The lockdown extension and a shift to online sales continue to create an impact on the average occupancy rate of Bangkok retail spaces in the third quarter as it falls to the lowest level in almost two decades.

Mrs Punnee believes the format of retail stores is moving towards mixed-use developments.

Punnee Sritanyalucksana, chief operating officer of Edmund Tie & Co Thailand, a property consultant, said Bangkok retail spaces should see the average occupancy rate decline further in the third quarter from its nadir in the second quarter.

"The lockdown from mid-July to August is pressing the retail occupancy in Bangkok to possibly lower than 80%," she said. "Pedestrian traffic at shopping malls has dropped, resulting in the closure of some small retail outlets."

The third wave of the pandemic in April created many new clusters in Bangkok and other provinces. The record high of daily cases forced people to stay home and order food and products via online channels.

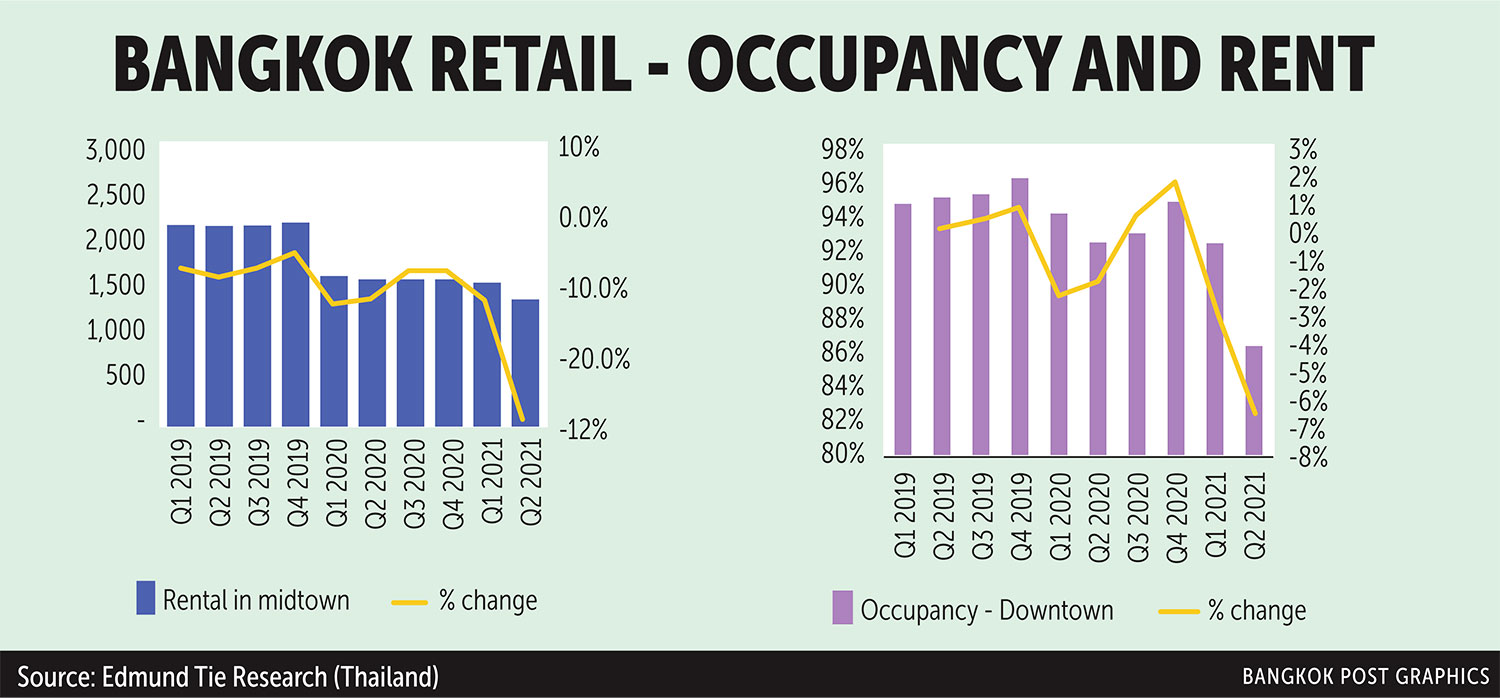

As a result, the average occupancy rate of downtown retail malls dropped to 86.3% in the second quarter this year from 92.4% in the first quarter.

It was the first time in history that downtown retail occupancy went below 90%.

The average occupancy rate of midtown malls decreased to 81%, a contraction of 6.5% from the first quarter.

Bangkok retail spaces saw the average occupancy rate drop continuously in the second quarter to 83.7% from 89.6% in the first quarter and 92.6% in the fourth quarter of last year, despite picking up from 91.1% and 90.4% in the third and second quarters of 2020.

"A steady downfall in the number of visitors to brick-and-mortar malls and a greater focus on online channels by retail operators during the pandemic were two key factors," said Mrs Punnee.

She said retail operators had deployed omni-channel marketing and offered home delivery services to support customers and help tenants boost their sales.

Additionally, some retail operators offer drive-through service to assure the safety of shoppers.

The financial struggle for tenants because of the prolonged impact of the Covid-19 outbreak caused retail operators to waive rental fees for the hardest-hit tenants.

They slashed rental rates by 30–70% for those whose liquidity reached crisis level.

The unprecedented viral outbreak also forced retail operators to provide financial relief measures to their tenants to survive together, at least until the outbreak is over, she added.

As a result, the average rental rate of downtown retail malls decreased to 1,700 baht per square metre per month in the second quarter, dropping 11% compared with 1,910 baht in the first.

For midtown spaces, the average rental rate plunged 12.7% from the previous quarter to 960 baht per sq m per month.

"An effective and timely vaccination programme will help ease pressure on businesses and improve expenditure as well as retail market conditions," Mrs Punnee said.

Following the current lockdown, the opening of new retail projects is likely to be delayed until the end of the fourth quarter of 2021 or early 2022.

"New openings will depend on the outbreak and the number of inoculated people in the country," she said.

Average rent in the third quarter should remain unchanged from the second quarter assuming landlords maintain financial aid for their tenants while attracting new tenants to fill up retail spaces, according to Edmund Tie.

The format of retail stores is seen moving towards mixed-use developments, retail shops in petrol stations or rest areas, standalone shops and mobile trucks, said Mrs Punnee.

In a highly competitive environment, retailers will introduce new retail concepts and shopping experiences and create distinctive selling points.

The popularity of e-commerce and online shopping will accelerate usage of mobile payments, QR codes and digital wallets, she said.

These e-payments will further drive the country towards a cashless and touchless society, said Edmund Tie.

According to the company, retail supply in downtown and midtown areas remained unchanged at 1.494 million sq m and 1.148 million sq m, respectively, in the second quarter.

The impact of Covid-19 that resulted in high infections, an economic slump, the loss in business operations and low consumer confidence caused developers to delay the launch of new retail projects.