The Stock Exchange of Thailand (SET) index plunged the most among Asian bourses Wednesday as investor confidence was rattled by China's tariff retaliation against the US, fuelling prospects of a full-blown trade war between the two largest economies.

The Thai bourse dropped 40.26 points, losing 2.3%, and closed at 1,724.98 in heavy trade worth 93.2 billion baht.

Brokerage firms were net sellers of 3.86 billion baht, with institutional investors dumping 3.86 billion baht worth of shares. On the other hand, retail investors were net buyers of 7.52 billion baht and foreign investors bought 204 million baht.

Large-cap stocks tumbled as investors rushed to reduce equity holdings, with KBANK (-7.8%), KTC (-9.5%) and IVL (-5.8%) hit hardest by the sell-off.

Beijing has struck back against Washington's plan to impose a 25% tariff on 1,300 Chinese products, saying it would place 25% tariffs on 106 American goods, including soybeans, cars and orange juice.

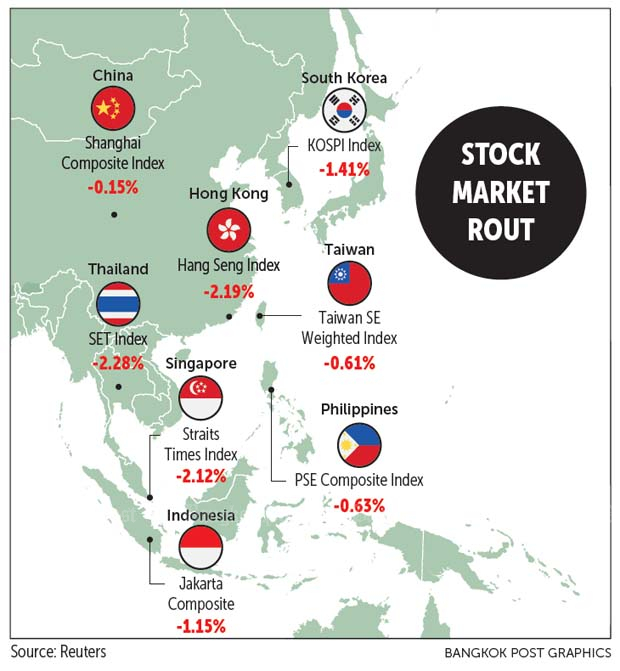

The move prompted negative sentiment across global stock markets, with Hong Kong's Hang Seng index dropping 2.2% and Singapore's Straits Times index falling 2.1%.

Crude oil prices are under pressure from the brewing trade war, while the outlook of the domestic banking sector continues to be negative after a reduction in fee income and the possibility of lower deposit interest, said Jitra Amornthum, head of research at Finansia Syrus Securities.

The New York Stock Exchange has reeled from sagging tech stocks, especially those in the FAANG group (Facebook, Apple, Amazon, Netflix, Google), due to US President Donald Trump's attacks on Amazon's tax payments.

"In this regard, we view that investors continue to bet on domestic and defensive plays, such as the hospital and tourism sectors, at this time because they have moved better and outperformed the market lately," Ms Jitra said. "All the negative news comes from the external front and has no impact on Thailand's corporate performance, so investors should consider accumulative purchases of good stocks after the market correction, with the SET index's rebound projected at 1,730-1,700 points."

SET president Kesara Manchusree said concerns over the looming trade war between the US and China will have a minimal impact on Thailand's exports, as the country's raw material exports to the US market comprise a small amount concentrated mainly in the consumer goods segment.

Thai corporations' and listed firms' exports to China, meanwhile, make up 10% of total annual exports, implying that global tax barriers will not hurt Thai exporters, Mrs Kesara said.

The negative sentiment is deemed a short-term trade effect, she said, as investors are reducing stock exposure and assuming a wait-and-see stance to assess investment incentives.

Vajiralux Sanglerdsillapachai, deputy managing director at Asia Wealth Securities, said the SET's heavy sell-off Wednesday was due to the trade war's spectre and weakening oil prices.

She said stocks poised to benefit from China's tariff imposition on US goods are those associated with soybean production.

Thai Vegetable Oil Plc uses soybeans as raw material for production, while Charoen Pokphand Foods Plc, GFPT Plc and Thai Foods Group Plc are expected to benefit from cheaper prices of soybeans and corn because of a likely oversupply, since the US will not be able to sell its stock to China, creating the need to lower prices to sell these products in other markets, Mrs Vajiralux said.

Thailand may have an opportunity to export chicken to China to fill the void created by China's insufficient domestic production amid high demand, she said.