Recap: Asian equities were mixed yesterday following another blow-out session on Wall Street, with new vaccine hopes and central bank largesse offset by a well-below-forecast US jobs reading and tensions between Washington and Beijing.

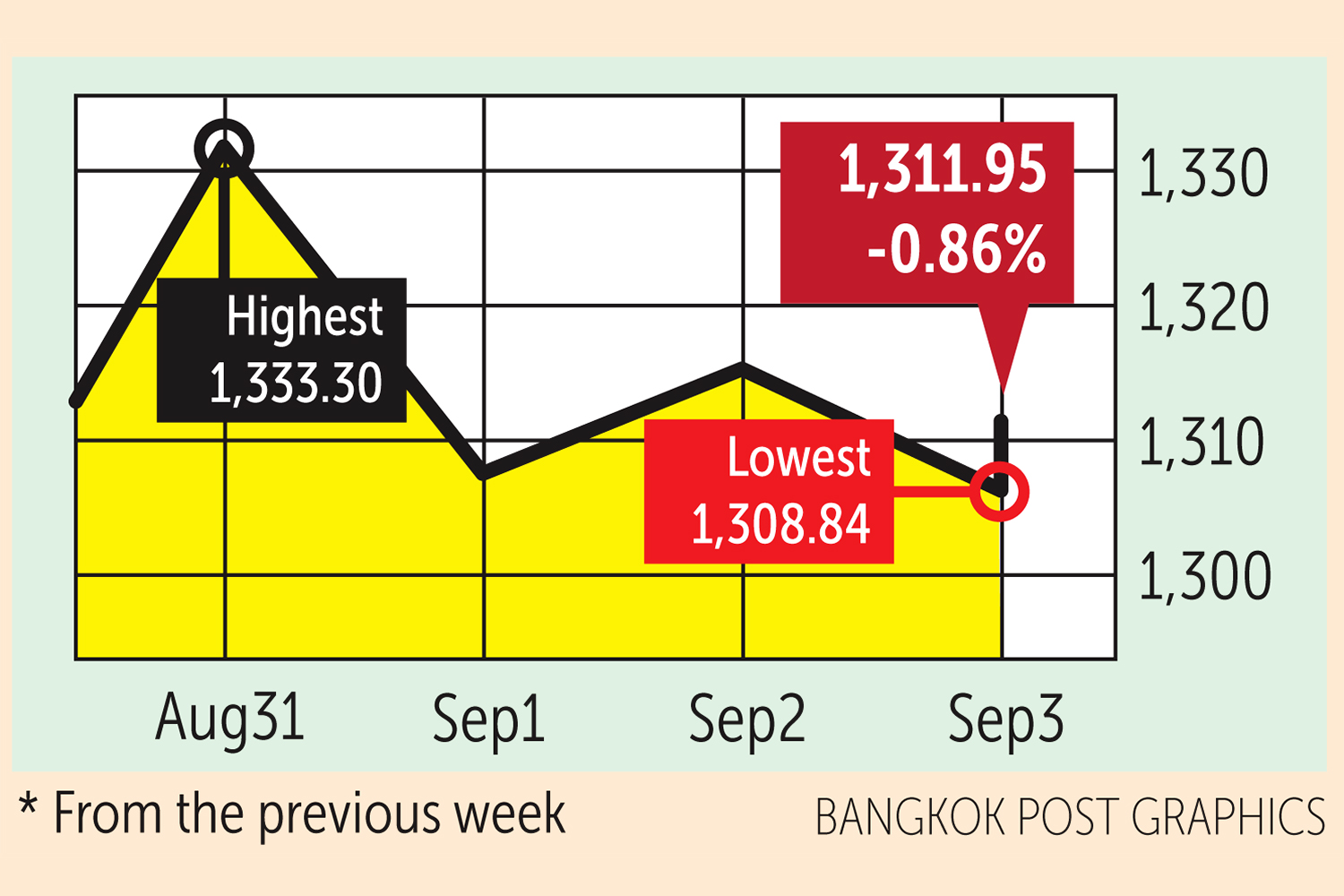

The SET index moved in a range of 1,308.84 and 1,333.30 points this week before finishing the holiday-shortened week at 1,311.95, down 0.86% from the previous week, in daily turnover averaging 49.17 billion baht.

Retail investors were net buyers of 9.26 billion baht, local institutions bought 1.66 billion and brokerage firms purchased 267.01 million baht worth of shares. Foreign investors were net sellers of 11.18 billion baht.

Newsmakers: India is fast becoming the world's new virus epicentre, setting a record this week for the biggest single-day rise in cases. The country of 1.3 billion is on track to move ahead of Brazil into second place as soon as the weekend -- and ultimately pass the US -- as the site of worst outbreak globally.

- Malaysia will block citizens of India, Indonesia and the Philippines from entering the country starting from Monday as a Covid-19 precaution. The restrictions will affect those with long-term passes, students, expatriates, permanent residents as well as family members of Malaysians.

- Japan and Taiwan have agreed to reopen their borders for newly arriving expats and other long-term residents from Tuesday.

