Experts say the best way to lay sound foundations for a skill is to learn it at a young age, whether it is music, art, a language or even financial literacy. And for children, one of the most practical and wonderful tools is literature.

Books can teach personal finance to kids.

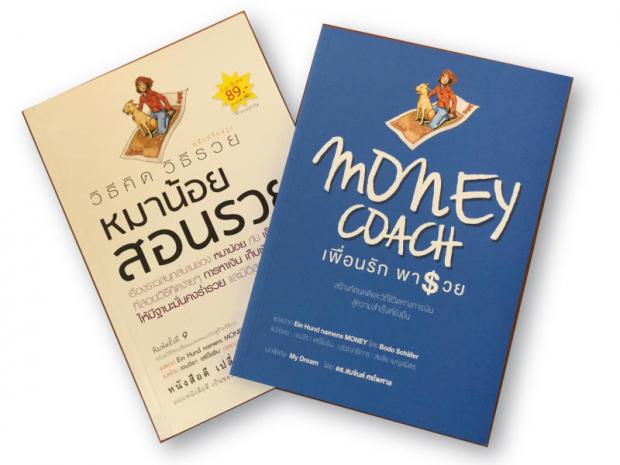

A German book called Ein Hund namens Money (A Dog Named Money) was written in 2000 by successful businessman Bodo Schafer to help parents instil financial knowledge in their children through two characters: a 12-year-old girl, Kira, whose family faces financial problems from a business start-up, and a talking white labrador retriever named Money who teaches Kira about financial discipline.

The book has received overwhelming praise from parents who have used it as a tool to teach their children about basic financial principles. It has been translated into several languages and has become a best seller in Japan, South Korea and China.

Somjin Sornpaisarn, TMB Asset Management's chief executive, is one of those parents prioritising financial knowledge as fundamental education for his three children. The Thai version of Schafer's book, Money Coach: Puen Rak Pa Ruay, has been invaluable.

"This is my favourite book and I use it as a tool to build financial discipline in my children," Mr Somjin says.

The story is built around little Kira and dog Money, who is Kira's financial coach. The coach tells Kira to start by listing 10 dreams and to select three of them by prioritising.

Kira eventually prioritises going to America for a summer course to improve her English, buying a laptop so that she can work on it and saving money to help repay her parents' debts.

Then Money asks Kira to place her three wishes in three piggy banks and to put her disposable income in them on a daily basis. The dog suggests the little girl makes this a habit until her savings are enough to achieve her dreams.

To make her wishes come true more quickly, Kira decides to walk her dog's canine friends in exchange for some cash.

Listing dreams or goals will help a person see a clearer direction and set up plans to achieve them.

Money also asks Kira to write down her small achievements on a daily basis so that she can be proud of herself. Small steps can lead to big success in the future.

Kira's effort pays off when she saves enough money to travel to America. Then Kira also learns to multiply her savings through an investment in mutual funds.

"This book is better than others because it doesn't just teach but shows the thinking process of successful people. It also encourages children to dare to dream and believe that they can make their dream come true," says Mr Somjin.

"This will help build self-esteem, which is an essential element when children grow up."

Mr Somjin bought this useful book for children Jabb, Job and Fudgy and read it out loud to them in his car as he drove his children to school every morning.

Later, out of curiosity, his children finished the book by themselves within less than a month. As a father, Mr Somjin convinced his kids that they could also do what Kira did.

He also bought his children notebooks so that they could record their small achievements. He listed the good points of each child on the first page of each notebook.

"Telling your kids that you're proud of them is a good starting point. And then they can record their own successes in the books," says Mr Somjin, adding that this method is a good way to build the children's self-esteem.

Later, to continue implanting financial discipline in his children, Mr Somjin taught them about mutual funds and let them open accounts.

He initially put about 50,000 baht in each mutual fund. Then he raised his children's monthly pocket money so that they could have some savings left to invest in mutual funds.

"There are two purposes in giving them more money. One is to let them decide whether to spend this money, while the other is to let them learn how to make this money grow," he says.

His children have also been motivated to get part-time jobs to earn extra money, just like Kira does in the book.

"These days, my monthly job is to ask how much they want to save and invest in their mutual fund accounts," says Mr Somjin.

Jabb, the eldest daughter who is good at English, started to teach English to earn some cash. Job, the middle son, decided to get some extra income by working as a part-time salesman at a direct-sales company.

Mr Somjin believes having part-time jobs will teach his children about the value of money while allowing them to learn about the real work environment.

"However, if these part-time jobs disturb school classes or other activities aimed at developing essential life skills, they will not be allowed to do the jobs," the father adds.

He says his children have consistently put money into their mutual fund accounts for more than four years. They are all proud to watch their money grow fruitfully. And it all started with one simple children's book.