ME by TMB, the digital banking do-it-yourself platform of TMB Bank, and Kasikornbank (KBank) have seen their experiments in opening savings accounts using electronic Know Your Customer (e-KYC) exit the central bank's regulatory sandbox.

The new service is convenient for customers opening new accounts in ME SAVE on the digital platform as depositors are no longer required to go to branches, said Benjarong Suwankiri, head of ME by TMB.

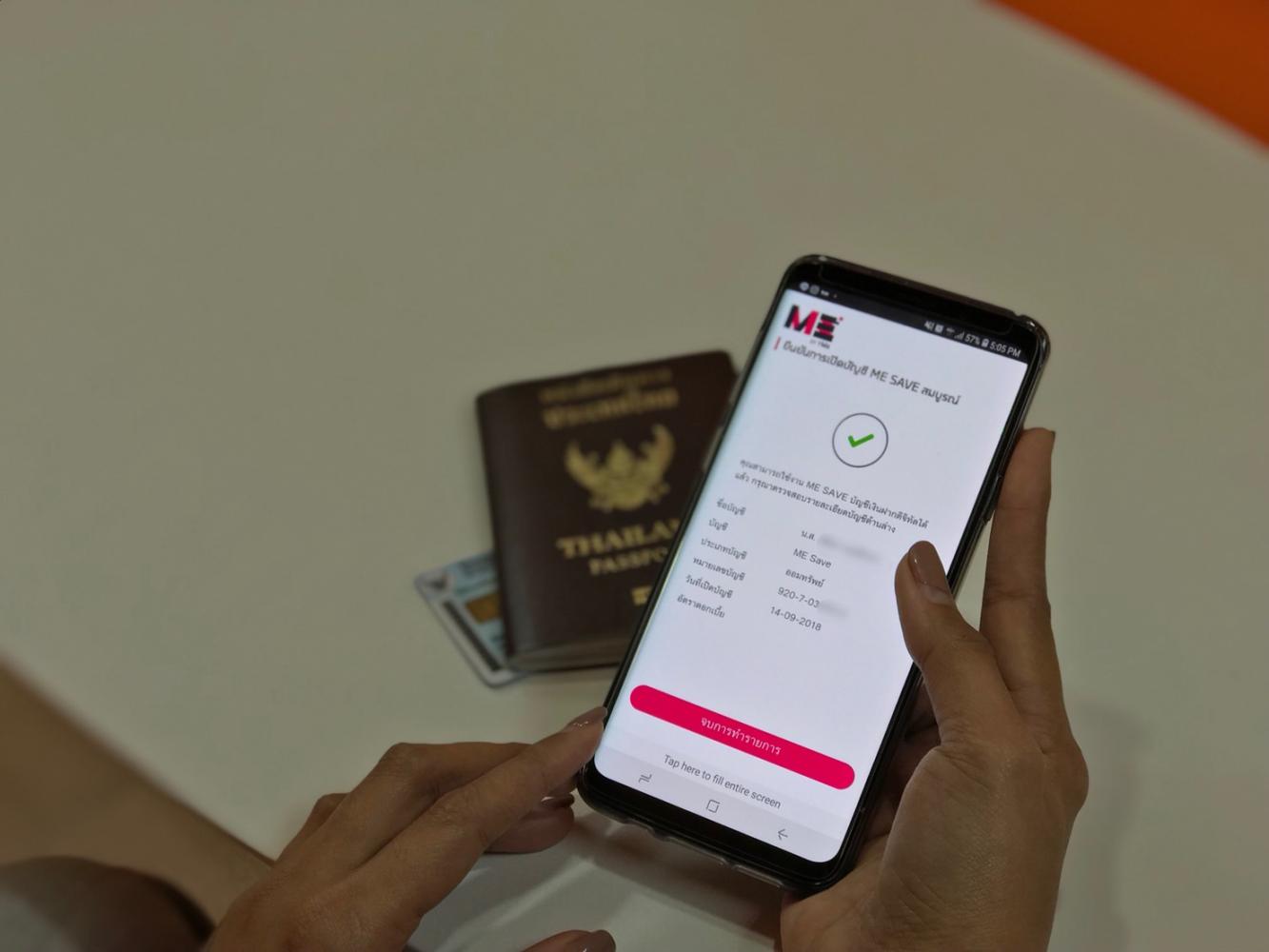

To open a deposit account via a smartphone with Android NFC functionality, both ID card and passport are needed for facial authentication.

The first phase e-KYC through facial recognition enables only existing customers of each bank to open a new deposit account through the digital channel without visiting a branch, while the second phase allows people to use cross-bank identity verification through the National Digital ID (NDID) platform to open bank accounts.

The Bank of Thailand recently said six banks -- KBank, Siam Commercial Bank, Bangkok Bank, Bank of Ayudhya, TMB Bank and CIMB Thai Bank -- are testing their cross-border identity verification in the regulatory sandbox. They are expected to exit and offer digital deposit account opening by the end of the year.

Mr Benjarong said ME has also run experiments with cross-bank identity authentication in the central bank's regulatory sandbox.

With more comprehensive technology and an ecosystem, it will provide customers greater convenience when making digital banking transactions, he said.

Opening new digital deposit accounts on the NDID platform requires customers to show their ID card through smartphones with iOS and Android operating systems.

"We expect our second phase will exit the regulatory sandbox in the second half. We will then set a clearer plan about expanding digital deposit account opening," said Mr Benjarong.

Supreecha Limpikanjanakowit, first senior vice-president of KBank, said the bank's first phase of e-KYC has exited the regulatory sandbox.

The bank has prepared for its K-eSaving account opening through facial recognition technology since last year by collecting and updating customers' facial data at all branches nationwide.

KBank has also expanded its dip-chip points, an authentication machine that allows insertion of ID cards into the reader, at its ATMs and retail stores in collaboration with several business partners.

The bank aims to expand the number of dip-chip points to 100,000 nationwide this year.

However, the bank has not set a specific target for K-eSaving accounts yet, waiting for clearer signs, especially regarding the coronavirus, before outlining marketing and business plans.

"Now is not the time to launch a marketing campaign. We need to wait for the situation to improve, but the bank continues to prepare its infrastructure base," he said.