- Chief cabinet secretary Yoshihide Suga has emerged as the clear frontrunner to become Japan's next prime minister. The ruling Liberal Democratic Party will vote on Sept 14 on a successor for Shinzo Abe, who resigned late last month for health reasons.

- Australia has fallen into recession for the first time in three decades and Brazil's economy shrank by almost 10% because of the coronavirus, leaving a recovering China as the only major nation recording economic growth at the moment.

- Recession-hit Argentina has managed to restructure 99% of $66 billion in debt issued under foreign legislation, said Economy Minister Martin Guzman.

- The Chinese military is pressing to double its 200-plus nuclear warheads within a decade with the ability to launch them aboard ballistic missiles by land, sea and air, the Pentagon said in a report.

- India said its troops clashed with Chinese solders along their contested Himalayan border, the latest skirmish in a conflict that has simmered since May.

- Vietnam is working on a plan to resume international flights from Sept 15 to and from six Asian cities: Guangzhou, Seoul, Vientiane, Phnom Penh, Taipei and Tokyo. Those arriving must still undergo two weeks of quarantine, unless the duration of their visit is under 14 days. The country has not yet reopened to tourists.

- Cash-strapped AirAsia Group Bhd said it would begin charging customers a fee to check in at airport counters, in part to encourage them to minimise physical contact with staff.

- Facebook threatened on Tuesday to block users and media organisations in Australia from sharing news stories if a government plan to force digital giants to pay for content goes ahead.

- The Indian oil-to-telecoms conglomerate Reliance is acquiring the retail, wholesale and logistics businesses of the Future Group for $3.38 billion, strengthening its presence in the country's hugely competitive e-commerce sector.

- Democratic nominee Joe Biden retains his lead over President Donald Trump in national polls two months before the US election, with neither candidate seeing a bounce in surveys after their party conventions. Significantly, a poll by Fox News, Mr Trump's biggest cheerleader, puts Mr Biden ahead in three states the incumbent must win.

- The euro zone's rebound from its deepest downturn on record faltered in August as growth in the bloc's dominant service industry almost ground to a halt, PMI figures showed on Thursday, suggesting the long road to recovery will be bumpy.

- Finance Minister Predee Daochai threw in the towel after just 26 days in the job, reportedly over a conflict with deputy Santi Prompat, a veteran politician, over who should head Excise Department. Prime Minister Prayut Chan-o-cha has accepted Mr Predee's resignation.

- The Industry Ministry insists the government needs a budget to finance its legal fight with the Australian gold mining company Kingsgate after a House committee vetting the fiscal 2021 budget slashed its 111-million-baht request. Kingsgate has taken the country to international arbitration over the military junta's order to close its Chatree gold mine in Phichit province.

- Lukewarm domestic demand has forced hotels to cash in on advance bookings by offering extended promotions for guests who seek holidays next year.

- The government plans new cash handouts of 3,000 baht to some 15 million people, as well as job measures, in a new 68.5-billion-baht package to support the virus-battered economy.

- The Thailand Convention and Exhibition Bureau is creating an escort team to help ease the process of visiting the country as more business activities start to take place.

- Thailand has introduced a new Thai overnight repurchase rate (THOR), starting with a transaction between Kasikornbank and CIMB Thai Bank. The new rate is positioned as an alternative reference rate in response to the cessation of the London interbank offered rate (Libor) at the end of next year.

- The Bank of Thailand is allowing unsecured loan borrowers to use collateral stemming from mortgage loans for debt restructuring through debt consolidation, with lower interest rates charged.

- The Office of the Insurance Commission will revise its risk-based capital calculation, with the changes expected to take effect from Dec 31 following a review process.

- Thai Union Group Plc (TU), along with a consortium of investors, has announced plans to purchase a majority equity stake in the US seafood restaurant chain Red Lobster from Golden Gate Capital.

- SET-listed Gulf Energy Development, Thailand's top power generator by capacity, plans to spend 100 billion baht over six years on various energy development projects to increase revenues by over 400%.

Coming up: Japan and the euro zone will release final Q2 GDP figures on Monday. Due the same day are Thai inflation data, Australian business confidence and Germany trade figures.

- Australia will announce September consumer confidence on Wednesday, China will release August inflation data and the Bank of Canada will announce its interest rate decision.

- Britain will release July trade figures on Friday and the US will release August inflation data.

Stocks to watch: Capital Nomura Securities suggests investing in stocks that have a positive earnings outlook in the third quarter such as TU, CPF, TASCO, ICHI, HTC, JMT, WICE, BEM, SMT, KCE and HANA. September portfolio recommendations are BBL, BDMS, CRC, ICHI, TOA and THANI.

- DBS Vickers Securities Thailand recommends top fundamental picks for the third quarter including CK, BGRIM, CPALL, CHG, DELTA, TISCO and TASCO. As the stock market remains highly volatile, the firm suggests increasing the weighting of high-dividend stocks in the portfolio. Recommendations are KKP, TISCO, LH, AIMIRT, WHART, DIF, JASIF, SENA, LALIN, NOBLE and ROJNA.

Technical view: Capital Nomura sees support at 1,301 points and resistance at 1,330. DBS Vickers sees support at 1,280 and resistance 1,340.