Recap: Chinese stocks edged up and European shares recovered from their lowest levels in a month, while Asian currencies were on course to end July with their best performance in months, as the US dollar tumbled on worries over a second Covid-19 outbreak derailing the US economic recovery.

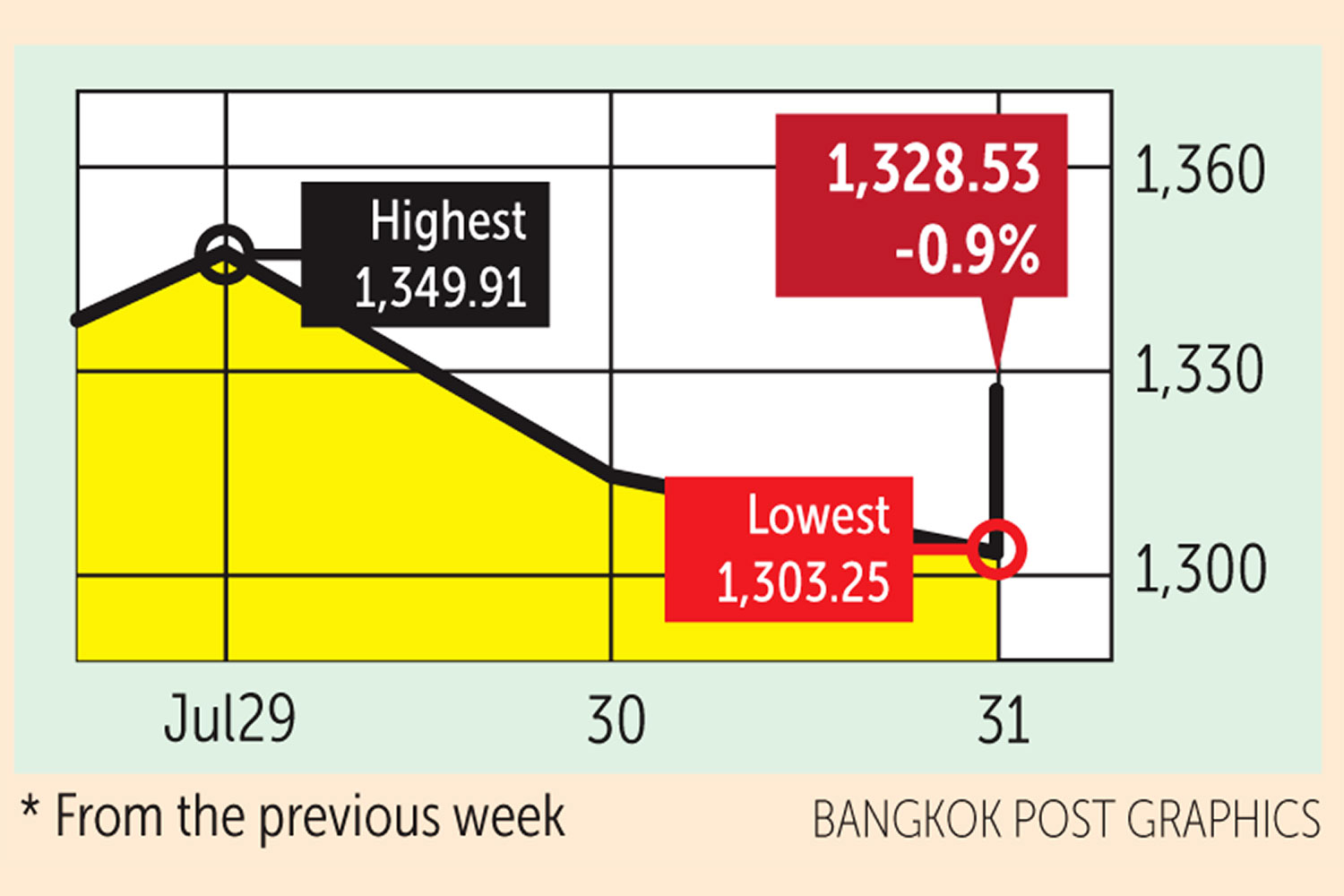

The SET index moved in a range of 1,303.25 and 1,349.91 points this week before closing yesterday at 1,328.53 points, down 0.9% from the previous week, in daily turnover averaging 61.5 billion baht.

Retail investors were net buyers of 5.3 billion baht. Institutional investors were net sellers of 3.5 billion, brokerage firms offloaded 1.7 billion and retail investors sold 76.5 million baht worth of shares.

Newsmakers: A resurgence of Covid-19 cases in countries where the disease was beginning to recede is causing anxiety. Vietnam started mass testing in Hanoi and banned gatherings in Ho Chi Minh City after reporting 45 new infections in Danang. Prime Minister Nguyen Xuan Phuc vowed to "act more swiftly and more fiercely" to control the outbreak, the first in three months.

- China reported 127 new cases on Thursday, 112 of them in the far northwestern region of Xinjiang. And Victoria state in Australia recorded 627 new infections on Thursday as health officials started examining data from Melbourne's lockdown to determine what is going wrong.

- The United States has doubled its investment -- to nearly US$1 billion -- to expedite development of a potential Covid-19 vaccine by the American firm Moderna, which on Monday begins the decisive final phase of clinical trials.

