The Office of the Insurance Commission's (OIC) board approved a revision of its risk-based capital (RBC) calculation last Friday, expected to go into effect from Dec 31 this year following a review process.

The new calculation will discount the risk charge of equity investment hedging, and the correlation between assets and insurance risk will be adjusted down to 25%.

This is intended to improve the industry's capital adequacy ratios (CAR), which have been declining for months across insurance types after the OIC changed its calculation last year to "RBC2", a decline compounded by the financial crisis' downward impact on equities.

Chayanin Kerdpholngarm, assistant secretary-general of OIC, said the new version (RBC 2.1) will be discussed through a hearing with business stakeholders in September, then should go into effect starting Dec 31 this year.

The revision is two-fold -- first it will revise derivative hedge transactions to protect the risk of an equity investment portfolio and can be included as a discount in the RBC calculation. Previously buying derivatives to hedge equity investment risk was not taken into account in the calculation.

Secondly, diversification based on correlation between asset risk and insurance risk will be adjusted from 75% down to 25%, equal to the European standard, but higher than Singapore where the correlation is zero (where the two factors are not related).

"When the discount obtained from diversification-based assets is small, capital funds will drop accordingly," Ms Chayanin said.

The higher the correlation between asset risk and insurance risks, the higher the range of CAR for insurers, especially in a bearish economy.

"The correlation-based values from March to June are likely to have increased," she said. "Therefore, we set a conservative threshold of 25% initially."

For this reason, Ms Chayanin said the board decided to collect data and analyse the first half of 2021 following the change in RBC, then update the situation accordingly and start another review process.

According to OIC data, at the end of the first quarter the average CAR for life insurance firms was 295%, declining from 362% at the end of 2019.

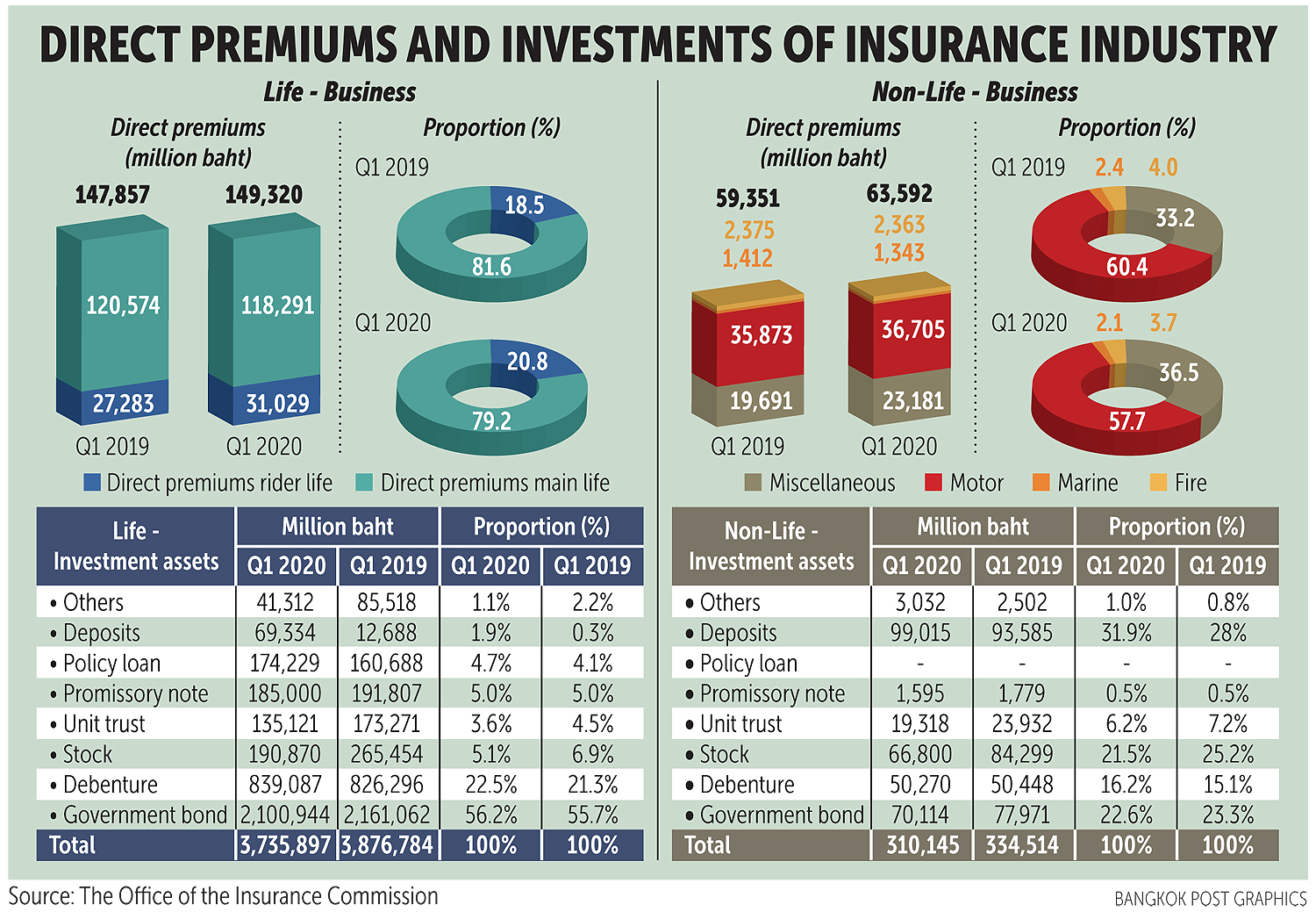

Life insurance premiums declined slightly to 79.2% from 81.6% over the first quarter last year. The rider premium was 20.8%, an increase from 18.5% as riders required lower risk charges.

The industry average investment in government bonds took up the major portion of 56.2%, followed by debentures at 22.5%, stocks 5.11%, promissory notes 4.95%, policy loans 4.66%, and the remainder in unit trusts, deposits and others.

For non-life insurance, the average CAR was 304% at the end of the first quarter of 2020, picking up slightly from 285% at the end of 2019.

Motor insurance contributed 57.7% of the non-life market, down from 60.4% over the first quarter of last year, miscellaneous insurance was 36.5%, up from 33.2%, fire insurance was 3.72% and marine insurance 2.11%.

Investments in deposits contributed the largest portion at 31.9%, up from 28%, followed by stocks at 21.5%, down from 25.2%, government bonds at 22.6% and debentures at 16.2%.