-related SET-listed stocks as fundamentals were previously hampered by Thailand's economic slowdown, the baht appreciation and fierce competition in the hospitality sector.

Analysts have recommended their clients shun equity investment in the tourism industry as it reels from the coronavirus outbreak, which has claimed more than 490 lives from over 24,000 confirmed cases of infection since news of the contagion that started in Wuhan, the capital of China's Hubei province, broke out in December.

SAPPED PROFITS

With no end in sight in terms of the virus spread and China banning outbound group tours, a sharp decline in tourists travelling to Thailand from the mainland is inevitable.

The country's lucrative tourism industry, which contributes more than 10% of GDP, will be hit hard, especially hotels and restaurants where a huge chunk of earnings comes from mainland visitors.

Annual Chinese tourist arrivals number around 10-11 million per year, accounting for more than 30% of the total.

If the Chinese government prohibits its citizens from travelling abroad for about two months and tourists from other countries avoid travelling to Thailand, arrivals may tumble by around 70% year-on-year in the first quarter, with Chinese tourists accounting for a 40% share, said an analyst at Capital Nomura Securities speaking on condition of anonymity.

The novel coronavirus outbreak will dent hoteliers' net profit this year, with ERW poised to see the biggest loss from lower tourist arrivals, with an 11% decline in annual net profit, said the analyst.

For other hoteliers, annual net profits of CENTEL and Minor International Group Plc (MINT) are projected to fall by 7% and 5%, respectively. A double whammy derailing net profits is a slow recovery in domestic tourism and the adoption of the new accounting standard called the Thai Financial Reporting Standard 16, said the analyst.

"Given these bearish factors, we recommend avoiding the tourism sector for now," said the analyst.

Nuanpun Noiruchchukorn, an analyst at Asia Plus Securities (ASP), said Thailand's tourism industry has a depressed outlook this year as annual tourist arrivals will be lower than expected because the coronavirus outbreak has not been contained.

The first-quarter net profit of SET-listed hoteliers will dive because of reduced revenue per room, said Ms Nuanpun.

All three hospitality equities in ASP coverage have a negative outlook, with ERW facing the most pain as hotel revenue makes up 90% of the group's total earnings.

For CENTEL, the company generates 36% of revenue from hotel business, while MINT earns 8% from domestic hotels, with the main source of revenue generated from overseas hotel businesses.

ASP has given an underweight outlook for Thailand's hotel and tourism industry until the World Health Organization announces official containment of the viral outbreak.

SUPPLY CHAIN SPILLOVER

Tourists are not the only ones avoiding Thailand as international funds withdrew US$562 million (17.4 billion baht) from Thai equities last month, the biggest sell-off in the first month of any year since 2011, Bloomberg reported.

Foreign investors continued to be net sellers of Thai equities worth 16.6 billion baht as of Feb 4 after a net offload of local shares worth 45.2 billion for full-year 2019.

"Rising fatalities from the novel coronavirus outbreak have spread into the supply chain segments from previous concerns related to the aviation and tourism sectors, with growing concerns over how the virus will deal a blow to global economic growth," said Mongkol Puangpetra, executive vice-president of strategy research at KTB Securities Thailand.

For instance, shares of CP All Plc, which owns and operates the 7-Eleven convenience store chain, saw a 3.9% decline on Monday as fears have fanned over retail businesses suffering considerable losses because of lower Chinese tourist arrivals.

The Brent crude oil price has stumbled amid mounting fears of a larger pandemic as there are concerns over how China, the world's biggest crude oil importer, is using less oil for its manufacturing sector as factories, offices and shops remain shut, the BBC reported.

The cost of crude hit its lowest level in a year after falling 20% since its peak in January.