Recap: Global stocks steadied on Friday, but the MSCI Index of emerging markets was poised for a 2.9% weekly fall, while emerging market currencies also retreated.

Global bond funds recorded their biggest weekly inflow in over three months as investors rushed for safety on rising concerns over China's economic recovery and the fast-spreading Delta variant of Covid-19.

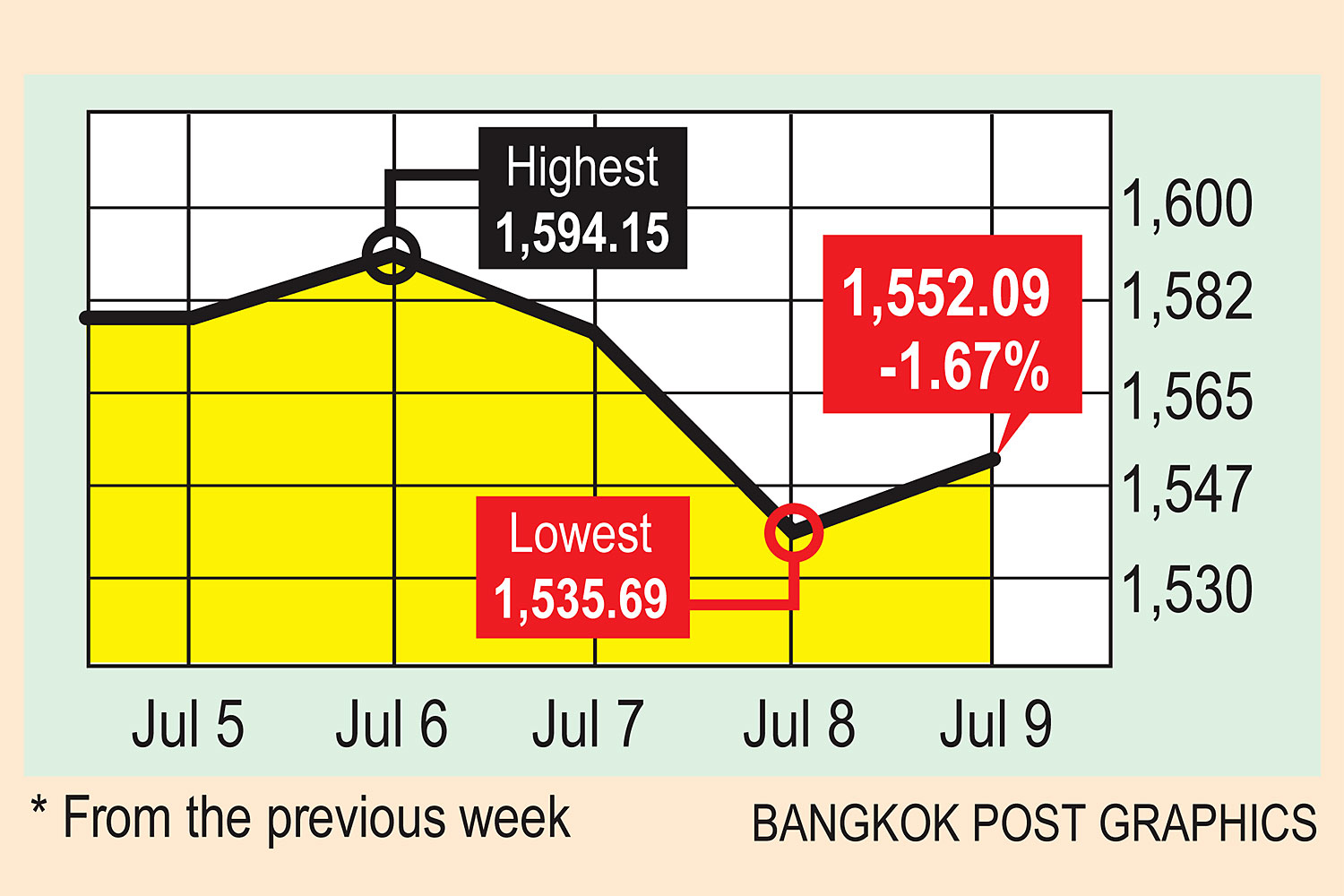

The SET index moved in a range of 1,535.69 and 1,594.15 points this week before closing yesterday at 1,552.09, down 1.67% from the previous week, in daily turnover averaging 81.28 billion baht.

Retail investors were the only net buyers of 5.39 billion baht. Institutional investors were net sellers of 3.72 billion, foreign investors sold 1.6 billion and brokerages offloaded 79.84 million baht worth of shares.

Newsmakers: The global Covid-19 death toll has crossed 4 million, with the worst of the pandemic only just starting to hit some parts of Asia and cases rising again in the United States.

- Oil prices headed for their biggest weekly loss since April as a dispute between Saudi Arabia and the United Arab Emirates derailed plans by Opec+ nations to boost output in August and beyond to meet rising demand.

- Businesses spent $1.74 trillion on mergers and acquisitions involving US companies during the first six months of the year -- the highest amount in more than four decades -- as finance chiefs tapped into cheap funding options to acquire technologies, services and other assets.

