Recap: Most Asian stock markets fell on Friday as Sino-US tensions were exacerbated after China said it would impose new national security legislation on Hong Kong following last year's pro-democracy unrest.

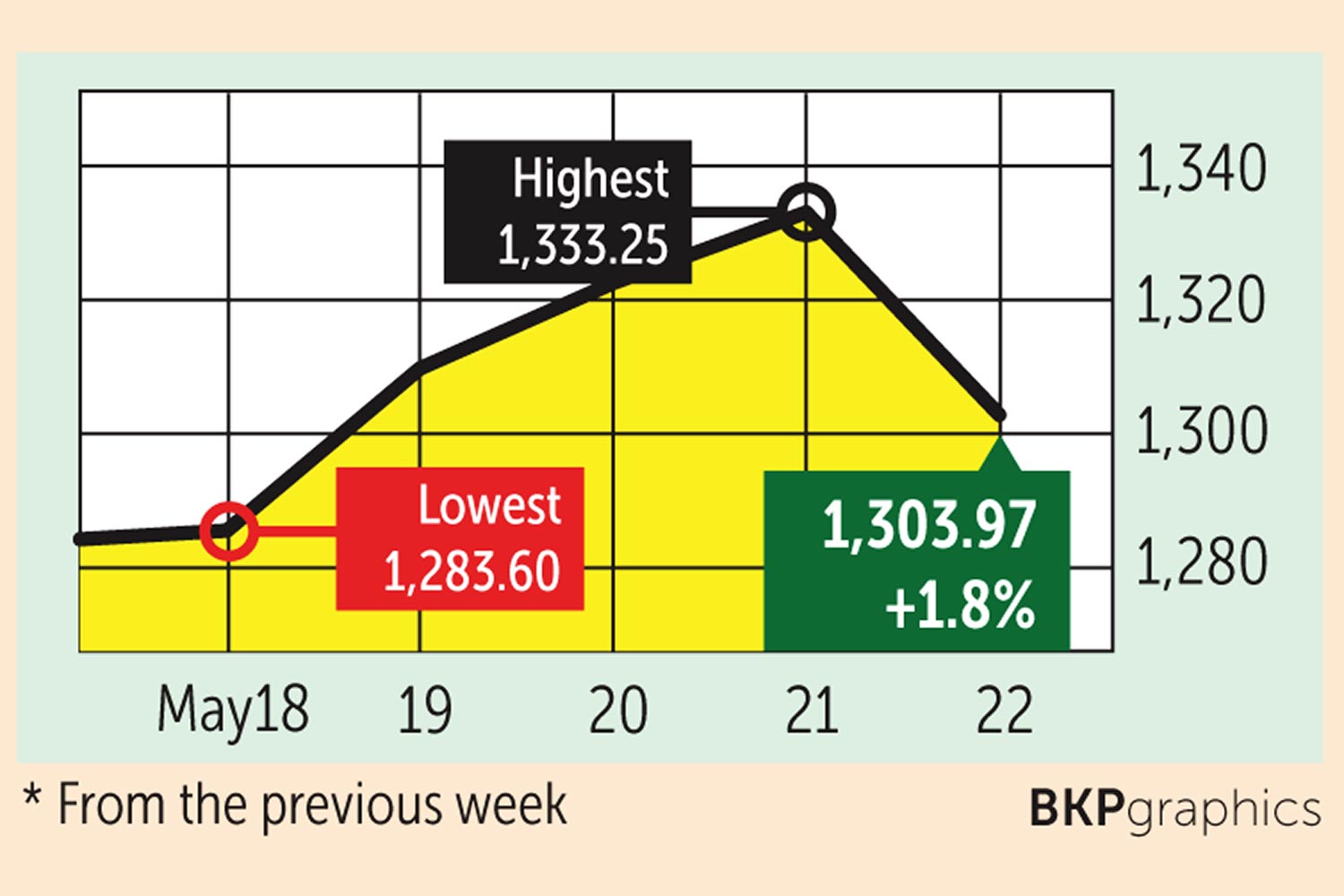

The SET index moved in a range of 1,283.60 and 1,333.25 points this week before closing down 16.72 points yesterday at 1,303.97, a gain of 1.8% from the previous week, in daily turnover averaging 67.42 billion baht a day.

Retail investors were net buyers of 3.96 billion baht, institutional investors bought 6.3 billion and brokerage firms purchased 655.8 million worth of shares. Foreign investors were net sellers of 10.96 billion baht.

Newsmakers: US President Donald Trump attacked the World Health Organization as a Chinese "puppet" and confirmed he is considering slashing or cancelling US support. He also lashed out at China for "mass worldwide killing" and floated the idea of gathering G7 leaders in person at his Camp David retreat for their annual summit on June 10.

- Chinese President Xi Jinping said Beijing has been "transparent" throughout the coronavirus crisis, and offered to share a vaccine as soon as one was available -- as well as $2 billion in aid.

- Singapore expects three-quarters of its economy resume normal operations when anti-Covid curbs are eased from June 2, although the relaxing of measures could lead to more daily virus cases.

