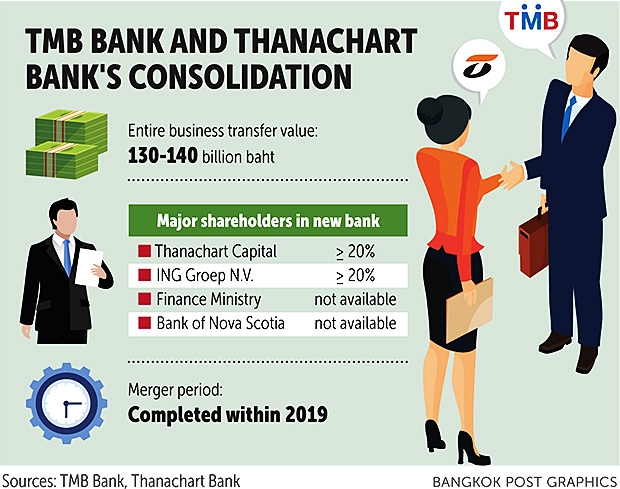

TMB Bank has entered into a non-binding memorandum of understanding (MoU) to consolidate with Thanachart Bank (TBank) through an entire business transfer with an estimated transaction value of 130-140 billion baht.

"Following the transactions and the equity financing, ING Groep N.V., the Finance Ministry and Thanachart Capital [TCAP] are expected to be major shareholders in the combined bank, with ING and TCAP having respective shareholdings of at least 20%," TMB said in a filing with the Stock Exchange of Thailand (SET) Tuesday.

"Bank of Nova Scotia [BNS] is expected to hold a significantly smaller stake."

TMB plans to finance the transactions via a combination of debt and equity financing, it said.

Equity financing is expected to account for 70% of the transaction value.

The final transaction value depends on due diligence findings and the latest book value of TBank and its subsidiaries, said TMB.

As part of the equity financing, TMB will allocate newly issued shares worth around 50-55 billion baht to TCAP and BNS at a price of 1.1 times TMB's latest book value.

The remaining 40-45 billion baht in newly issued shares will be allotted to the bank's major shareholders and either an IPO and/or private placements to new or existing investors.

The amalgamation is expected to be completed by year-end.

According to the major shareholder structure of both banks, the Finance Ministry holds a 25.9% stake in TMB, while ING has a 25% stake.

TCAP holds a 51% stake in TBank and Canada's BNS owns the remainder.

"The combination of TMB and TBank would significantly enhance the scale of the combined bank's business, making it one of the leading banking franchises in Thailand. The combined bank would have total assets of some 1.9 trillion baht and more than 10 million retail customers, ranking sixth in the local industry," TMB said.

The consolidation is expected to create coordination in terms of balance sheets, cost and revenue.

The consolidated bank will be renamed, taking into consideration the commercial strengths of the existing brands of TMB and TBank after the integration process is completed.

"Integrating TMB and TBank into one entity would be the most efficient in terms of taxes and other privileges under relevant schemes," TCAP said in a separate filing.

"TCAP will be a major shareholder and be on the board of directors of the combined bank after the merger."

TMB shares closed unchanged on the SET Tuesday, at 2.28 baht, in trade worth 67.8 million baht.