Recap: Global shares struggled to avoid losses for a fourth consecutive day following weakening business activity in the euro zone, while German and British 10-year bond yields touched multi-month highs. Asian markets were mixed amid fear of inflation spurred by the economic recovery.

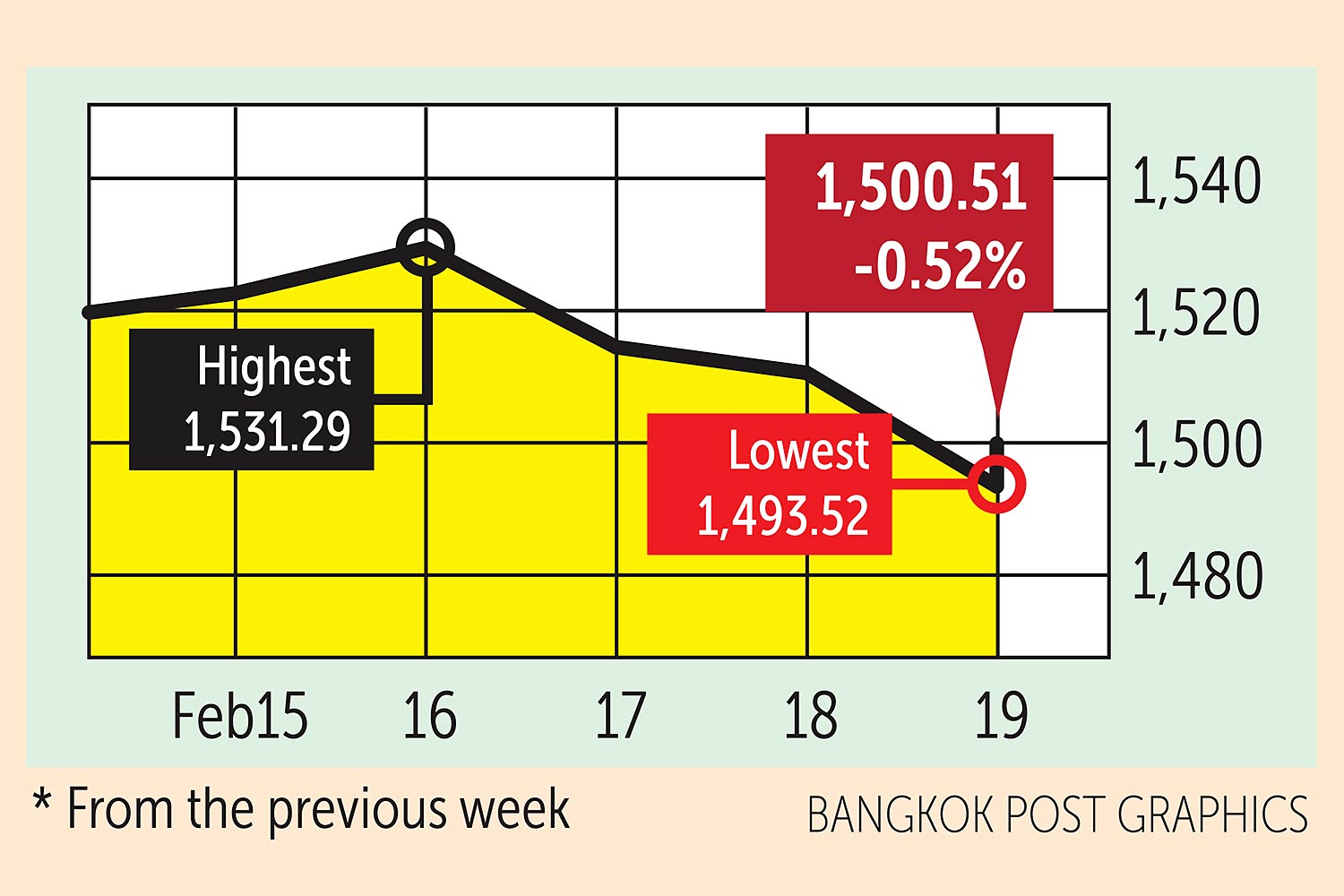

The SET index moved in a range of 1,493.52 and 1,531.29 points this week before closing yesterday at 1,500.51 points, down 0.52% from the previous week, in daily turnover averaging 95.83 billion baht.

Retail investors were net buyers of 9.81 billion baht this week and brokers purchased 947.84 million baht. Institutional investors were net sellers of 8.22 billion baht and foreign investors offload 2.54 billion baht worth of shares.

Newsmakers: The giant US fund manager BlackRock is the latest big name to jump on the bitcoin investment bandwagon, sending the price of the cryptocurrency past $52,000 on Wednesday.

