Thailand's mutual fund industry saw a 15.3% drop in total assets in the first quarter from year-end 2019, with most of the outflows deriving from fixed-income funds, says Morningstar Thailand.

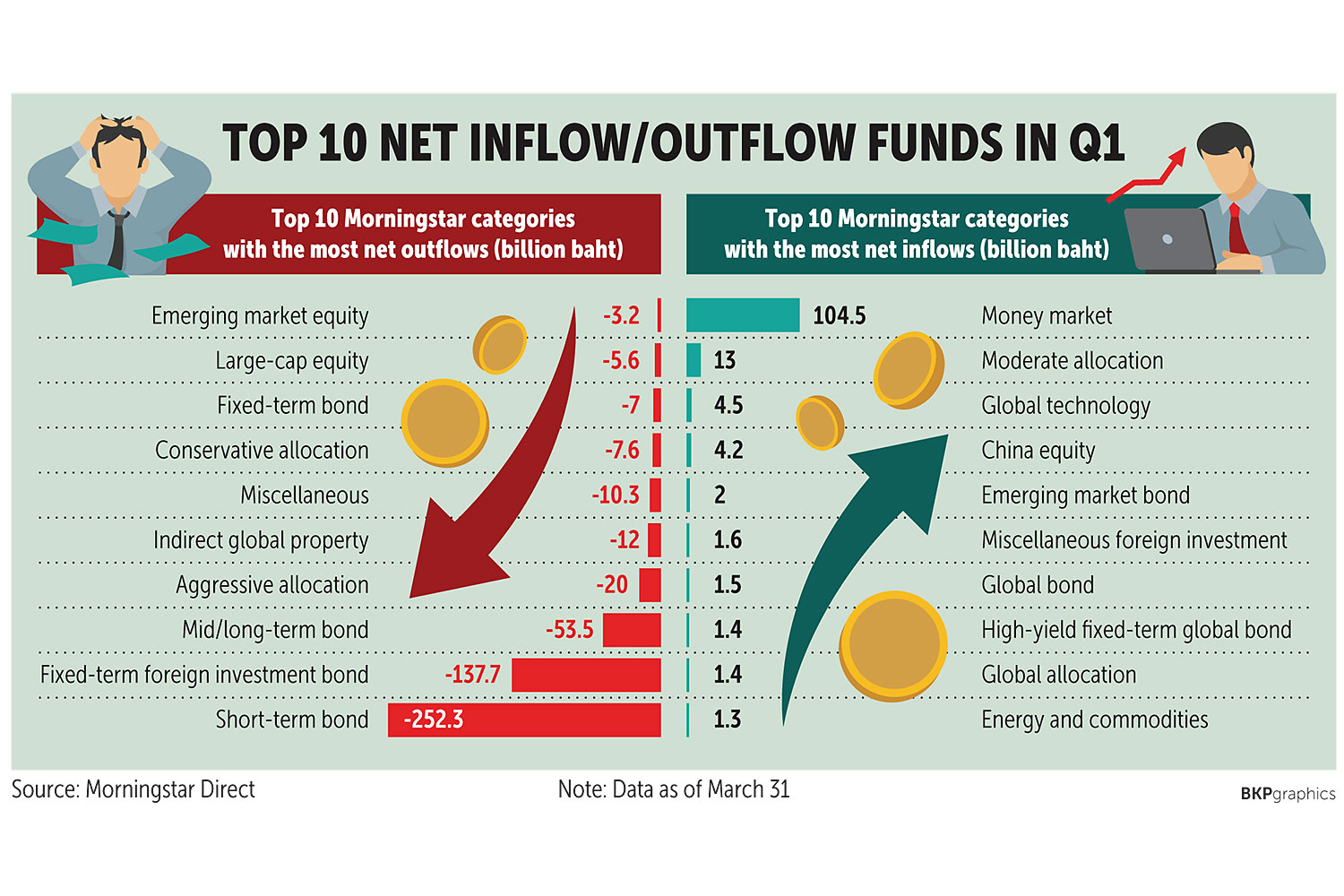

Most of the net outflows worth 390 billion baht came from fixed-income funds, while the majority of net inflows worth 105 billion baht were into money market funds, said Chayanee Juengmanon, senior research analyst at Morningstar Thailand.

Net assets of the domestic mutual fund industry totalled 4.6 trillion baht at the end of March.

Most of the largest funds saw their net assets drop by more than 20% from last year's final quarter.

Total net asset value of Thai mutual funds, excluding closed-end funds, real estate investment trusts, infrastructure funds and exchange-traded funds, fell by 17.1% from year-end 2019 to 3.6 trillion baht.

With the exception of money market funds, assets of all sizes saw a quarterly decline, with equities down 25%, followed by fixed-income securities (-23.2%) and aggressive allocation (-15%).

Equity funds had total net outflow of 23.9 billion baht in the first quarter, with the largest outflow coming from the indirect global property category, according to Morningstar Thailand.

The money market category had the highest net inflow of 104.6 billion baht, while other net inflows were concentrated in categories related to foreign investments.

Since money market funds received the most net inflow and equity funds saw the most net outflow, the implication is that investors switched to a risk-off mode against the backdrop of a relatively weak economic outlook, Ms Chayanee said.

Investors shied away from Thai bond funds because of liquidity problems in the bond market.

Short-term bonds set a new record for monthly net outflow in March with 310 billion baht as funds dropped in value and ignited a sell-off in the bond market.

Medium- and long-term bonds saw a similar fate, with net outflow of 104.5 billion baht in March.

Two fixed-income funds of TMBAM Eastspring sparked a major redemption in Thailand's mutual fund industry, to the point where the selling spree nearly caused a liquidity crunch.

Later on, the company terminated two other fixed-income funds because there had been a heavy sell-off by unit holders to hold cash instead.

Units in these fixed-income funds, which invested heavily in foreign debt securities, were among those in the sell-off rush as investors wanted to reduce their risk exposure and hold cash against the backdrop of rising uncertainty and a lower-interest-rate outlook.

Other markets, such as Australia, Hong Kong, Singapore and the US, saw a similar sell-off in fixed-income funds, Ms Chayanee said.

For long-term equity funds, total net assets plummeted 25.4% from year-end 2019 to 303 billion baht. Retirement mutual funds also saw a decline of 13.6% from year-end 2019 to 263.8 billion baht.

Thailand's stock market underperformed among Asian bourses, with the SET index tumbling 29% from year-end 2019.