Recap: US and European stock markets and oil came under heavy selling pressure after the US president tested positive for Covid-19, while demand for traditional safe-haven investments surged.

The SET index moved in a range of 1,231.11 and 1267.67 points this week before closing at 1,237.54, down 0.6% from the previous week, in daily turnover averaging 45.52 billion baht.

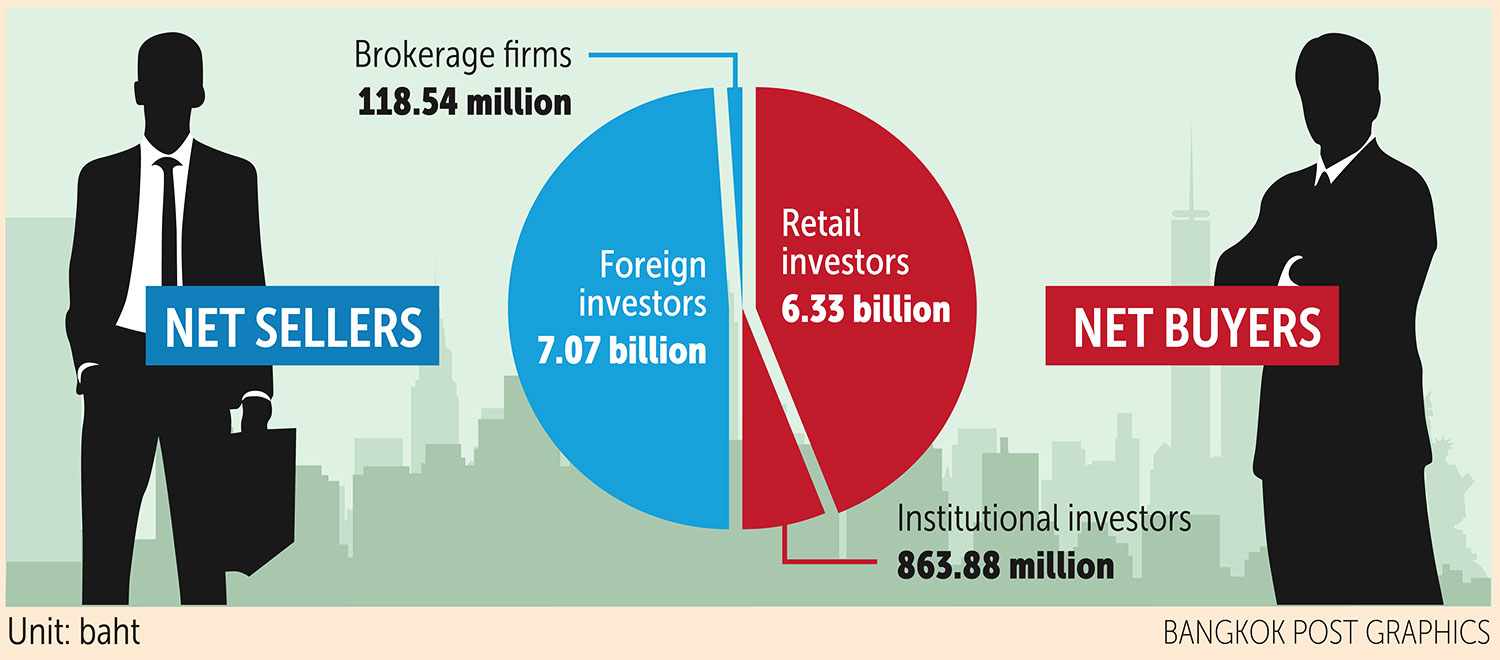

Retail investors were net buyers of 6.33 billion baht and institutional investors purchased 863.88 million. Foreign investors were net sellers of 7.07 billion baht and brokerage firms offloaded 118.54 million baht worth of shares.

Newsmakers: US President Donald Trump has tested positive for Covid-19, forcing him to cancel campaign trips and adding new volatility to the already tense US election. Challenger Joe Biden has made the president's mishandling of the Covid crisis a key election issue. The two men are scheduled to debate again on Oct 15, following a nasty exchange earlier this week.

- The global death toll from Covid-19 has risen past 1 million, a bleak milestone in a pandemic that has devastated the global economy and changed the way people live.

- Malaysia yesterday recorded the biggest single-day increase in new coronavirus cases, at 287, since the outbreak began, as authorities consider whether it needs to bring back movement limits. All of the cases were found in the country and not among travellers from overseas.

- Donald Trump paid just US$750 in federal income tax in 2016, the year he ran for the US presidency, and in 2017, his first year in the White House, The New York Times reported.

- A Canadian judge has reserved a decision on a complaint by lawyers for Huawei executive Meng Wanzhou. They argue that the US misled Canada about the Chinese executive's alleged crimes to secure her detention on foreign soil as Washington presses for her extradition.

- The European Commission is pressing ahead with legal action against Britain over its plans to override parts of their withdrawal agreement, raising the stakes at a critical moment in talks that will determine whether the two sides can avert an economically ruinous rupture.

- TikTok has avoided a government-ordered block on new downloads in the US after a judge issued a temporary injunction. But Treasury Secretary Steven Mnuchin has warned that Oracle's deal for the Chinese-owned video-sharing app cannot be closed unless terms meet US security requirements, including holding code in the United States.

