Despite providing tacit approval for the merger of True Corporation and Total Access Communication (DTAC), the National Broadcasting and Telecommunications Commission (NBTC) has prescribed harsh remedial measures that could mean lower margins for the new firm, according to people associated with the regulator.

The measures are also meant to support reform in the industry, the regulatory sources said.

On Thursday the five-member NBTC board voted 3-2 for the stance that it has no authority to consider approving or rejecting the planned merger, which paves the way for the amalgamation.

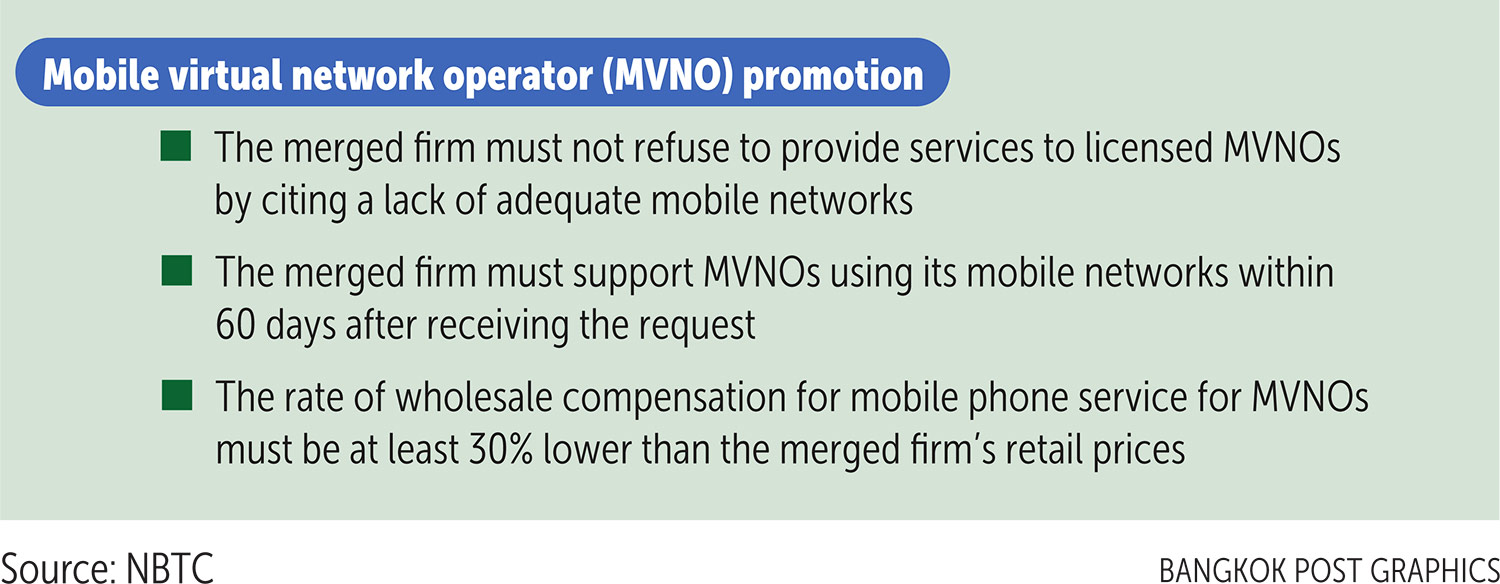

It also issued a raft of measures meant to regulate the merger. Despite being seen by some observers as "weak", the sources maintained they are tough enough to rein in True and DTAC.

The measures include the obligation that True Move H Universal Communication (TUC), a mobile business arm of True, and dtac TriNet (DTN), a mobile service unit of DTAC, must have separate brands of service for three years. They cannot pursue frequency sharing, according to related regulations.

The merged firm will also be required to comply with a price ceiling for average service fees and average cost prices.

The regulator can check the merged firm's structure of costs and service fees to determine average cost pricing, which has to be applied to excess usage of both unbundled and bundled packages.

BITTER PILL

Prawit Leesathapornwongsa, former NBTC commissioner and current advisor to the NBTC chairman, said several conditions in the measures serve as "a bitter pill" for the merging parties.

"It may look weak in terms of blocking the merger procedure, but the conditions are good for regulatory reform of the industry in the long run," said Mr Prawit.

He said various conditions will set a new standard for regulation governing the industry, including Advanced Info Service, the biggest mobile operator.

"The series of measures could dent their margins, while creating benefits for users," Mr Prawit said.

Some important details of the measures could upset the merging parties, he said. The merging parties are obliged to adhere to the NBTC Act's Sections 41 and 44, which mean TUC and DTN cannot engage in frequency sharing, Mr Prawit said.

Additionally, the merger of TUC and DTN requires a future resolution by the NBTC board. The regulator's legal committee was assigned to make suggestions to the board about the issue, he said.

Air Marshal Thanapant Raicharoen, an NBTC board member, confirmed that TUC and DTN cannot pursue spectrum sharing under the related regulation, which states the right to use spectrum is awarded by the NBTC and cannot be shared with others.

The proposed merger also requires forwarding to the NBTC for consideration, he said.

LEGAL CHALLENGES

A source in the telecom industry who requested anonymity said the NBTC board could be at risk of legal action stemming from Thursday's voting process.

Dr Sarana Boonbaichaiyapruck, chairman of the board, used his power as chairman to cast the deciding vote for the 3-2 decision supporting the stance that the NBTC has no power to approve or reject the merger.

The initial vote was split 2-2, with AM Thanapant choosing to abstain.

The source said because this was an extraordinary meeting, not a general agenda meeting, the chairman was unlikely to have the power to cast a second, tie-breaking vote.

AM Thanapant could also face legal action for opting to abstain from the vote, the source said.

Pisut Ngamvijitvong, senior equity research analyst at Kasikorn Securities, said DTAC and True would now be heading for a voluntary tender offer.

However, a petition to the Central Administrative Court by the Thailand Consumers Council and others could pose a challenge to the deal.