Recap: Emerging market stocks were driven by strong economic readings across the globe, including Chinese factory activity and US payroll data. However, the spike in US Covid-19 infections remains a drag on risk appetite.

The SET index moved in a range of 1,312.59 and 1,380.08 points this week before closing yesterday at 1,372.27, up 3.2% from the previous week, in daily turnover averaging 63.3 billion baht.

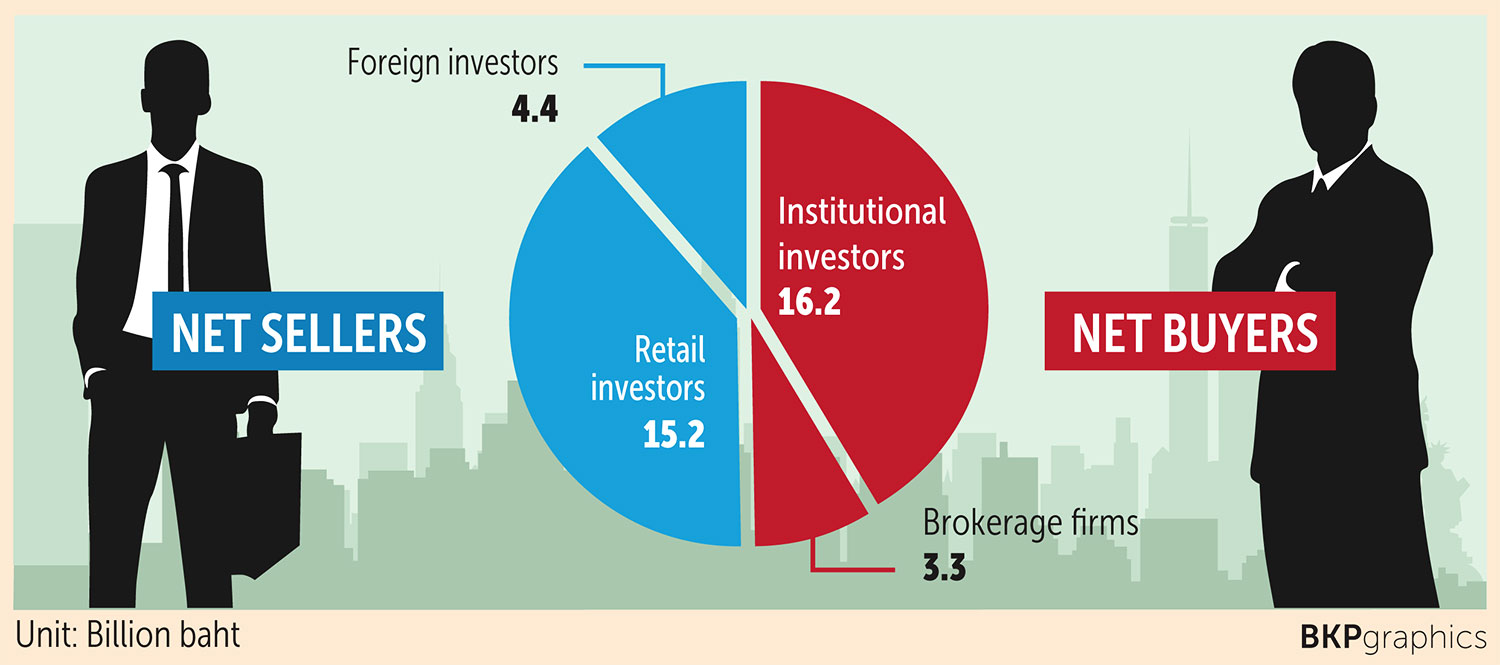

Institutional investors were net buyers of 16.2 billion baht and brokerage firms purchased 3.3 billion worth of shares. Retail investors were net sellers of 15.2 billion and foreign investors offloaded 4.4 billion.

Newsmakers: Hong Kong marked the 23rd anniversary of its handover to China on Wednesday under the thumb of a tough new national security law imposed by Beijing. Thousands of marchers defied a protest ban and about 400 were arrested, including at least 10 who were charged under the new law.

- The British government has ditched coronavirus quarantine rules for travellers arriving from 75 countries including Thailand so that people can go on holiday, The Daily Telegraph reported.

- The European Union has moved to reopen its borders to visitors from 15 "safe" countries including Thailand, but not the United States, where new Covid-19 are spiking once again.

- American businesses added 4.8 million nonfarm jobs in June as economic activity resumed, bringing the unemployment rate down to 11.1% from 13.3% in May.

- Gold futures edged closer toward $1,800 an ounce -- a level last seen at the end of 2011 -- as demand for safe-haven assets surged amid concerns over a new wave of virus infections.

