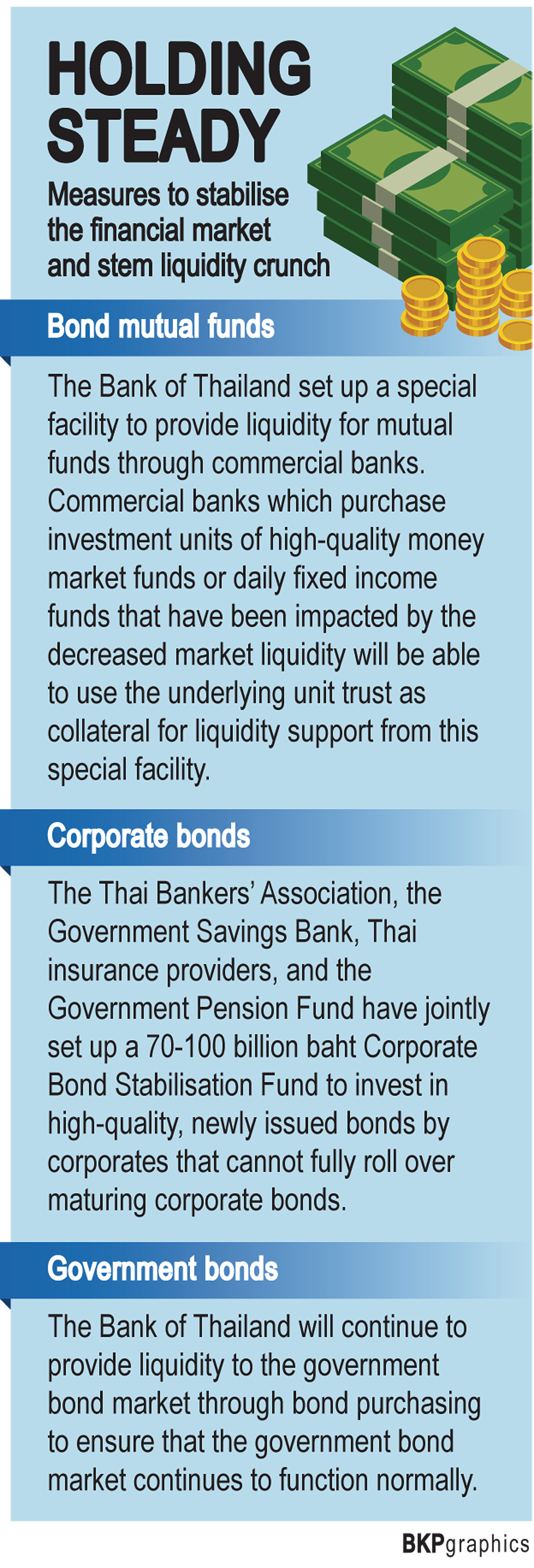

Measures are being launched, including a liquidity support fund valued at 70-100 billion baht, to help manage risk in the debt market made vulnerable by the intensifying coronavirus spread.

The Bank of Thailand (BoT) has offered special credit facilities to shore up liquidity in money market funds or daily fixed income funds through commercial banks.

At the same time, a consortium led by the Thai Bankers' Association has set up a 70-100 billion baht Corporate Bond Stabilisation Fund (CBSF) for investment in high-quality, newly-issued bonds by the corporates which cannot fully roll over maturing corporate bonds.

Under the special lending facility scheme, commercial banks are allowed to purchase investment units in high-quality money market funds or daily fixed income funds affected by ailing market liquidity and use the underlying unit trust as collateral for liquidity support from the central bank, BoT governor Veerathai Santiprabhob said in an urgent press briefing yesterday.

"We're ready to provide financial support until the situation returns to normal," Mr Veerathai said.

The measures came after some mutual fund operators announced they will temporarily close redemption for fixed income funds following a mutual funds selloff triggered by growing concerns over the unfolding Covid-19 outbreak developments.

Mr Veerathai said financial institutions are still strong with high liquidity and authorities will ensure sufficient liquidity and the functioning of the debt market.

He insisted the state of the economy is a far cry from the 1997 financial meltdown when the country had high foreign borrowings and faced a severe liquidity crunch when its international reserves were in the doldrums. Now, the country's finances are generally stable and liquidity is in good shape. The international reserve is also high, he said.

The BoT will continue to provide liquidity to the government bond market through bond purchasing to ensure it continues to function normally, according to a joint statement issued by the BoT, Finance Ministry and Securities and the Securities and Exchange Commission (SEC) on Sunday. "These measures are expected to provide liquidity and help the normal functioning of the financial market and help build investors' confidence," it said.

The fresh measures followed the decision of the Monetary Policy Committee to slash its key interest rate by 25 basis points to 0.75% in a special meeting on Friday.

With the bond mutual funds, the BoT has set up a special facility to provide liquidity for mutual funds through commercial banks. The facility will remain open until market conditions return to normal. BOT's preliminary estimate of eligible bond mutual funds is approximately one trillion baht.

For corporate bonds, the Thai Bankers' Association, the Government Savings Bank, Thai insurance providers, and the Government Pension Fund have together set up the CBSF. As for government bonds, the BoT will continue to provide liquidity to the government bond market through bond purchasing.