The Bank of Thailand expects the amended regulations governing auto title loans, including a cap on interest rates and practical guidelines for operators, to take effect next month.

The amended draft on auto title loans, which is meant to better protect consumers, is expected to be published in the Royal Gazette later this month before implementation in February, said Wajeetip Pongpech, assistant governor of the financial institutions policy group.

The draft is going through a public hearing.

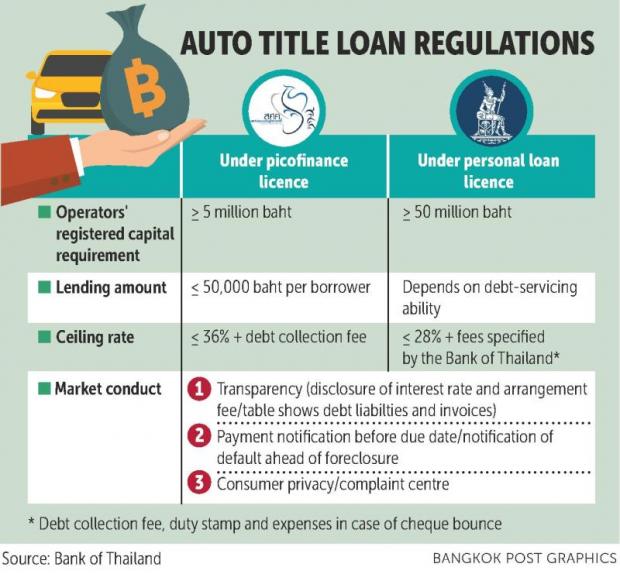

Under the draft, all auto title lenders must be operated through either picofinance or personal loan licences, which will determine business area operations, interest rates and lending amount.

Those operating under picofinance licences will be supervised by the Finance Ministry's Fiscal Policy Office, and they can run businesses in specific provinces. To qualify for a licence, they are required to have registered capital of at least 5 million baht and they are limited to extending loans of up to 50,000 baht per borrower. Lenders can charge a maximum rate of 36%.

Those with personal loan licences will be governed by the Bank of Thailand. They can operate in any province, but they are required to have minimum registered capital of 50 million baht and they are prohibited from charging more than 28% interest.

There is no maximum requirement for loan amount for borrowers who apply for auto title loans at operators regulated by the central bank. It will depend on their debt-servicing ability.

Existing auto title lenders who seek a personal loan licence but have registered capital below the central bank's minimum demand must meet the requirement within one year after the law comes into force.

There are more than 1,000 auto title lenders nationwide, Mrs Wajeetip said, and 70 of them have sought the central bank's permission to operate their business under a personal loan licence.

The central bank will spend 120 days to consider the process.

Mrs Wajeetip said auto title loan operators are prohibited from imposing prepayment charges and must pay borrowers the difference in cases where the foreclosed cars can be sold at a higher price than the deficiency balance.

"The regulations will create more fairness for consumers in terms of both rates charged and information," she said. "It should also better protect consumers, particularly those at the bottom of the economic ladder."

One goal is to counteract loan sharks, she said.

Somkiat Jaturabundit, president of the Pico-Finance Thailand Association, said that more than 900 members, of which 200 are car-for-cash lenders, attended yesterday's public hearing.

"Some of our members want to apply for personal loan licences to widen their scope or area," he said. "Several operators have potential in terms of capital and capability to upgrade to operate under personal loan licences."

But Mr Somkiat said the maximum credit line for picofinance licence holders of 50,000 baht per borrower is too low to solve the loan shark problem. He suggested doubling it to 100,000 baht.