CP All Plc's shares yesterday slid to their lowest level in four and a half years on worries that its offer price for Siam Makro Plc is too high.

The local operator of 7-Eleven convenience stores has offered 188.88 billion baht in the largest merger and acquisition in the global retail sector this year.

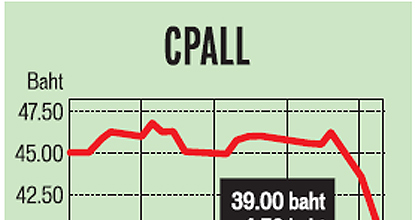

Its stock was suspended on Tuesday pending the deal's announcement. CP All traded at 38.50 baht, its lowest level since October 2008, at the opening bell yesterday, down from 43.50 at the close on Monday. It ended at 39 baht, down 4.50 baht, in trade worth 19.36 billion.

Makro shares, however, surged to 754 baht, up 72 baht, in trade worth 2.86 billion. The stock resumed trading yesterday after a two-day suspension.

"It is a panic sale as investors fret over the buying price. They thought the deal may not be a worthwhile investment," said Kawee Manitsupavong, an analyst at Asia Plus Securities.

"We recommend 'buy' on CP All with a revised fair value of 60 baht from 52 baht following the deal."

CP All announced its takeover of Makro, a cash-and-carry wholesaler, on Tuesday.

CP All plans to spend 121.54 billion baht to acquire a 64.35% stake in Makro at 787 baht per share from Dutch holding company SHV Nederland NV.

It will spend another 67.34 billion baht to buy the remaining shares from other shareholders through a tender offer that will be launched later.

Siam Commercial Bank is the buyer's financial adviser, while HSBC serves as the seller's financial adviser.

Under the plan, 90% of the deal will be financed by one-year syndicated loans, mostly denominated in US dollars, and the remainder will be funded by CP All's cash flow.

Mr Kawee said CP All, which is a debt-free company, will have a debt-to-equity ratio of about six times after the hefty borrowing, but the ratio is expected to fall to one time within five years, assuming that CP All maintains its dividend payout ratio at more than 50% of net profit.

Maybank Kim Eng Securities said in a note that CP All's weak share price presents buying opportunities.

"We have positive views on CP All for long-term growth. The interest-rate burden will be offset by Makro's profit, a higher profit margin from increasing bargaining power and better logistics, Makro's assets and opportunities for overseas expansion," it said.