- Lee Hsien Yang, the estranged younger brother of Singapore's Prime Minister Lee Hsien Loong, will not contest the city-state's July 10 general elections, deflating the hype built up after he joined the opposition.

- Vietnam's economy unexpectedly grew in the second quarter, albeit by only 0.4%, as exports slumped because of the coronavirus pandemic.

- Uber is in talks to buy the food delivery app Postmates in a US$2.6 billion deal, US media reported.

- Shares of Sri Trang Gloves Thailand (STGT) jumped 78% on their SET debut on Thursday, supported by rising demand for rubber gloves amid the pandemic. The world's third-largest rubber glove maker sold 438.78 million IPO shares, or 30.7% of its total, at 34 baht each. They closed on Thursday at 60.50 baht in heavy trade worth 17.26 billion baht.

- The Civil Aviation Authority of Thailand has lifted its ban on international flights but only for certain groups such as foreign work permit holders and foreigners with Thai families. Numerous other conditions related to coronavirus control also apply.

- A travel bubble plan for leisure travellers has been proposed with three phases for opening, starting with a mere 1,000 tourists per day across five provinces.

- Thailand is expected to see at most 8 million foreign tourists this year, down 80% from a year earlier, as the pandemic cuts global travel, says the Tourism Council of Thailand. Some 2.6 million workers in the industry are at risk of unemployment, another report said.

- The World Bank flagged a warning that 8.3 million workers in Thailand could lose jobs or income from the pandemic, but said the Thai economy is estimated to bounce back to pre-pandemic level in the next two years.

- Up to 16,680 local factory workers lost their jobs in the first six months of the year, with 404 factories closing, according to the Department of Industrial Works.

- The Joint Standing Committee on Commerce, Industry and Banking is worried political infighting could hinder economic rehabilitation plans, especially if there are major reshuffles in ministries overseeing the economy.

- The government's new move to apply price-control measures to online food and parcel delivery services could heap pressure on operators already suffering from losses, while riders would be at risk of having their share of revenue diminished, say industry executives.

- The banking industry's bad loans are seen climbing higher for the rest of the year, but the central bank says their capital buffers are strong enough to withstand the challenge even if the economy shrinks by 8.1% this year.

- Banks' outstanding balance in savings accounts at the end of June jumped 14% from the end of last year, showing money continued to pour into deposits as they are perceived a safe haven amid economic uncertainties and despite rock-bottom interest rates.

- Fund inflows into extra units of the Super Savings Fund were estimated to have reached 10 billion baht before the one-time investment incentive lapsed on June 30, says the Association of Investment Management Companies.

- Thailand's manufacturing production index in May climbed slightly from April to 80.3, but was still down by 23.1% year-on-year. The improvement was mainly attributed to the easing of the lockdown, though overall production remained weak.

- Consumer sentiment picked up for a second straight month in June, boosted by businesses reopening and state relief and economic stimulus schemes.

- Thailand's R&D spending is expected to drop to 166 billion baht, or 1.1% of GDP this year, weighed down by the pandemic impact, says the National Higher Education Science Research and Innovation Policy Council.

- Given the contentious debate about whether the country should join the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP), Thailand is unlikely to be able to submit a formal request to join the controversial pact within this year.

- The closure of the budget airline NokScoot is unlikely to have a significant impact on the domestic aviation industry due to international flight restrictions, say brokerage firms.

- Kasikornbank (KBANK) expects to set aside additional loan-loss provisions for the remainder of this year to strengthen its capital buffer.

- SET-listed Bangkok Dusit Medical Services (BDMS), Thailand's largest private hospital network, has entered into an agreement with China-based Ping An Health Insurance, in which CP Group is the largest shareholder, to tap the lucrative Chinese medical tourist market.

Coming up: Canada will release June PMI on Tuesday and the Reserve Bank of Australia will announce its interest rate decision.

- China will release June inflation data on Thursday, Germany will release May trade figures and the euro zone nations will gather for a Eurogroup meeting in Brussels.

Stocks to watch: UOB Kay Hian Securities Thailand recommends companies expected to report good Q2 performance, such as SCC, IVL, PTL, THRE and STA. Recommended defensive stocks are CPALL, ADVANC, INTUCH, RATCH, SSP and SUPER. Second-half recovery plays include EASTW, WHAUa, WHAUP, CPF and TU.

DBS Vickers Securities Thailand recommends firms poised for a third-quarter recovery, among them AMATA, BGRIM, CPALL, DELTA, TISCO and TASCO.

Technical view: DBS Vickers sees support at 1,300 points and resistance at 1,400. Maybank Kim Eng sees support at 1,350 and resistance at 1,400.