- Hong Kong authorities yesterday postponed the Sept 6 legislative elections for a year, citing concerns about a resurgence in coronavirus cases. Earlier they had barred 12 activists including Joshua Wong from seeking electoral office and arrested four others over social media posts under the new Beijing-imposed security law.

- Former Malaysian prime minister Najib Razak faces at least 12 years in prison after being convicted of all seven charges related to the looting of the state investment fund 1MDB. He is out on bail pending an appeal.

- Boeing suffered a bigger-than-expected loss in the latest quarter and signalled additional job cuts as it contends with the protracted air travel downturn. ANA of Japan also reported a record quarterly loss exceeding $1 billion.

- Huawei of China overtook Samsung to become the world's top smartphone seller in the second quarter on the back of strong domestic demand, the industry tracker Canalys said.

- With vast monetary easing by the Federal Reserve pushing the US dollar lower against many currencies, gold is scaling new heights, reaching $1,958 an ounce in the spot market on Thursday, nearly $40 above its previous record set in 2011. The local price has reached 29,000 baht per baht weight (15.2 grammes).

- The manufacturing production index (MPI) dropped by 17.66% in June from a year earlier, led by lower production of cars, petroleum and tyres, the Industry Ministry said.

- The economy is forecast to shrink by 8.5% this year as the pandemic dampens exports and foreign tourist arrivals, says the Fiscal Policy Office.

- Thailand's exports are likely to shrink by as much as 13.5% this year, the worst showing in a decade, if a Covid-19 vaccine is not available this year, according to the Center for International Trade Studies.

- The cabinet on Wednesday approved the appointment of Sethaput Suthiwart-Narueput as the next governor of the Bank of Thailand. He will succeed Veerathai Santiprabhob at the end of September.

- The Bank of Thailand is considering severing the link between gold trading and the baht as a way to limit the currency's gains without incurring criticism by the US of foreign-exchange manipulation. Local traders say they are open to quoting prices in dollars if it will help stability.

- The debt burden from the rice pledging scheme of the Yingluck Shinawatra government has declined by more than half, says the Public Debt Management Office. The amount outstanding is now about 211 billion baht and will take around eight more years to be paid off.

- Overall oil consumption is likely to contract by a record 8.7% this year, to 144 million litres per day on average, from 157 million last year, because of the Covid-19 impact, says the Department of Energy Business.

- The "We Travel Together" campaign may be extended to the end of the year, while travel bubbles for foreign tourists could start to materialise in October, says the Tourism and Sports Ministry. Inbound tour operators want a clear decision on travel bubbles so they can prepare marketing campaigns, saying 80% of them may exit the market if no new tourists arrive this year.

- The delivery app Line Man says it will merge with Wongnai, a restaurant review platform, while securing a fresh capital investment worth US$110 million from BRV Capital Management to bolster the new entity.

- Shares of MAI-listed Silicon Craft Technology Plc (SICT), a radio frequency identification microchip R&D firm, soared 200% on their debut on Wednesday, closing at 4.14 baht, against the IPO price of 1.38 baht.

- A large drop in revenue and profit is compelling PTT Exploration and Production Plc (PTTEP) to focus on diversification into artificial intelligence, robotics and the supply and value chain of liquefied natural gas.

- The Airports of Thailand (AOT) board has resolved to extend a 6-month credit term payment to 12 months for businesses and airlines affected by the Covid-19 pandemic at airports.

- Siam Cement Plc (SCC) has reported a 9% drop in revenue to 201 billion baht in the first half this year because of the impact of Covid-19 and lower prices of chemical products.

Coming up: Japan will release final first-quarter GDP data on Monday and China will release July manufacturing PMI. On the same day, Thailand will announce July manufacturing PMI and business confidence.

- The Reserve Bank of Australia will announce its interest rate decision on Tuesday, and the country's June trade figures will also be released.

- The Bank of Thailand's Monetary Policy Committee will announce its interest rate decision on Wednesday and the Commerce Ministry will announce July inflation. Elsewhere, Canada and the US will release June trade figures.

- The Bank of England and the Reserve Bank of India will hold policy meetings on Thursday, while Thailand will announce July consumer confidence and unemployment.

- Germany will release June trade figures on Friday and the US will release July non-farm payrolls.

Stocks to watch: Tisco Securities says stocks expected to report good performance and pay interim dividends include DCC, BCH, CPF, SMPC, TASCO, TU and TVO. Domestic tourism stimulus beneficiaries are ERW, BJC and CPALL. Firms poised for profit recovery over the next 12 months are CPALL, HMPRO, BBL, KKP, BAM, AEONTS, SCC, CK, SEAFCO and BEM. Defensive stocks shielded from Covid-19 impact are CPALL, BJC, HMPRO, CPF, DTAC, INTUCH, TRUE, BDMS, BAM and RATCH.

Capital Nomura Securities recommends firms expected to post good Q2 results: TASCO, CPF, TU, TFG, AP, DOHOME, TOA, JMT, JMART, WICE, TPCH, SC, ICHI, OSP and XO. Top picks for August are BDMS, ICHI, TASCO, TU, SPALI, SMT and WICE.

Technical view: Capital Nomura sees support at 1,290 points and resistance at 1,333. DBS Vickers Securities Thailand sees support 1,300 points and resistance at 1,360.