Recap: Asian stocks inched up although most bourses continued to struggle amid worries about a resurgence in coronavirus cases and lingering disappointment that central banks merely affirmed their monetary support this week, without promising any new stimulus.

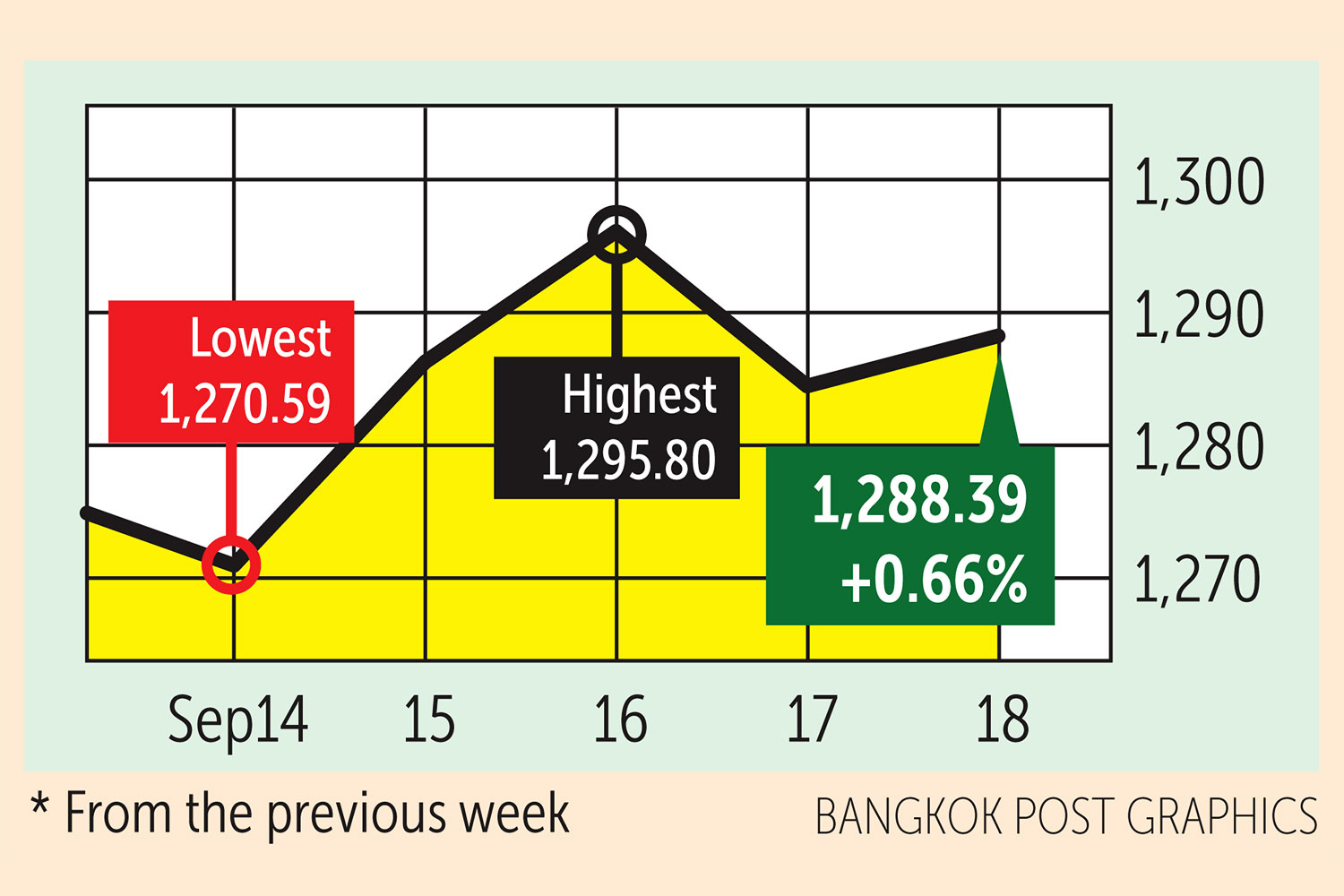

The SET index moved in a range of 1,270.59 and 1,295.80 points this week before closing yesterday at 1,288.39, an increase of 0.7% from the previous week, in daily turnover averaging 46.6 billion baht.

Retail investors were net buyers of 3.4 billion baht and brokerages purchased 883.6 million. Foreign investors were net sellers of 3.6 billion and institutional investors sold 609.1 million baht worth of shares.

Newsmakers: US President Donald Trump expressed renewed confidence that a viable Covid-19 vaccine would be ready by October, contradicting a top administration health expert and facing fierce criticism from his Democratic election rival Joe Biden.

- Five leading vaccine candidates now in late-stage trials will be able to supply 5.9 billion doses, enough to inoculate nearly 3 billion people, a report by Oxfam says. But 51% of those jabs have been spoken for up by wealthy countries representing just 13% of the world's population, it added.

- As the number of global coronavirus cases moved past 30 million, the drug maker Moderna, as well as Pfizer and its partner BioNTech, took the unusual step of releasing their plans for analysing vaccine-trial data. They were responding to concern that the race for a safe and effective product is being politicised.

- British Prime Minister Boris Johnson said he has full confidence that Britain and the EU will avoid a potentially disastrous "no deal" at year-end. But he refused to back down on a proposed law that overrides parts of the Brexit treaty relating to trade in Northern Ireland, which could torpedo trade talks with the European Union.

- A top US diplomat arrived in Taiwan on Thursday, the highest-ranking State Department official to visit in 40 years, in a further sign of Washington's willingness to defy China and its campaign to isolate the self-ruled island.

