Recap: Global shares ended the week on a downbeat note despite a bounceback in European business activity as concerns flared over intensifying China-US tensions, while gold approached its all-time high of US$1,920 per ounce.

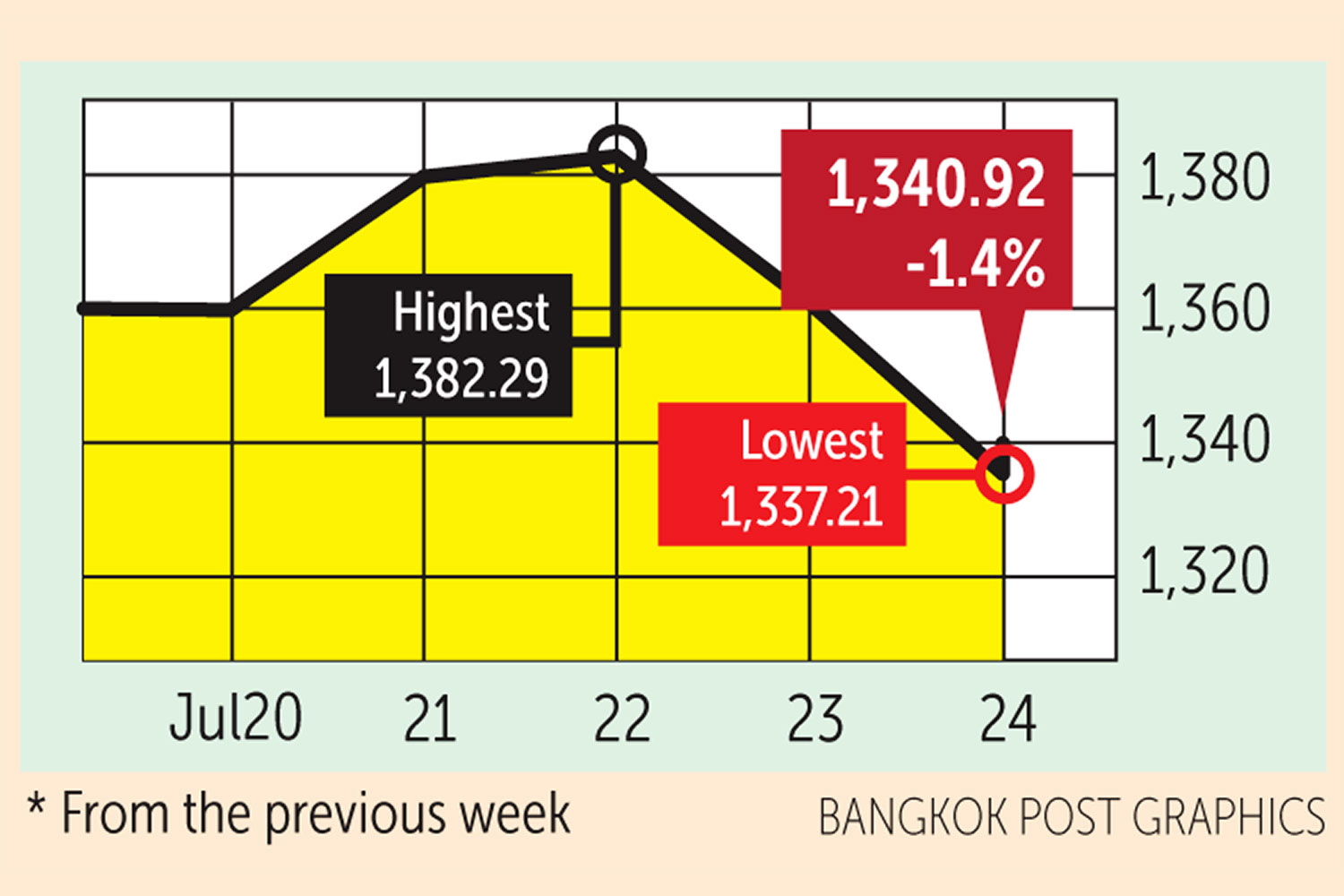

- The SET index moved in a range of 1,337.21 and 1,382.29 points before closing at 1,340.92, down 1.4% from the previous week, in daily turnover averaging 59.43 billion baht.

- Retail investors were net buyers of 11.2 billion baht. Foreign investors were net sellers of 6.6 billion, institutional investors offloaded 3.8 billion and brokerage firms sold 753.3 million worth of shares.

Newsmakers: Two new studies offered new hope of a potential coronavirus vaccine. One trial among more than 1,000 adults in Britain found that a vaccine induced "strong antibody and T cell immune responses" against the virus. A separate trial in China involving more than 500 people showed most had developed widespread antibody immune response.

- US-Chinese relations, already tense over the pandemic and Beijing's crackdown in Hong Kong, deteriorated further on Wednesday as Washington ordered the closure of the Chinese consulate in Houston on spying allegations. Beijing retaliated yesterday by closing the US consulate in Chengdu.

