The Bangkok office market is still on an upward trend, with a lot of new space due to come onstream over the next three years. But the pace of expansion and the growth rate are expected to ease, reflecting uncertain economic conditions.

Many developers and landlords with prime plots of land, especially freehold land, prefer to build condominiums instead of offices as the former offer better returns, which is critical given the high land prices in the Bangkok central business district (CBD).

For those seeking to develop office buildings or other commercial properties to generate recurring income, it is more practical to do so on leasehold land. Most of the office buildings built in the CBD over the past three years, as well as those in the pipeline, are on leasehold sites.

Office development in Bangkok boomed in the late 1980s and early 1990s as the Thai economy expanded, but activity ground to a halt after the 1997 financial crisis. Some 76% of the capital's total office supply was completed before 2000, with very little new building in the first decade of the new century.

Activity picked up as the world recovered from the 2008-09 financial crisis and the investment outlook brightened in emerging economies, including Thailand. There has been a notable uptick in office development in the last few years, with a lot of new space scheduled to come on the market between now and 2022. Meanwhile, office rental costs and occupancy rates have been increasing steadily.

Bangkok has 9.06 million square metres of office space, 40% of it in the CBD and 13% in the Ratchadaphisek area. The latter has become an attractive alternative for businesses that find CBD space too expensive, while office development in Bangkok's suburbs is also on the rise.

New office space formats that are more flexible and user-friendly are also emerging. Co-working and flexible spaces are attracting a lot of interest, but most of these are managed by global developers or operators such as JustCo, WeWork, Spaces, Hubba and Glowfish.

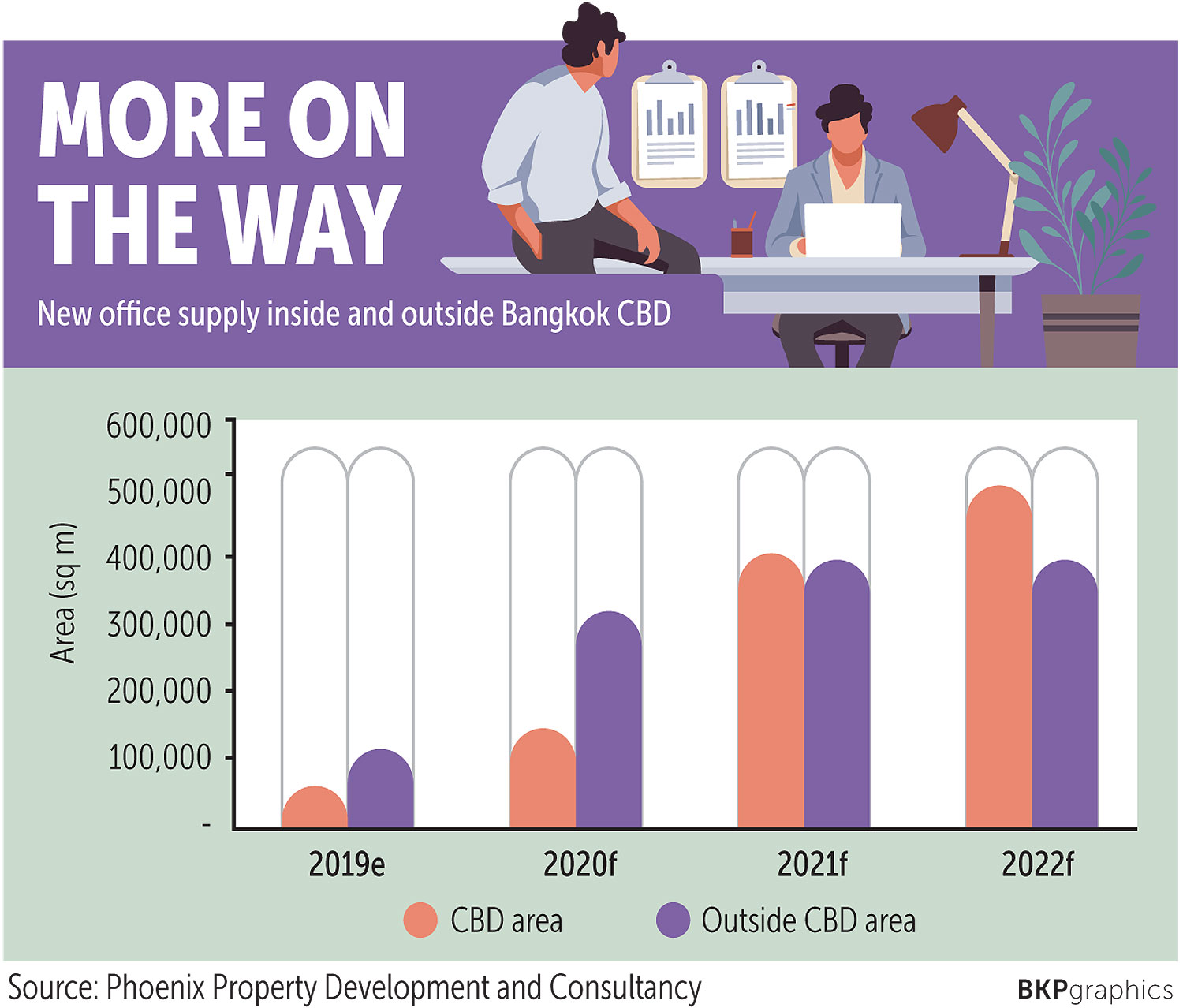

The majority of new office space scheduled to open this year and next is outside the CBD, but the pattern is set to reverse in 2021 and 2022, as large mixed-use projects that include office buildings take shape in the CBD. Total new office supply scheduled to be completed in 2022 in the CBD is 500,000 sq m.

Some 1 million sq m of new office building space is expected to be completed from 2022 onwards and around 809,000 sq m will be in the CBD, including large mixed-use projects on Rama IV Road.

The average occupancy rate for all office space in Bangkok has been holding steady this year at 93%. The highest occupancy rates are on Phahon Yothin Road, but this accounts for only 7% of total supply in the capital. Occupancy rates in the CBD, home to 40% of the capital's office space, offer a better guide to the health of the market and the economy.

Office rental rates in Bangkok overall have increased by 3-5% since last year. Rates in the CBD vary widely, given the variety of building types and ages. Grade A space in the CBD ranges from around 1,000 to 1,600 baht per sq m per month. Rents in Grade A buildings outside the CBD are around 850 to 880 baht per sq m per month. But tenants still have room to negotiate, depending on the amount of space they need and the length of the lease term.

Surachet Kongcheep is managing director of Phoenix Property Development and Consultancy Co Ltd.