The price of Bitcoin rose to more than US$64,000 on Tuesday after the US Securities and Exchange Commission greenlit the establishment of a Bitcoin futures-based exchange-traded fund (ETF) on the New York Stock Exchange (NYSE), and traders bet it could drive more institutional investments into cryptocurrencies.

According to Jirayut Srupsrisopa, chief executive and co-founder of Bitkub Capital Group Holdings, the ProShares Bitcoin Strategy ETF debuted on the NYSE on Oct 19 and garnered heavy trading volume from institutional investors, which raised the total market capitalisation of digital assets to $2.6 trillion, from $2 trillion at the start of the year.

Mr Jirayut said many institutional investors and funds had been interested in investing in Bitcoin and other digital assets but were unable to because they lacked the US SEC's approval.

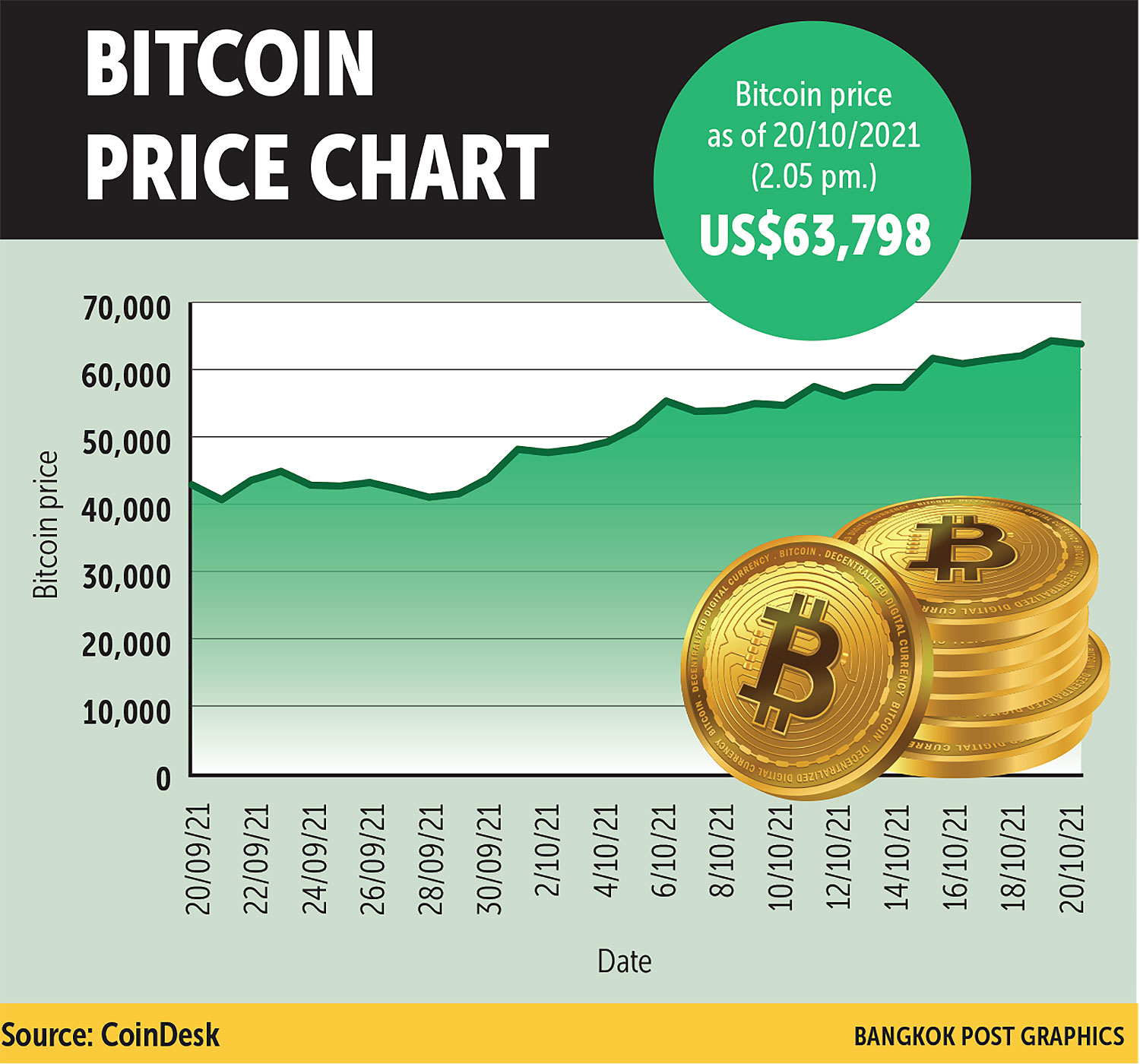

Although the ETF is prohibited from directly investing in Bitcoin, the news of its establishment has greatly raised awareness of the cryptocurrency among global investors over the past month and caused the price to rise by almost 50% from two months ago.

Mr Jirayut said that this year the Bitcoin price had fallen sharply to around $40,000 after the Chinese government banned all digital businesses and Bitcoin mining. However, the news pertaining to the establishment of the ETF has revived investors' interest in the asset.

Mr Jirayut said the current size of the digital asset market stands at around $2.6 trillion, relatively small compared to the asset size of global stock markets, which stands at around $70 trillion.

The digital asset market is still in its infancy and there is plenty of room for growth in the future. Mr Jirayut said Bitcoin and other altcoins will become a key investment in a portfolio, and the price of these coins tends to rise in response to higher demand.

Palakorn Yodchomyan, a co-founder and chief executive of KULAP, said investments in digital assets have a high potential for growth in the future as the technological infrastructure is constantly improving to better serve the digital asset ecosystem.

He said the digital asset market is always evolving, and new dimensions of digital asset investments will emerge. Traders can now invest not only in cryptocurrencies but also in other types of digital assets such as non-fungible tokens (NFT) that currently help Thai and other Asian artists make their artwork available for sale globally, said Mr Palakorn.

Kasikorn Business-Technology Group (KBTG) recently launched KASIKORN X to serve as a new S-curve venture builder supporting startups related to decentralised finance. The company has also debuted Coral, an NFT marketplace platform.

Blockchain technology and internetworking systems in Thailand have rapidly improved and would help support the domestic digital asset ecosystem's growth next year, said Mr Palakorn.

Win Phromphaet, an executive vice-president at Bank of Ayudhya, said investing in digital assets has become increasingly popular. He recommended allocating 3-10% of a portfolio to digital assets in the long term to generate higher returns.

Investors can invest both through digital asset-related funds registered in foreign stock exchanges or local digital asset exchanges, he said.