- China blasted Britain's decision to suspend its extradition treaty with Hong Kong over Beijing's recent imposition of a sweeping national security law on the territory.

- South Korea has fallen into recession from the impact of the pandemic. Asia's fourth-largest economy saw its GDP fall by a worse-than-expected 2.9% year-on-year in the second quarter, the steepest decline since 1998.

- EU leaders on Tuesday approved a landmark stimulus package to fight the aftershocks of the coronavirus outbreak, with the first-ever bloc-wide borrowing programme worth up to 750 billion euros.

- Japan will begin granting re-entry to foreign residents stranded abroad as it eases its travel ban. Talks will begin soon for further travel relaxation for residents of 12 countries including Thailand.

- A Malaysian court on Wednesday ordered former Prime Minister Najib Razak to settle 1.69 billion ringgit in unpaid taxes for the seven years while he was in office.

- The Bank of Thailand says it has not intervened in the baht for any competitive trade advantage and its foreign exchange transactions have been in line with rapid capital movements.

- Thailand does not need financial assistance from the IMF because of the country's strong economic fundamentals and the financial sector, says the central bank.

- The domestic gold price hit a record for the fourth consecutive day on Thursday, surging to 28,150 baht for a one baht-weight gold bar.

- Most financial institutions reported lower first-half net profits and higher bad loans, mainly from higher provisions for loan losses, in line with rising loan delinquency prospects.

- Domestic car sales shrank for a 13th straight month in June, dropping 32.6% from a year earlier to 58,013 vehicles, as the virus outbreak hit demand, the Federation of Thai Industries.

- Thailand's rice exports are likely to plunge to 6.5 million tonnes this year, the lowest in a decade, from an earlier projection of 7.5 million because of a spate of negative factors, says the Thai Rice Exporters Association.

- The pandemic will likely leave up to 8 million people in a workforce of about 38 million unemployed by the end of this year, says the Federation of Thai Industries.

- Response to the domestic tourism stimulus programme has been slow as limited supply and price gouging marked the first two days of bookings, prompting the government to allowed non-licensed hotels to join the scheme this week. The cabinet has also expanded subsidies on purchases by travellers from Monday to Thursday to stimulate weekday travel.

- Tourism-related businesses are at a tipping point after more than 30% of them have exited the market, with many set to follow, according to the Tourism Council of Thailand.

- Two candidates, one an insider and the other an external applicant, have been shortlisted to become the next Bank of Thailand governor. The names will be forwarded to the finance minister for a decision, and then to the cabinet. Incumbent Veerathai Santiprabhob is stepping down on Sept 30, having decided not to seek a second term.

- Construction of Thailand's first floating storage regasification unit for liquefied natural gas is expected to be approved soon by the board of the Electricity Generating Authority of Thailand.

- PTT Exploration and Production (PTTEP) and its business partners have reached a US$14.9-billion agreement with creditors to push ahead with a liquefied natural gas (LNG) facility development project in the Rovuma Offshore Area 1 of Mozambique.

- The duty-free retail giant King Power expects sales to plummet by 50% this year to about 90 billion baht, largely because of the impact of the pandemic.

- SET-listed Khonburi Sugar (KBS) is delaying the commercial operation of its new biomass-fired power plant in Nakhon Ratchasima because of the impact of the pandemic, but plans to launch a 2.8-billion-baht infrastructure fund next month to fuel investment expansion plans.

- Best Inc, a Chinese logistics firm backed by Alibaba, plans to invest 300 million baht in the second half to strengthen its Best Express unit in Thailand.

Coming up: Germany will release the July business climate survey on Monday and the US will release June durable goods orders.

- The US Federal Reserve will announce its interest rate decision on Thursday. Q2 GDP data for Germany and the US will be released the same day.

- Q2 GDP data will be announced on Friday for the euro zone, France, Italy and Spain. Due the same day are Japan's July consumer confidence index, China's July manufacturing PMI and US personal income and spending for June.

Stocks to watch: Capital Nomura Securities recommends firms expected to post good Q2 results, among them TASCO, CPF, TU, TFG, AP, DOHOME, TOA, JMT, WICE, TPCH, SC, ICHI, OSP and XO. Firms poised to benefit from the economic slowdown or distressed asset management are JMT, BAM and CHAYO.

- DBS Vickers Securities Thailand recommends fundamental stocks with Q3 growth potential such as AMATA, BGRIM, CPALL, DELTA, TISCO and TASCO. High dividend-yield stocks include KKP, TISCO, LH, TPRIME, LALIN, AIMIRT, WHART, DIF, JASIF and SENA.

Technical view: Maybank Kim Eng Securities Thailand sees support at 1,320 points and resistance at 1,365. DBS Vickers sees support at 1,310 and resistance at 1,380.