Muang Thai Life Assurance (MTL) expects its new insurance premiums to grow at least 10% this year, driven by health protection, unit-linked products and wealth management.

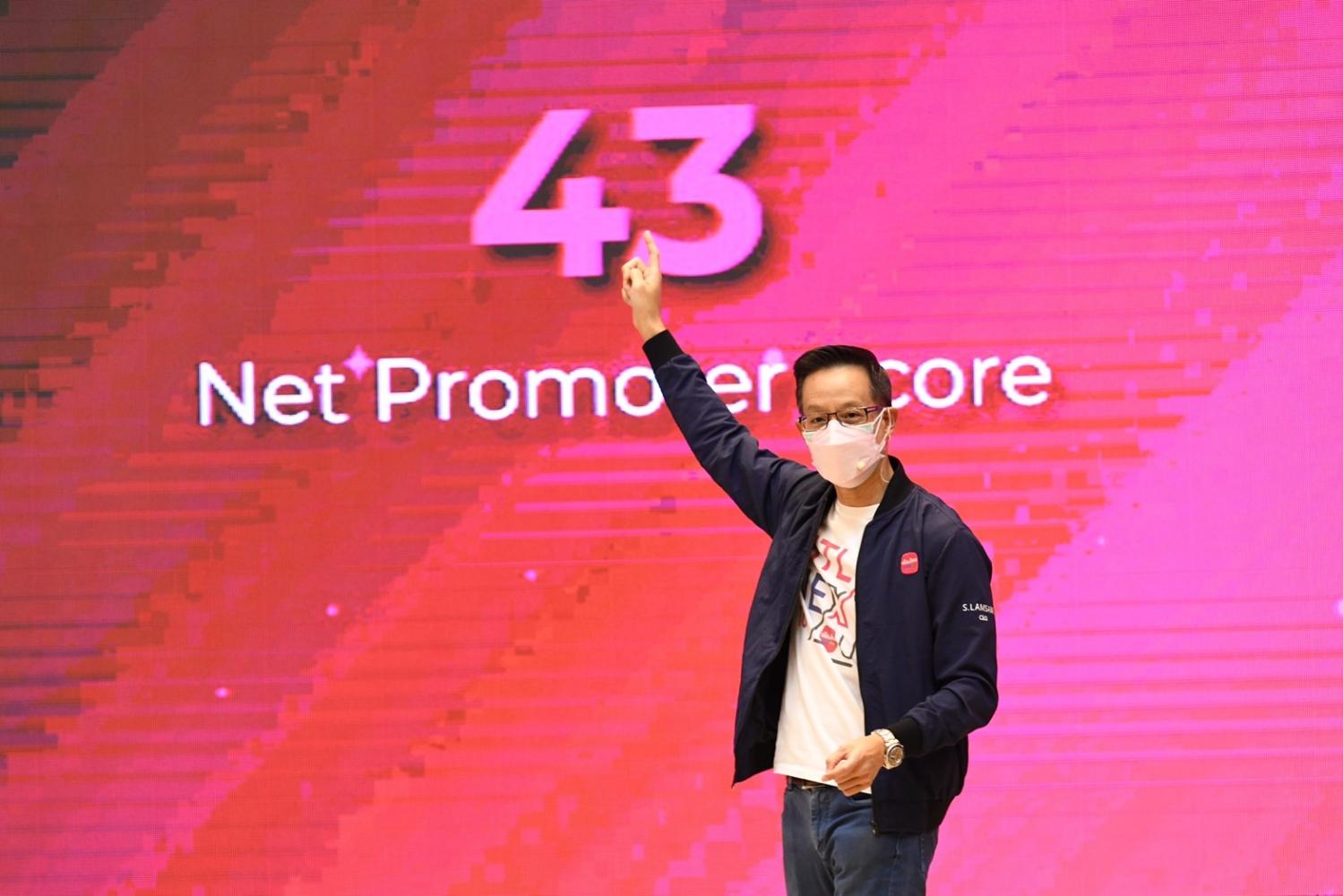

Sara Lamsam, MTL's managing director and chief executive, said the company was less affected by the surge in claims from Covid-19 insurance and continued to see high growth last year as health claims are already included in the general health insurance policy so that the damage was contained.

Mr Sara said the company expects to continue seeing growth this year through its "MTL Next to You" strategy that will allow MTL to fully integrate digital technology into its online sales platform, provide its customers easier and more convenient access to the products and respond to all dimensions of customers' demand for health protection.

MTL is preparing to expand its business and services through alliances that cover all lifestyles into potential foreign markets with high potential for growth such as Asean countries.

The company also aims to become a data- and technology-driven organisation to boost the efficiency of its products and services for customers.

MTL will maintain its position as a market leader in wealth insurance by offering the products and services through more innovative and modern technology, Mr Sara said.

Furthermore, the company will also continue to enhance the health coverage in its life and heath insurance products which are the key factors for the company's strong and sustainable growth, in order to meet customer demand.

For 2021 operating results, Mr Sara said the company saw the highest growth from the sales of unit-linked products which grew 1,116%, followed by protection and investment insurance products which grew 77%, health and critical illness (CI) life insurance products which grew 31% and new insurance premiums which grew 10%.

As of the end of 2021, the company's capital ratio stood at 300%, far above the minimum level of 120%, said Mr Sara.

He said in 2022 the company is aiming for a 10% growth in new premiums, especially for its additional contract life insurance products.

It expects the sales of health and CI insurance, unit-linked products, protection insurance and saving insurance to grow over 10%, 40-50%, 7-10% and 5-7%, respectively.