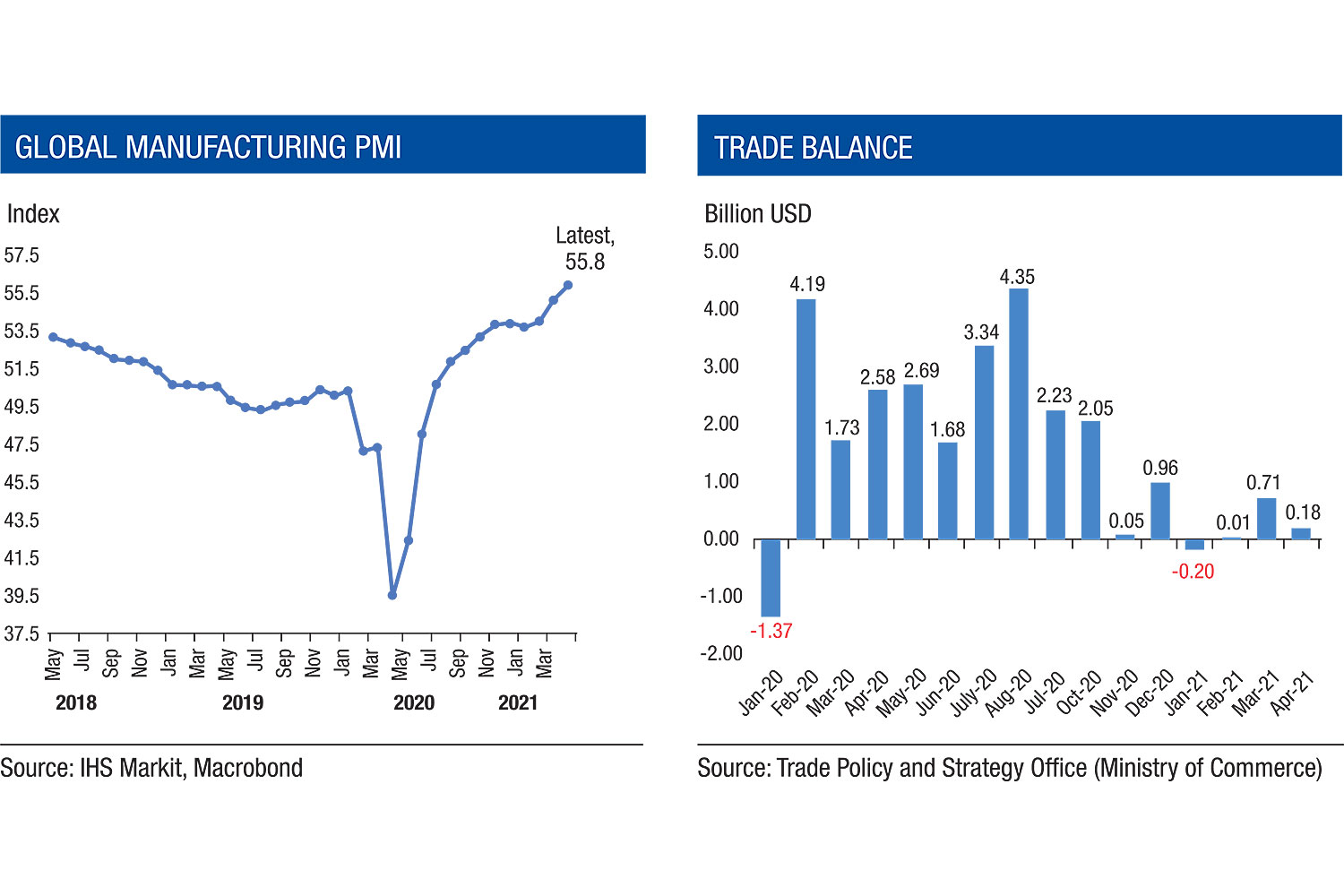

In April 2021, Thailand’s export value surpassed $20 billion for the third month in a row, with a growth rate of 13.09% YoY, the largest gain in 36 months. Excluding gold, oil-related products, and weaponry, April exports skyrocketed 25.7% YoY. Rising export trend is consistent with Global Manufacturing PMI level of 55.8, the highest in 11 years. Nevertheless, imports climbed 29.8% YoY to $21.25 billion, resulting in a comparatively small trade surplus of $182.48 million — a collapse from April 2020 surplus of over $ 2.5 billion. Perhaps, it’s worth noting that last year’s export performance was distorted, and therefore severely understated, by the global lockdown.

Automobile, equipment and parts were the main drivers for a strong Thai export performance in April— accounting for around 5% of export growth contribution. The COVID-19 pandemic hit the automotive sector on both the demand and supply sides, making 2020 a terrible year for the industry. The demand side was affected by lockdown restrictions and uncertainty over future income stability, decimating automobile demand. On the supply side, many car manufacturers had temporarily shut their production to help combat the spread of COVID-19 last year.

By contrast, the automotive industry is expected to recover strongly this year as the major car markets, such as China, the US and Europe experience a sharp bounce back in activity due to economic reopening. In Thailand, exports of automobiles, equipment, and parts increased by 135.86% YoY this month. However, a new wave of outbreak in Asia and a shortage of semiconductors (chips) are likely to weigh on the automotive industry in the coming quarters.

Further, the strong demand for “Work from home” and COVID-19 protection products continued to underpin the export recovery. (Contribution to growth: Electronics: 3.1%, Electrical appliances: 3.8% and Rubber products: 2.3%). New digital lifestyle for work, school, and entertainment has led to a surge in demand for electronics products since last year. (Computer, equipment and parts +28.72% YoY in April 2021)

Similarly, Demand for medical products such as rubber gloves surge, as indicated by a sharp increase in export of rubber products. (+55.5% YoY). Sri Trang Gloves Thailand (STGT), the largest glove producer in Thailand, expects a 20% increase in rubber glove sales this year.

Most Asian exports continued to recover in April from their low base value last year when the pandemic hit. Among ASEAN-5 countries, exports from Indonesia and Singapore surged 51.9% and 34.9% YoY, respectively. South Korean exports were up 59.1% for the first 20 days of May as demand for chips and cars remained strong. According to Capital Economics, South Korean exports will remain elevated for some time as clients rush to refill their stockpiles. Based on strong correlation between the two countries’ exports, we expect Thai exports to expand by more than 20% YoY in May.

Nevertheless, there remains a risk that Thai exports, in fact global trade, will be disrupted by the global shipping container shortage. Exporters are now looking for alternative routes such as land, rail and air to deliver their goods to the consumers. Strong demand for lockdown-related products, electronics and medical equipment will underpin export growth for the coming months. But rising freight charges threaten to undermine the trade boom. For example, the freight charge for shipment from Thailand to Shanghai for a 20 foot container rose to $350 from $200 from two years ago. That said, we also expect export to cool down in the second half of 2021 as economic reopening will shift consumption patterns away from goods to services like travel, concerts, cinemas and dining out.