- Trading in Tokyo's stock markets, which are among the world's biggest, was halted for the whole day Thursday after the system was hit by one of its worst ever glitches.

- The Tourism Authority of Thailand (TAT) says the initiative to welcome foreign tourists back under the Special Tourist Visa (STV) programme will proceed as planned, though it might be delayed. A group of 120 tourists from China is scheduled to arrive in Phuket under the STV scheme within this month, though the timing of the visit remains unclear.

- The new finance minister will be announced next week, says Prime Minister Prayut Chan-o-cha. The position has been vacant for a month after banker Predee Daochai quit after just 26 days.

- Thailand's economy could contract by as much as 10.4% this year as trade and tourism are severely dampened by Covid-19, with the ongoing drought and floods adding to the woes, says the World Bank.

- JP Morgan Thailand, meanwhile, says the GDP contraction could be less severe than feared because of the resumption of economic activity, but the government should be more assertive in shoring up public and private consumption to offset depressed exports and tourism

- The economy is expected to return to growth in the second quarter next year, supported by government stimulus measures and a low-base effect, says the Bank of Thailand.

- The tourism index has plunged for two consecutive quarters, with 10% of operators already closing and 537,280 employees laid off, according to the Tourism Council of Thailand.

- Airlines want a definitive answer from government on whether they will receive soft loans, which they requested six months ago, after Deputy Prime Minister Supattanapong Punmeechaow said they might not receive aid unless they adhere to strict conditions related to retaining staff.

- Uncertainty over domestic politics and economic policy, along with external factors over the past 14 years have cost the country 4.9 trillion baht in GDP, according to a research paper by the Bank of Thailand, Chulalongkorn University and the Puey Ungphakorn Institute for Economic Research..

- The government's consumption stimulus measures and 50:50 co-payment scheme are expected to get 81 billion baht circulating through the economy, boosting GDP by 0.25%, says the Finance Ministry.

- Life insurance premiums shrank 5.7% in the first half while non-life premiums witnessed 1.9% growth, with both segments seeing an increase in gross profits thanks to a sharp reduction in claims during the lockdown period.

- The Electrical Vehicle Association of Thailand vows to make charging outlets for electric vehicles (EVs) more widespread, similar to ATMs, to help the government reach its goal to increase EV production to 30% of total automotive output by 2030.

- Hoteliers have to accept feedback, says the Thai Hotels Association, commenting on a case that has made worldwide headlines after a Koh Chang sort sued an expat guest for defamation over negative comments that followed a bad review on Tripadvisor.

- The government is preparing to introduce fresh stimulus measures, particularly aiming to spur spending by middle- and high-income earners and boost private investment. Deputy Prime Minister Supattanapong Punmeechaow said the new measures will be based on a co-payment principle and include the features of the Taste-Shop-Spend scheme, which involves cash giveaways and cash.

- Higher export opportunities are seen for Thai premium rice in the EU after the bloc allowed imports of 24,883 tonnes with zero import tariffs for October.

- Thailand climbed one spot to 39th out of 63 countries in the digital competitiveness ranking for 2020 released by the IMD World Competitiveness Center.

- Organisers of the Thailand Mobile Expo are considering whether to shelve the country's flagship device trade show next year following a slowdown in the handset market because of the pandemic.

- SET-listed Finansia Plc (FNS) will acquire all shares of MK Real Estate Development Plc (MK) in a deal worth around 2.8 billion baht. FNS will acquire 892.58 million shares at the tender offer price of no more than 3.10 baht each.

- SET-listed developer SC Asset Corporation recorded 38% year-on-year growth in low-rise house presales in the first nine months, driven by units priced higher than 10 million baht.

- In keeping with projections that the economy will take about three years to fully recover from the impact of the pandemic, Berli Jucker (BJC) has lowered its retail investment for the next three years.

Coming up: Australia will release September business confidence on Monday, euro zone finance ministers will meet, and Thailand will announce September inflation.

- The Reserve Bank of Australia will announce its interest rate decision on Tuesday. Due the same day are trade figures from Australia, Canada and the US.

- Germany will release August trade figures on Thursday. Also due are minutes of the most recent Fed meeting, a Bank of England Financial Policy Committee statement and Thailand's September consumer confidence. Britain will release August trade figures on Friday.

Stocks to watch: SCB Securities suggests selective buying of small-cap equities that have a track record of net profit growth in the second half including AUCT, IIG, PRIME, SVI, WICE, ZIGA, XO, ILINK, NOBLE and IP. The brokerage also recommends high-quality defensive stocks with low market prices such as BAM, BDMS, CBG, EGCO and GFPT.

Finansia Syrus Securities recommends an emphasis on defensive stocks as part of the portfolio strategy for October, with selective buying of shares in businesses capable of generating sustainable income. Recommended picks are ADVANC and GULF, while high-growth stocks are identified as ORI, SAPPE and SYNEX.

Technical view: Maybank Kim Eng Securities Thailand sees support at 1,200 points and resistance at 1,255. Finansia Syrus sees support at 1,200 and resistance at 1,250.