Same-day delivery, quality 24-hour service and a slowing price war with Chinese logistics firms are brightening prospects for the Thai logistics sector, says Shippop, a local logistics aggregator.

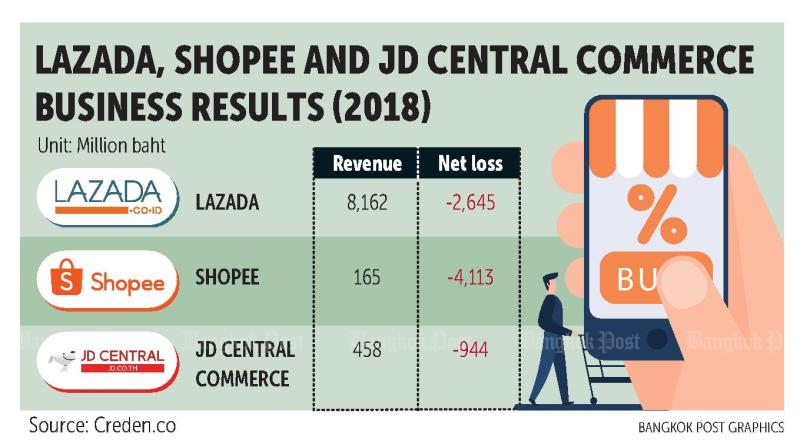

E-logistics services are booming, the startup said, driven by the popularity of e-commerce, even in the face of an economic downturn and fierce competition among global e-marketplace providers.

Thailand's e-logistics services are expected to grow up to 15% in 2019, up from 31 billion baht in 2018.

"There are still new logistics providers, particularly from China, waging price wars to attract new customers, but overall logistics services will return to focusing more on service quality and delivery prices will surge," said Sutthikead Chantarachairoj, chief executive of Shippop.

The lower price of 10-19 baht per parcel leads to poor-quality delivery that frustrates customers, he said.

"Some Chinese logistics providers can slash prices in order to build a customer database and add new services such as loans, but other rivals will focus on delivery fees that will not escalate into a price war and the situation will improve in the second half," Mr Sutthikead said.

Logistics providers will expand same day deliveries this year, mostly focusing on upcountry, as well as next day delivery.

Same day delivery will serve Thais that might be willing to pay extra for faster deliveries as surveys found 47% of consumers were willing to pay extra, according to Boston Retail Partners. In 2018, same day delivery services grew 43% accounting for 22% of total deliveries.

For Shippop, the top five most delivered items are toys, mother and child products, health and beauty, home appliances, women's fashion and food and beverage. The top five destinations were Bangkok, Nonthaburi, Pathum Thani and Chiang Mai.

In addition, logistics providers will offer 24 hour, seven days a week services to offload transaction of merchants and differentiate services from rivals.

Previously, the number of parcel would rise on Mondays and Tuesdays after gathering a backlog over the weekend. Online shoppers also tend to make purchases at night and noon.

Mr Sutthikead said he expects logistics delivery services will grow between 5-15% in 2019, from 31 billion revenue in 2018, which grew 11.3% from 2017, thanks to 11 million online shoppers and increasing social commerce activity, as well as cut-throat competition.

Logistics providers will shift to offer COD (cash on delivery) to differentiate themselves from rivals.

The overall logistics market averaged 350,000-400,000 parcel deliveries per day through e-commerce and Thailand's e-commerce industry is expected to grow 22% during 2018-22.

According to an Electronic Transactions Development Agency survey, 66% of online shoppers prioritise delivery services and 65% use COD.

To capitalise on COD needs, Shippop opened a COD gateway, the first of its kind in Thailand for online merchants to use as a one-stop service to compare COD fees, delivery costs and service coverage.

Online merchants will get a report summary and receive transfer payments every Friday, reducing the number of money transactions to avoid banks reporting merchants to the Revenue Department under the new e-payment law.

Shippop will get revenue shares from COD fees with logistics providers. They expect the service to be popular as some customers are afraid of fraud from digital transactions.

There are 50 logistics providers in three different groups: express, on-demand and cross-border delivery. Shippop is partnered with 15 couriers, five of which offer COD.

By the end of this year, Shippop will offer new services like big data.