- The US is facing a severe economic downturn but will not suffer another Great Depression, as a recovery should begin later this year, Federal Reserve Chair Jerome Powell said.

- The global economy will take much longer to recover fully from the virus shock than initially expected, says IMF managing director Kristalina Georgieva, who stressed the danger of protectionism.

- Japan dived into its first recession since 2015, with the economy contracting by 0.9% in the first quarter.

- The British aircraft engine maker Rolls-Royce said it would cut at least 9,000 jobs and slash costs elsewhere, as the pandemic cripples the aviation sector.

- The struggling Japanese conglomerate SoftBank Group has reported record losses, as the pandemic compounded woes caused by its investment in the troubled office-sharing company WeWork.

- Lufthansa on Thursday confirmed it was in talks with the German government to take a major stake in the stricken airline as part of a rescue worth E9 billion.

- Thailand's economy contracted in the first quarter by 1.8% year-on-year for the first time since 2014 as the pandemic crushed tourism and shuttered commerce. On a quarterly basis, GDP shrank 2.2%.

- The Bank of Thailand cut its policy rate by 25 basis points to a fresh record low of 0.5%, saying it is ready to use additional tools to soften the economic blow from Covid-19.

- Four commercial banks -- Kasikornbank, Siam Commercial Bank, Krungthai Bank and Bank of Ayudhya -- followed in the footsteps of Bangkok Bank in cutting prime lending rates following the central bank's latest move.

- Despite massive fiscal stimulus packages and monetary easing, the economy could continue falling sharply this quarter, with a GDP contraction possibly even deeper than the 12.5% seen in the second quarter of 1998, says CIMB Thai Bank.

- The cabinet on Tuesday resolved that struggling Thai Airways International would seek business rehabilitation, likely including massive job cuts, under the Central Bankruptcy Court. In doing so, it rejected plans for another taxpayer bailout and also said the airline must shed its state enterprise status.

- The non-performing loan (NPL) ratio of local commercial banks climbed to a nine-year high of 3.05% of credit outstanding at the end of March, with consumer bad loans outpacing commercial NPLs for the first time in four years.

- Thailand's car production in April hit a 30-year low of 24,711 units amid weak global demand, factory shutdowns and widespread layoffs.

- A combined 89% of the 621 SET-listed firms reported a 58% year-on-year decline in net profit in the first quarter against the backdrop of the coronavirus crisis, says Tisco Securities.

- Thailand's industrial confidence index stood at 75.9 in April, its lowest in 11 years, and a slight decrease across all sectors from 88 the month before.

- Local hotels have rejected a proposal by the giant European tour operator TUI Group to delay debt repayment. They propose an optional deferment requiring 50% of the overdue amount by this month.

- Mall operators have called on the government for a financial remedy, citing losses of almost 15 billion baht in sales revenue during forced closure from March 22 to May 17. They are also seeking standardised guidelines for restaurant operators and extended service times to recoup sales opportunities.

- New corporate bond issuance plummeted 41.9% year-on-year for the four months through April as the pandemic dented demand, according to Kasikornbank.

- The pandemic is likely to cause residential property sales nationwide to fall by 15% this year, according to the Real Estate Information Center.

- The head of Grab Thailand, Tarin Thaniyavarn, is leaving the job to pursue his own dream after more than two years with the fast-growing on-demand app.

- The cabinet agreed to postpone the enforcement of most chapters of the Personal Data Protection Act (PDPA) by a year to give the public and private sectors more time to prepare their internal processes and ease the financial burden they are shouldering at present.

- The SEC says it is considering toughening regulations governing auditing firms and auditors to improve fairness to capital market stakeholders.

- True Group reported a first-quarter net loss of 161.1 million baht, compared with a net profit of 1.5 billion a year earlier. The loss was attributed to the adoption of new accounting standards. Service revenue rose 3% to 26.6 billion baht, supported by firm earnings from fixed and mobile broadband internet services.

Coming up: Germany will release final first-quarter GDP data and May business sentiment on Monday, followed by consumer confidence on Tuesday. The euro zone will announce May business confidence on Thursday, with the US releasing the second Q1 GDP estimate and April durable goods orders.

Several countries will report Q1 GDP growth data on Friday, among them Brazil, Canada, France, Italy and Turkey. On the same day, Britain and Japan will release May consumer confidence and the US will release April personal income and spending.

Stocks to watch: UOB Kay Hian Securities Thailand recommends accumulating IVL, SCC, STA, TIP and VRANDA. Recommended defensive stocks are GPSC, BCPG, RATCH, BCH, CHG, SSP and SUPER. Suggested insurance stocks are TIP and THRE, while financial firms with low share prices are BFIT and AMANAH.

DBS Vickers Securities Thailand recommends stocks benefiting from spending by people receiving state aid, such as CPALL and HMPRO. It also recommends firms benefiting from mall and department store reopening, among them CPN, CRC, COM7, HMPRO, DOHOME and GLOBAL.

Technical view: DBS Vickers sees support at 1,250 points and resistance at 1,350. Asia Wealth Securities sees support at 1,280 and resistance at 1,350.