The forthcoming auction for Suvarnabhumi airport’s duty-free concession is set to cast a spotlight on concession outcome as the winds of change sweep through King Power International Group, the airport’s sole duty-free operator.

While questions have been raised about concession transparency, business competition and the drafting process of the terms of reference (ToR), the recent loss of King Power founder Vichai Srivaddhanaprabha casts a shadow over the auction.

Many are questioning how the conglomerate will be able to hold its dominant grip over Thailand’s duty-free sector.

Vichai, 60, was Thailand’s fifth-richest man when he died in a helicopter crash after watching his beloved Leicester City play on Oct 27. He leaves behind a wife and four children — two sons and two daughters — with all five sitting on the executive board of King Power.

King Power’s master concession model to operate duty-free retail shops at Thailand’s major airports has been lucrative. The company has been the sole duty-free operator at Suvarnabhumi since the airport’s opening in 2006, but the concession will expire in September 2020.

Airports of Thailand Plc (AoT) said it would hold a new auction this year and finalise the ToR for bidding last month, but no progress has been announced so far.

Monopoly power

While the auction’s ToR details remain up in the air, the general public and academics have voiced concern over the transparency of the bidding process and chewed over which concession models are best suited for the country’s main airport.

For observers, given the expansions done on Suvarnabhumi airport over the past decade, and with another major expansion on the way, granting the concession to only one operator to manage all the duty-free zones doesn’t seem to be the best option.

Allowing one company to control the duty-free business could also breach the Trade Competition Act of 2017, as pointed out by academics.

As one of the world’s busiest airports, Suvarnabhumi received about 57 million passengers last year. When the third-phase expansion is completed in 2021, it will be able to handle as many as 90 million passengers a year.

A surge in tourist arrivals over the past few years is promising for local businesses, as tourist spending offers a steady revenue stream for retailers, restaurateurs and hoteliers.

While Thai airports are thronged with visitors, the duty-free shops are not attractive to tourists, said Deunden Nikomborirak, research director for good regulatory policy at the Thailand Development Research Institute.

According to Euromonitor, the average tourist spends just US$47 (around 1,500 baht) on duty-free items in Thailand, compared with $260 in South Korea. As a result, total duty-free sales in Thailand in 2016 were a mere $1.9 billion compared with $10.1 billion in South Korea.

The main reason behind South Korea’s booming duty-free industry, whose growth was 18% in 2017, is the government’s promotion of competition in the market, Ms Deunden said.

Twelve duty-free concessions were handed out at Incheon airport, the primary facility serving Seoul. The airport’s size is comparable to that of Suvarnabhumi.

At Incheon’s Terminal 1, six concessions were handed out to different concessionaires based on location, while another six were granted based on product categories at Terminal 2.

Several duty-free shops can also be found in Seoul and in the provinces, Ms Deunden said.

“The duty-free market landscape in Thailand is diametrically opposite from that of South Korea,” she said. “There is only one duty-free retailer in Thailand operating in international airports and downtown locations.”

The concession expiration offers the government a chance to ensure greater duty-free competition by announcing a clear policy to promote such an objective, she said.

In addition to opening bids for multiple duty-free concessions at Suvarnabhumi for greater variety and quality of products, which would increase income for the airport, the government should license multiple duty-free stores in Bangkok and major provinces such as Chiang Mai, Ms Deunden said.

This would require a central pickup counter at major airports so that tourists can collect duty-free goods they bought from downtown stores before leaving the country, she said.

UPHILL TEST

Although King Power has vast connections in Thailand’s political, military and business circles, the loss of its founder and chairman poses a myriad of challenges and marks a turning point for the conglomerate, valued in the hundreds of billions of baht, said a business veteran speaking on condition of anonymity.

In a system that relies on concessions and good relationships for future business expansion and revenue streams, King Power’s corporate management faces pressure in maintaining its political ties and privileges, the veteran said.

In the political arena, King Power has gained strong support from the Bhumjaithai and Palang Pracharath parties. The company’s business benefited greatly after being granted the duty-free concession at Suvarnabhumi under the Thaksin Shinawatra government in 2006.