- The Chinese ride-hailing giant Didi Global is being sued by US shareholders after a crackdown by Beijing triggered a 20% slump in its share price days after its New York debut. Chinese regulators reportedly urged the firm to delay its $4.4-billion IPO in order to address security concerns, advice the company did not heed.

- Prices to ship containers from Asia to the US and Europe are rising at a historic pace as cargo owners bid up rates in a search for transport capacity that shipping industry executives expect to remain tight for the rest of the year.

- Gold prices have risen for seven straight days, pushing back above $1,800 an ounce as US bond yields continued to sink and Fed minutes showed policymakers want a more solid economic recovery before setting a timeline for paring back stimulus.

- Huawei has struck a licensing deal that will allow use of its 4G technologies in connected vehicles manufactured by Volkswagen Group, the Chinese tech giant said on Wednesday.

- Zeng Yuqun, the founder of the world's biggest electric-vehicle battery maker, has overtaken Alibaba founder Jack Ma as China's richest person with a fortune of $49.5 billion, according to Bloomberg.

- The online marketplace Bukalapak aims to raise as much as $1.5 billion in an initial public offering in Jakarta, the first of Indonesia's tech unicorns to tap the country's stock market.

- Visa Inc says its customers spent more than $1 billion on its crypto-linked cards in the first half of this year. It is partnering with 50 cryptocurrency platforms to make it easier to convert and spend digital currencies at 70 million merchants worldwide.

- A proposed tax on share sales by individual investors on the SET is part of a broader tax reform agenda, according to Revenue Department chief Ekniti Nitithanprapas. Reuters reported that a rate of 0.11% on monthly volume exceeding one million baht is being considered.

- Tourism authorities expect to attract 2,000 travellers to Koh Samui and its two neighbouring islands in the first month of the "Samui Plus" scheme, which is still slated to begin on July 15, two weeks after the start of the Phuket Sandbox.

- Household debt has hit an 18-year high after rising to 90.5% of GDP in the first quarter. This could slow the recovery as people use their income to repay debt rather than spend on consumption, the National Economic and Social Development Council has warned.

- Thai Credit Guarantee Corporation (TCG) is proposing the Bank of Thailand consider raising the ceiling of TCG-guaranteed loans for pandemic-affected borrowers beyond the current total of 100 billion baht as that level will be reached soon.

- Thailand's economy faced significant downside risks and limited policy room should be preserved for use at the most effective time, minutes of the last Bank of Thailand policy showed on Wednesday.

- The Federation of Thai Capital Market Organizations (Fetco) has suggested the government consider raising the public debt ceiling from 60% of GDP because the country requires more economic relief funds.

- Consumer confidence dropped to a record low in June, dented by surging Covid cases, a slow vaccine rollout and a sluggish economic recovery. Business sentiment also fell to a record low.

- Major Cineplex Group has agreed to sell its 30.36% stake in the community mall developer Siam Future Development (SF) to Central Pattana Plc (CPN) for 7.76 billion baht. CPN will be required to make a tender offer for the remaining SF shares, bringing the total transaction value to 17.8 billion baht.

- AirAsia is aiming to use its strong network in Thailand to speed up the growth of Gojek in the country and put the loss-ridden ride-hailing and delivery app service on the path to profit.

- Factory expansion projects decreased by 70.2% year-on-year to 209 from October 2020 to June 2021, and new factory registrations fell 6.3% to 1,894, according to the Department of Industrial Works (DIW).

- The Commerce Ministry has launched a loan-matching scheme for export-oriented small and medium enterprises facing tight liquidity because of the pandemic.

- Thailand's exports are expected to rise more than 7% in the third quarter from a year earlier and 6% in the final quarter of the year, lifted by higher global demand and a weaker baht, the Thai National Shippers' Council said on Tuesday.

- Total claims for Covid insurance ballooned to 1.77 billion baht as of June 30 from 588 million as of May 15, according to the Office of the Insurance Commission (OIC).

- The state-run Electricity Generating Authority of Thailand (Egat) has joined with PTT Plc to co-invest in a second liquefied natural gas (LNG) receiving terminal project in Rayong as part of new gas supply management.

Coming up: China will release data on new loans on Monday and June trade figures on Tuesday. The US and Germany will release June inflation data on Tuesday, and euro zone finance ministers will meet the same day.

- New Zealand and Canada will announce interest rate decisions on Wednesday, the US will release the June federal budget balance and weekly crude oil inventory data. The same day, Japan and euro zone will release May industrial production and the US will release June producer prices.

- Australia will release June employment figures on Thursday, and China will release June industrial production and second-quarter GDP data. The euro zone will release June inflation and May trade figures on Friday, and the US will release June retail sales figures.

Stocks to watch: Capital Nomura Securities recommends stocks that will benefit from baht weakness with a 1-3% gain in net profits for every one-baht depreciation against the dollar. Picks from the group include TU, CPF, ASIAN, NER, XO and SAPPE. Also benefitting will be electronics firms such as SVI, HANA and KCE. The weak baht will not benefit airline and power generation stocks.

Asia Plus Securities recommends stocks that will recover after the fourth wave of the pandemic has passed or after the lockdown. Its picks include MCS, AEONTS, SPVI, TFG, DOHOME and GPSC.

Technical view: SCB Securities sees support at 1,525 points and resistance at 1,570. Kasikorn Securities sees support at 1,540 and resistance at 1,580.