- Bitcoin mania has been one of the factors pulling down gold, which is off to its worst start in 30 years. The metal, which surged past $2,000 an ounce last year on pandemic-induced safe-haven buying, low interest rates and stimulus spending, has dropped more than 6% in 2021 and was trading below $1,800 this week.

- Brent crude prices briefly surpassed $65 a barrel for the first time in a year as a cold blast that has pummelled US oil production escalated into a global supply shock.

- Pentagon officials said Wednesday that about one-third of the US military are declining to receive the Covid-19 vaccine, despite significant coronavirus infection levels in the forces.

- Japan's economy shrank in 2020 for the first time in more than a decade as it was battered by the coronavirus but the contraction was less than expected and it ended the year on a strong note thanks to a pickup in exports and huge government support.

- Japan began its Covid-19 vaccination programme on Wednesday, with health workers in Tokyo being given Pfizer-BioNTech jabs. Authorities are trying to solve a shortage of special syringes that could lead to the waste of millions of doses of the Pfizer vaccine, which must be stored at super-cold temperatures.

- Getting a Covid-19 vaccination in Indonesia will be mandatory for eligible citizens, the government said. Citizens who refuse the vaccine could face fines or the suspension of social assistance and administrative services.

- Malaysia says it has secured access to enough coronavirus vaccines for its entire population, as it prepares to begin its inoculation programme by the end of this month.

- The Thai economy is expected to expand this year more slowly than previously forecast because of a resurgence in coronavirus cases, the central bank said, singling out the uncertain recovery in tourist arrivals as a "major risk" to the medium-term outlook.

- The National Economic and Social Development Council (NESDC) has downgraded its economic growth forecast for this year to between 2.5% and 3.5%, from a range of 3.5% to 4.5% forecast in November, mainly because of the new Covid wave.

- The government is speeding up work to establish a revolving fund to help sectors harmed by free trade agreements, including the Regional Comprehensive Economic Partnership (RCEP), the world's biggest FTA, which Parliament ratified last week.

- The Bank of Thailand is preparing to issue accounting and financial reporting standards for specialised financial institutions (SFIs) to better reflect borrowers' actual risks and strengthen financial fundamentals of banks.

- The cabinet has approved a 50-billion-baht low-interest loan programme to assist informal workers and small and medium-sized enterprises related to the tourism sector.

- The Public Debt Management Office (PDMO) is preparing to increase the issuance of government savings bonds sold digitally, potentially reaching 10 billion baht if there is adequate demand.

- The Finance Ministry is considering allowing other state-owned banks besides Krungthai Bank to help handle offline registration for the popular Rao Chana (We Win) programme. KTB branches were overwhelmed this week as huge crowds of people without smartphones queued to join the financial assistance scheme.

- The Securities and Exchange Commission (SEC) is putting cryptocurrencies and digital assets on the top of its agenda this year. It aims to establish a clear direction for the regulation of emerging digital assets in order to support skyrocketing trade volume and to protect lawful users and the public.

- The Tourism Authority of Thailand (TAT) wants to establish Thailand as the first country to welcome cryptocurrency holders by targeting Japanese tourists in the initial phase.

- Krungsri Consumer expects its non-performing loan (NPL) ratio for personal loans to peak at 4% this year, attributed to the second-wave outbreak.

- Charoen Pokphand Group has begun rebranding its Tesco Lotus branches nationwide to Lotus's. The move follows the completion of the conglomerate's US$10.6-billion acquisition of the UK retailer's businesses in Thailand and Malaysia.

Coming up: Thailand will release January trade figures on Monday, China will announce the one-year prime lending rate and Germany will release the February Ifo business climate outlook. Britain will release January jobless data and the euro zone will release January inflation on Tuesday. Due Wednesday are German fourth-quarter GDP and US new home sales for January.

- Thailand will release December retail sales, the January coincident index, private investment and consumption data on Thursday; Germany will release the March consumer confidence outlook and the US will release January durable goods orders.

- Thailand will release January unemployment, new car sales, industrial production and current account data on Friday, Japan will release January retail sales, and US will release January personal income and spending.

Stocks to watch: DBS Vickers Securities recommends buying stocks with good fundamentals, among them ADVANC, KBANK, PTT, PTTEP, RJH, SCC, SCGP, STGT, TQM and UTP.

UOB Kay Hian Securities suggests hemp-themed stocks, including DOD, SAPPE, TIPCO, MALEE, STA and PTG. It also recommends firms whose share prices could be lifted by mass vaccinations and the economic recovery for short-term investment. Its picks are BBL, SCB, AWC and MINT.

Technical view: DBS Vickers sees support at 1,480 points and resistance at 1,530. Maybank Kim Eng Securities sees support at 1.478 and resistance at 1,520.