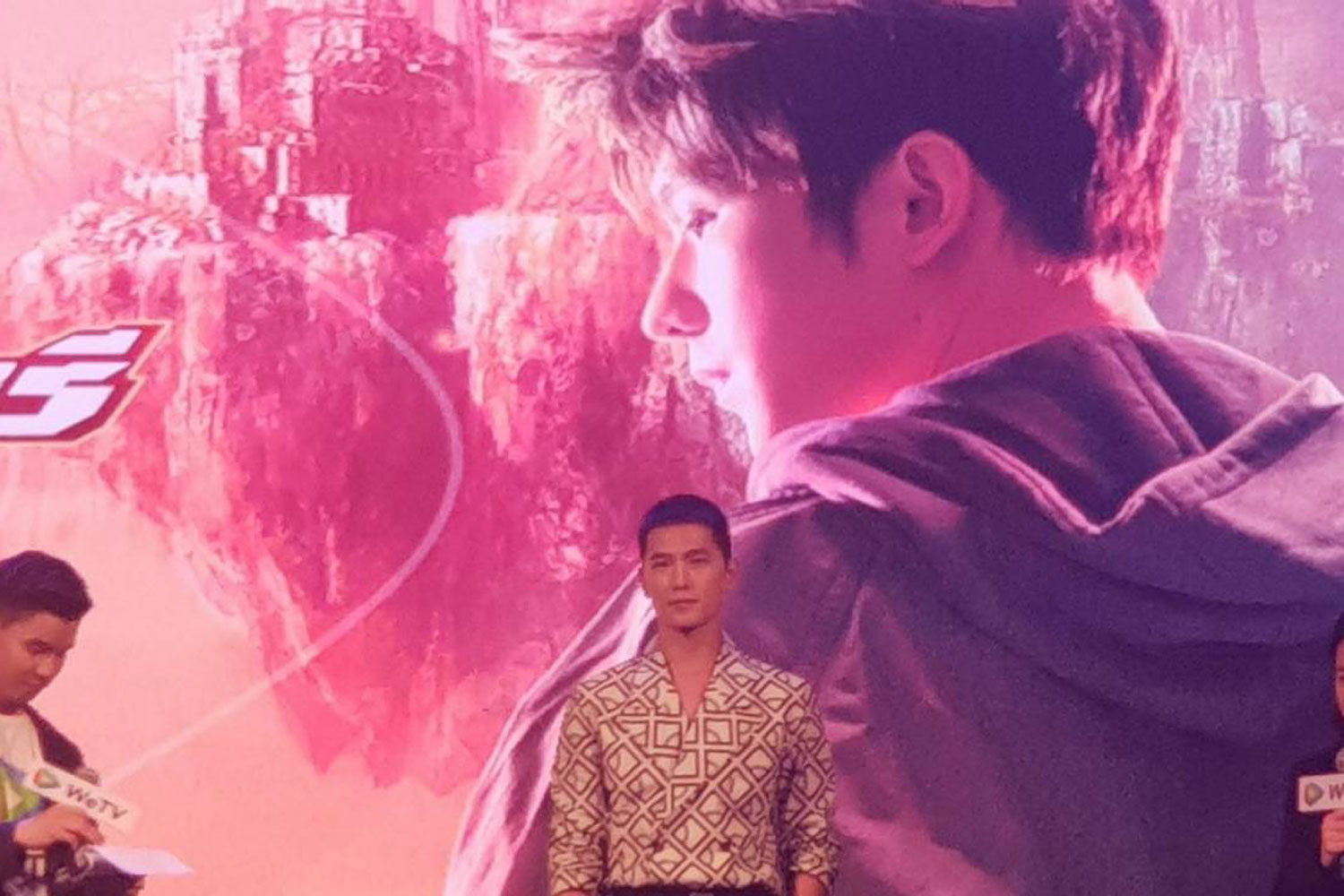

Tencent Thailand plans to expand its over-the-top streaming service, WeTV, to become one of the top three OTTs in the country by adding half a million users this year.

The move will spark competition in the crowded OTT market, dominated by overseas players such as US-based Netflix, Japan's Line TV, Malaysia's iFlix and Singapore's HOOQ.

"We selected Thailand as the first country to launch the overseas business to show our commitment," said Jeff Han, senior vice-president of Tencent Penguin Pictures.

Tencent Video is the No.1 OTT platform in China, with about 200 million daily active users, 550 million monthly active users and 89 million paid subscribers. In 2018, the company had 80 titles made in-house.

Tencent Video also has China's largest collection of Thai content, which is fairly popular among the Chinese.

Krittee Manoleehagul, managing director of Tencent Thailand, said video on demand (VOD) is still a blue ocean market, as Thais watch 3.44 hours of online videos a day via VOD out of 9.11 hours per day spent on the internet.

In 2018, there were an estimated 4 billion mobile internet users globally, with 14.6% located in Asia.

WeTV uses content resources from Tencent Video, particularly Chinese series that are familiar to Thais and will attract more mass market users, not just youngsters.

Since a soft launch in early 2019, WeTV has acquired 100,000 users, 75% of whom are female, with an average watch time of 84 minutes. The largest demographic is age 18-34.

WeTV content is 60% Chinese, 20% Thai, 10% South Korean, 5% American and 5% other. The top three content categories are romantic comedies, period dramas and action fantasy series.

Mr Krittee said the company offers a freemium model by letting users watch for free with advertising or by becoming a VIP member for 139 baht per month with exclusive content like fan meetings and no advertising.

"We hope to have paid users at a similar ratio to our China market," he said.

Mr Krittee said brand engagement with audiences and product placement in content also present revenue opportunities.

WeTV will bundle packages with its music streaming service, JOOX, by collaborating with mobile operators.

The company also has local partners with One31 channel, GDH and Insight technology.

"Local partners will have the opportunity to export content to Chinese users," Mr Krittee said.

Kaichen Li, the director of Tencent Video overseeing business operations, said WeTV plans to create original content with local partners, to be broadcast in Thailand and exported to Chinese audiences. Plans call for creating two titles in each quarter of 2020.

"We offer a flexible model for revenue sharing, co-production and fixed margins," Mr Li said.

GDH will adapt its popular movie, Bad Genius, as a series for WeTV. It will focus on quality content and new services, such as simultaneous broadcasts of Chinese series on the platform.