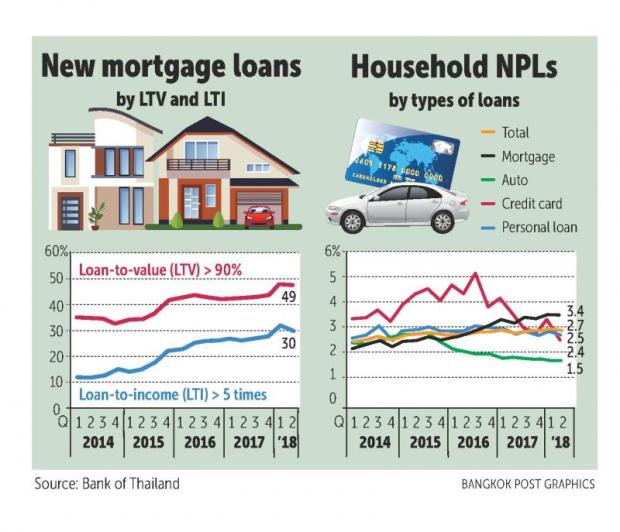

Almost half of new mortgages in the second quarter had a loan-to-value (LTV) ratio of more than 90%, and those with a loan-to-income (LTI) ratio above five times made up nearly one-third, says a senior official at the Bank of Thailand.

The data points to deteriorating credit standards, explaining why the central bank is concerned about mortgage lending. The central bank plans to outline measures to supervise mortgage lending today.

Mortgages with LTV ratios of more than 90% surged considerably to 49% of new housing loans in the second quarter this year, up from around 35% in the first quarter of 2014, said Bank of Thailand assistant governor Jaturong Jantarangs.

The central bank has issued guidance requesting financial institutions avoid providing mortgages with LTV ratios of more than 95% for low-rise residential projects and 90% for high-rise ones. LTV is a lending risk assessment that indicates the ratio of a loan to the value of an asset purchased.

Typically, a loan with a lower LTV ratio bears lower risk for both lender and borrower, as less capital is being borrowed.

He said mortgages exceeding five times a borrower's income accounted for 30% of the total in the second quarter this year, up from just above 10% in the first quarter of 2014.

Mortgages are the only type of consumer loans in which non-performing loans (NPLs) continue rising, said Mr Jaturong.

Mortgage NPLs rose to 3.39% in the second quarter, up from 3.38% in the previous quarter, according to central bank data.

Bank of Thailand governor Veerathai Santiprabhob recently said the central bank has set out measures to rein in mortgage lending after it found widespread search-for-yield behaviour in the residential market. A public hearing on the measures is to be conducted soon.

A banking source who requested anonymity said the central bank discussed with mortgage lenders at the recent meeting several tentative measures, including a LTV requirement for second or third homes, higher down payments for the upper residential segment, debt servicing ratios for some homebuyer segments, and a cap on credit lines for mortgage refinancing.

MPC wary of housing market

The central bank's Monetary Policy Committee (MPC) members voiced concerns that the financial system showed signs of increased vulnerability in the property sector, given an increasing share of mortgage loans extended to borrowers for second or third homes, with credit standards deteriorating, according to the minutes of their meeting on Sept 19.

Furthermore, the oversupply of condominiums in certain areas remained high.

"It is important to monitor the build-up of financial system vulnerabilities so we don't underestimate potential changes in conditions, especially competition in the mortgage market that led to looser credit standards," the minutes said.

The committee plans to closely monitor household debt accumulation, which had yet to show clear signs of deleveraging, while the prolonged low interest rate environment and low rates of return could affect savings going forward, the minutes said.

The rate setters are watching other types of search-for-yield behaviour including high returns offered by savings cooperatives and corporate bond issuance concentrated among large corporations, as such behaviour could lead to underpricing of risks.

"In the prolonged low interest rate environment, the issuance of corporate bonds was concentrated among large corporations, which tended to invest more in non-core businesses and overseas businesses. This would pose greater risks to business operations," it said.

The minutes said most committee members viewed financial stability risks as manageable because some risks could be self-correcting through the market mechanism, though macro-prudential measures could be applied to address other more persistent risks.

However, some committee members are concerned that vulnerabilities might begin to build up in the financial system, potentially affecting sustainable economic growth in the long term.

"They believe vulnerabilities have started to become widespread in part because of the prolonged low interest rate environment, which would induce households and businesses to underestimate potential changes in financial conditions. Consequently, relying only on macro-prudential measures would not be sufficiently effective," said the minutes.

Path to a rate hike

Should economic expansion continue and inflation move more firmly within the target, the need for a policy rate increase to build up policy space in the future would increase, said the MPC.

"The committee's evaluation of the appropriate conditions would be data-dependent, including careful assessment of the outlook for economic growth and inflation, as well as the risks, especially on the external front," said the minutes.

At the latest meeting, the MPC stood pat on its policy rate, but an additional committee member unexpectedly voted for a 25-basis point hike, reinforcing signs that the rate will increase at coming meetings for the first time since 2011.

Five members voted to keep the rate steady at 1.50%, where it has been since April 2015, while two voted for a quarter-point hike, up from one vote in the past several meetings.