“A prime concern is the capital investment of King Power from now on,” the veteran said. “What will be the fate of King Power? Will the successor to Vichai be able to run the conglomerate as well as he did in the past?”

Besides the conglomerate’s empire covering retail, football and hospitality, Vichai also invested 14 billion baht in MahaNakhon Tower, purchased from Siam Commercial Bank, to be developed into a mixed-use landmark. It remains to be seen how this acquisition will unfold.

A politician and close aide to Vichai said his departure is unlikely to affect King Power’s business operations. Vichai had already deputised his son to run the duty-free business, the aide said.

King Power’s business is doing well and Vichai’s wife is in a position to help with the duty-free business, the aide said.

INTENSIFYING COMPETITION

Competition in the upcoming duty-free concession auction should be intense, said a retail industry veteran who asked not to be named.

“King Power is the bonanza of the Srivaddhanaprabha family,” the retail veteran said. “Mr Aiyawatt [Vichai’s youngest son], who was voted chief executive of King Power for a decade, is likely to work hard to retain the company’s legacy.

“Mr Aiyawatt sounds much like his father, who nurtured corporate culture, focusing on caring for people and staff at all levels. I believe the connections and networking Vichai developed for years will stay intact. Connections are not something that can be created overnight.”

Despite being roughly the same size, South Korea’s Incheon airport hauls in five times more duty-free sales than King Power at Suvarnabhumi airport. WALAILAK KEERATIPIPATPONG

But sceptics remain, with another retail industry source noting that although Mr Aiyawatt has been groomed, King Power will have to spend big at the auction to keep its duty-free empire.

With over 100 billion baht in annual sales, King Power is estimated to enjoy a profit of about 20 billion baht, the source said. It will come as no surprise if the conglomerate spends 20-40 billion baht to capture a part of the new duty-free concession, the retail veteran said.

Central Group seems to have enough firepower to compete in the auction, given its annual revenue of more than 300 billion baht last year, the person said.

The Mall Group, with annual sales of about 50 billion baht, may find it difficult to contest these two retail titans. Two others expected to vie for the concession are Bangkok Airways Plc and South Korea’s Lotte.

NOVEMBER AUCTION

After experiencing several hiccups in finalising the ToR details and legal conditions, AoT is scheduled to call a new bid for operating duty-free shops in Suvarnabhumi by the end of this month.

The winners are expected to be named this year.

AoT president Nitinai Sirismatthakarn said the process of finalising the ToR is nearing completion and interested parties will be allowed to bid.

“Various businesses are interested in operating duty-free shops at Suvarnabhumi airport,” Mr Nitinai said.

The concession auction needs to happen this year to give new operators enough time to prepare for duty-free operations, he said.

Under the new ToR, AoT aims to increase its percentage of annual total concession revenue derived from Suvarnabhumi concession space from 44% to 50%.

Additional income is to come from combining existing spaces, as well as the addition of spaces at the new terminal, which is expected to open in the second or third quarter of 2022.

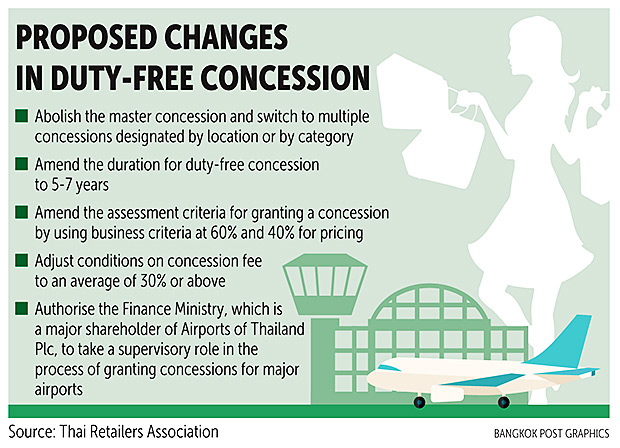

Goldman Sachs conducted equity research on AoT and found that concession fees earned from duty-free shops operated solely by King Power averaged 17% a year, calculated from the concession period granted for Suvarnabhumi airport. That percentage is considerably lower than the global average fee of 30-40%.