The upside gain for the baht, Asia's strongest performing currency this year, is limited after rallying since the beginning of this month, propelled by the escalating trade tension between the US and China, says a senior official at Kasikornbank (KBank).

The baht's appreciation is expected to continue until the end of this month because of continuing uncertainties related to the US-Sino trade spat, said Kobsidthi Silpachai, head of capital market research at KBank.

As investors consider the baht a safe haven currency, further offshore funds are expected to flood into Thailand, with the main destination short-term bonds, he said.

On Wednesday the baht stood at 31.59 to the dollar, compared with 32 on May 2.

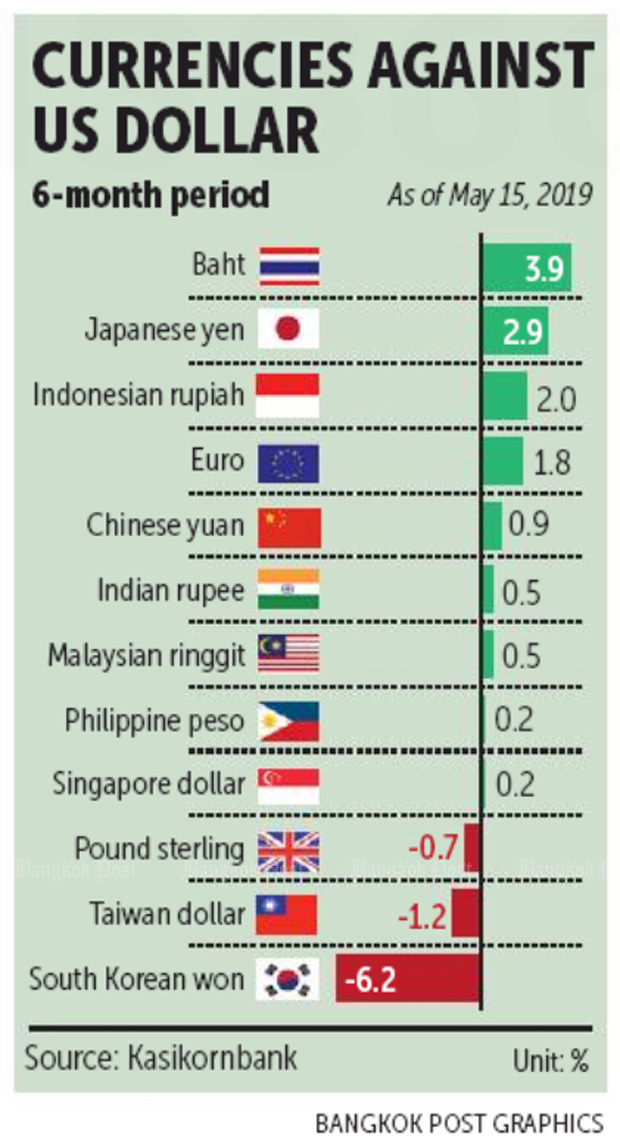

Over the past six months, the local currency surged 3.9% against the greenback, followed by the Japanese yen, which gained 2.9%, the Indian rupee 2%, Chinese yuan 0.9%, and the Indonesian rupiah and Malaysian ringgit both rose 0.5%.

On the other end of the scale, the Korean won weakened 6.2% to the dollar and the Taiwan dollar was off 1.2%.

Mr Kobsidthi said Thailand's current account surplus is a magnet that attracts foreign inflows and this could continue to lend support to the baht.

"The bank is waiting for economic readings, particularly for exports, during the first quarter from the National Economic and Social Development Council before making a decision as to whether it will review the baht forecast," he said.

If the country's merchandise shipments show signs of either flat growth or a contraction, a revision to the forecast is justified, said Mr Kobsidthi.

KBank projects the baht will be at 33 against the greenback at year-end.

He said exports will find difficulty in achieving KBank's forecast of 3.2% growth this year following the higher possibility of outbound shipments contracting in the first half.

Mr Kobsidthi does not expect Thailand to be added to the US Treasury's watch list of currency manipulators, which will be released later this month, pointing out that Thailand's current account surplus is below 2% of GDP.

According to Bloomberg, the US list of possible manipulators will rise to about 20 from 12 countries after the threshold for currency surplus was reduced to 2% from 3% previously.

The report also said Thailand is expected to be included in the expanded watch list.

He hopes the central bank will be able to convince the US to keep Thailand off the list.