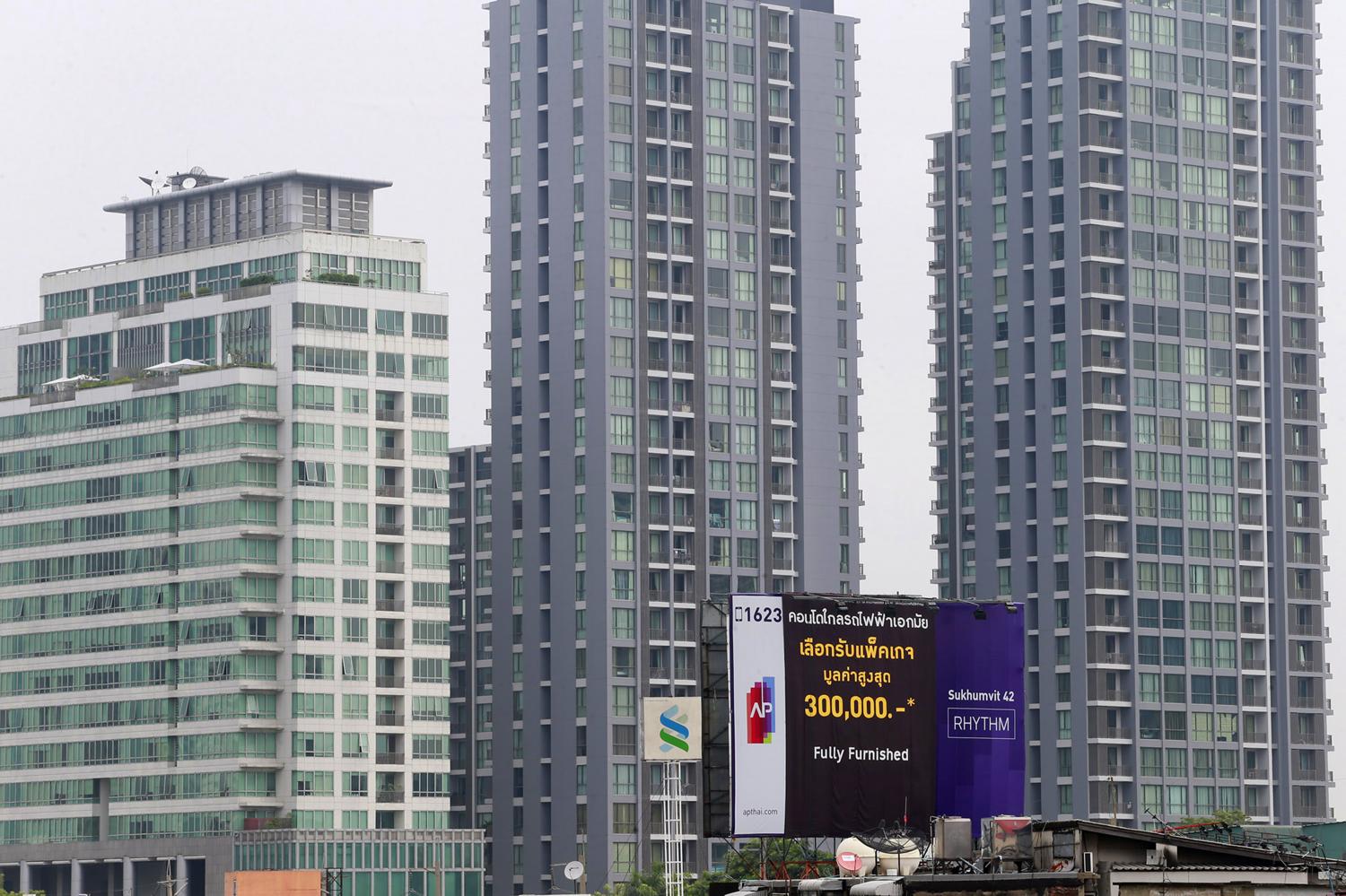

Bangkok condo prices are expected to remain strong despite the new city plan that will enlarge development area for condo projects.

Chukwan Nilsiri, director of the city planning division for the Bangkok Metropolitan Administration, said the new Bangkok city plan will help condo development flourish because the regulations offer more development area for projects.

"More development area should lower condo unit prices, but that is unlikely because of high land prices," she said.

The city plan unlocks locations along new mass transit lines for residential development.

City zoning in some locations will change to orange (medium-density residential zones) from yellow or green (lower-density residential zones), adding tens of thousands of rai to the former.

The plan also increases areas in the red zone, which allows commercial and high-density residential development, particularly in the central business district (CBD) locations and sub-CBD areas, Ms Chukwan said.

"Condos with a construction area of 10,000 square metres or more will be allowed to develop within 500 metres of a mass transit station and 800 metres from an interchange station," she said.

Other regulations to benefit condo development include bonus areas and a 25% reduction in allowable car parking space near 11 pilot mass transit stations.

The new city plan is a final draft, and a fourth revision is awaiting the election of a new Bangkok governor. The earliest it could take effect is the end of 2020, Ms Chukwan said.

Prasert Taedullayasatit, president of developer Pruksa Real Estate's premium business, said this year's new condo supply is expected to slump by more than 10%.

In the third quarter, the number of new condos launched declined by 30% from the same period last year. The decrease was carried over from the first and second quarters after the loan-to-value (LTV) limits took effect on April 1.

"The LTV limits should be postponed if [the government] wants to boost the property market and the economy," he said. "No property incentives or deductions of transfer or mortgage fees are needed."

Peerapong Jaroon-ek, chief executive of SET-listed Origin Property, sees things differently, saying the property incentives are needed to sustain the residential market.

"The economy is poor but purchasing power remains good," he said. "We agree with the LTV limits, as they can help build homebuyers' financial discipline."

He suggested new condo supply launches should be put on hold until the existing supply drains out. The existing condo supply will take at least 18 months to be sold if there are no new launches in the fourth quarter, he said.

Assada Kaeokhiao, president of the Whizdom brand at Magnolia Quality Development Corporation Limited, said the LTV limits have a psychological effect on homebuyers.

"Condo buyers slowed purchases because the new lending rules have frightened them more than the impact alone would have," he said. "We need to adjust the revenue realisation plan, as condo sales are not as good as expected."

Aliwassa Pathnadabutr, managing director of property consultant CBRE Thailand, said developers should adapt to change amid many negative factors like the economic slowdown and limitations from the new lending curbs.

"Next year condo developers should clear their existing unsold stock and try to avoid launching new condo supply as the condo market continues to slow," she said.