Thailand's motorcycle market is projected to stay flat at about 1.8 million units sold this year, says the Federation of Thai Industries (FTI).

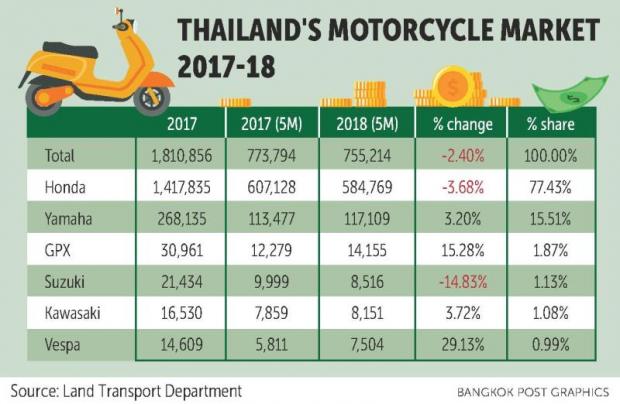

Citing figures from the Land Transport Department, the motorcycle market dropped 2.4% to 755,214 units sold over the first five months of 2018.

Japan's Honda controlled the largest market share with 584,769 units sold, up 3.7%, while rival Yamaha rose 3.2% to 117,109 motorcycles sold.

Thai brand GPX posted a sharp increase of 15.3% to 14,155 motorcycles sold, and Italy's Vespa tallied 7,504 units, a 29.1% gain.

Surapong Paisitpatanapong, spokesman for the FTI's automotive industry club, said the market remains flat because low-income workers have static purchasing power.

Pickup sales grew by 17.4% year-on-year to 171,744 units as a result of higher crop prices, but this factor did not beef up the motorcycle sector, he said.

"The mass segment for motorcycles is for personal use, unlike pickups, which are mostly commercial vehicles," Mr Surapong said. "The club estimates that the motorcycle market is becoming saturated, with 1.7-1.8 million units sold annually at the new level, unlike 2 million as in the past."

The club plans to revise its projections for the motorcycle and car markets in July.

Thailand's motorcycle market exceeded 2 million units sold for the first time in 2011 at 2.007 million, climbing to 2.129 million in 2012, which coincided with a daily minimum wage hike to 300 baht nationwide.

But in 2013, the market dropped to 2.004 million because of bearish economic sentiment, and it has stayed below 2 million since 2014.

Pornada Tejapaibul, managing director of Vespiario Thailand, the authorised importer and distributor of Italian scooters, said the mass market is shrinking, meaning motorcycles priced below 50,000 baht.

But the premium segment, representing 40% of the total market, has performed well; it comprises premium scooters, mid-sized motorcycles, sport bikes and big bikes.

Vespa scooters can claim a monopoly in the premium scooter segment because rival Scomadi sold only 170 scooters from January to May. Mrs Pornada voiced confidence that Vespa would hit its target in Thailand of 18,500 units sold in 2018, up 26.4% from 2017.

"The mass market faces high household debt and tighter hire-purchase loan approvals," she said.