- Japan's ruling party on Monday elected chief cabinet secretary Yoshihide Suga as its new leader, making him all but certain to replace Shinzo Abe as the country's next prime minister.

- New Zealand's economy plunged into recession for the first time in a decade, posting a record contraction in the June quarter due to the coronavirus pandemic, as Prime Minister Jacinda Ardern heads into next month's general election.

- Developing Asia's coronavirus-battered economy will shrink for the first time since the early 1960s, with GDP next year still seen below pre-pandemic projections even as growth recovers, according to the Asian Development Bank.

- Alibaba Group Holding Ltd is in talks to invest US$3 billion into the Southeast Asian ride-hailing giant Grab Holdings Inc, Bloomberg reported.

- The Tourism Ministry has pledged to bring the first batch of international tourists to Thailand by October, under the special tourist visa (STV) programme approved by the cabinet this week. The agency predicts that around 14,400 tourists a year would visit under the STV programme, generating about 12.4 billion baht in revenue.

- The government should aim high in the domestic tourism market by targeting at least 200 million trips next year if Thailand wants to extend a lifeline to the industry, says the Association of Domestic Travel.

- Business closures spiked 38.4% year-on-year from June to July, with even higher figures anticipated in the second half attributed to the economic downturn from the pandemic, says the Economic Intelligence Centre of Siam Commercial Bank.

- Car production in the first eight months of 2020 plunged 42% year-on-year to 812,721 units, but manufacturers still have another four months to boost sales in order to reach a target of 1.4 million units, says the Federation of Thai Industries.

- Investor confidence in Thailand for the three months to November has sunk into bear territory amid a sluggish economic recovery and flaring domestic political tensions.

- Business sentiment rose for the third straight month in August, the highest in 12 months, boosted by the relaxation of coronavirus lockdown measures, higher farm product prices, and recovering sales of pickups, electrical appliances and agricultural machinery.

- The Federation of Thai Industries plans to ask the Bank of Thailand to extend the debt moratorium scheme, which will end next month, for another two years. The extension would require businesses to pay 10% of interest payments for six months to alleviate the fear of higher bad loans.

- Deputy Finance Minister Santi Promphat aims to seek a credit line of 60 billion baht from the 1-trillion-baht loan decree to back guarantees for small and medium-sized enterprises through the state-owned Thai Credit Guarantee Corporation.

- Prime Minister Prayut Chan-o-cha says he will name a new finance minister next month, assuming he can find a candidate willing to take the post. Former banker Predee Daochai quit on Sept 1, just 26 days after being appointed, reportedly because of conflict with his deputy, veteran politician Santi Promphat, over appointments to key ministry departments.

- Disbursement of the fiscal 2021 budget is expected to be delayed by only a month and will not affect public investment, says finance permanent secretary Prasong Poontaneat.

- The Finance Ministry predicts a new 51-billion-baht cash handout will cover one-third of the population, including 14 million holders of state welfare cards, and help sustain private consumption in the final quarter.

- The Bank of Thailand is not expected to ease its policy interest rate for the remainder of this year as more government stimulus measures reduce the likelihood of further rate cuts, says the Thai Bond Market Association.

- The amount of coins in circulation is expected to decline by 30-40% in five years because of the increase in cashless transactions, says the Treasury Department.

- Thai Airways International received court approval for its debt restructuring on Monday. The company, which had total liabilities of 332.2 billion baht at the end of June, faces one of its biggest challenges in its 60-year history as the pandemic hits the country's tourism-dependent economy.

- Competition in the local online grocery delivery market is expected to escalate as Foodpanda enters the segment with its Pandamart service. It faces tough competition from GrabMart, linked with the super-app Grab, and Line-backed HappyFresh.

- Central Retail Corporation (CRC), the SET-listed retail arm of Central Group and the country's biggest mall operator, has launched a tender offer for all shares of the Office Mate and B2S operator COL Plc, at 19 baht per share for a combined 12.16 billion baht.

- A long-delayed IPO by PTT Oil and Retail Business (PTTOR), the country's biggest fuel retailer by revenue and volume, was given the green light by the Securities and Exchange Commission. Up to 2.7 billion shares will be sold to general investors, while the remaining 300 million shares are reserved for existing shareholders of PTT.

Coming up: China will announce the one-year loan prime rate on Monday and Thailand will release August trade figures on Tuesday.

- The Bank of Thailand's Monetary Policy Committee will announce its interest rate decision on Wednesday. Due the same day are Germany's October consumer confidence outlook and Spain's Q2 GDP growth data.

- Germany will release the September business climate survey on Thursday. On Friday, Britain will announce September consumer confidence and the US will release August durable goods orders.

Stocks to watch: Tisco Securities recommends accumulating shares of companies whose prices lag the market and have prospects for a second-half profit recovery. Suggested picks are AEONTS, BAM, BDMS, BEM, CPALL, KTC, MTC and WHA. The firm also recommends selective buys of stocks offering dividend yields of more than 4% per year including DCC, EASTW, INTUCH, LH, QH, NYT, PROSPECT, RATCH and TVO.

DBS Vickers Securities Thailand believes the healthcare sector has growth potential in the approaching high season of the healthcare cycle. Suggested picks are BCH, BDMS, CHG, RJH and RPH. It recommends avoiding banks as net profit will be dented by higher capital reserves, with results of stress tests to be released next month.

Technical view: DBS Vickers sees support at 1,250 points and resistance at 1,310. Maybank Kim Eng Securities Thailand sees support at 1,272 and resistance at 1,310.