Southeast Asia's healthcare system is struggling to meet the changing needs of its increasingly affluent population. Going forward, technology will play a key role in delivering treatment that is cost-effective, high in quality and convenient.

Places like Singapore and Bangkok are home to world-class hospitals. But for many of the region's 630 million people there are crowded medical facilities and high out-of-pocket costs. The problem is only going to get worse as ageing societies increase the need for long-term care of chronic conditions. For many patients, the typical experience is three minutes of care after a three-hour wait.

In the view of Monk's Hill Ventures, a Singapore-based venture capital firm, technology is key to maximising the use of limited resources so burgeoning demand for quality healthcare is met.

Innovative business models combined with the right technologies are essential to efficiently deliver treatment in a cost-effective manner.

A confluence of factors has put Southeast Asia at the forefront of global healthcare innovation, as growing demand for medical services comes at a time of economic development and technological innovation.

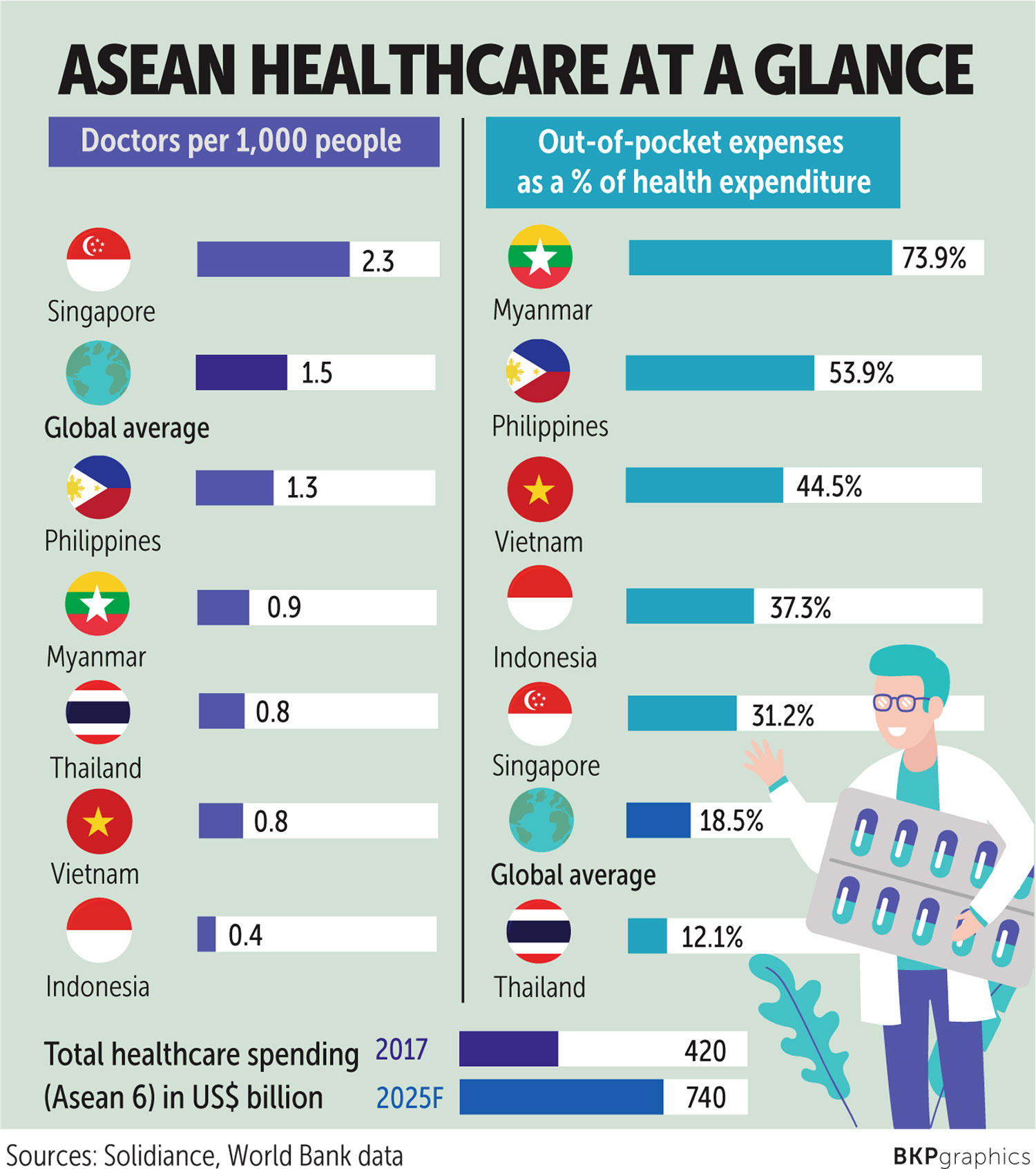

By understanding each of these factors, investors will be well-equipped to participate in a market where healthcare expenditure is expected to hit US$740 billion by 2025.

EVOLVING NEEDS

Southeast Asia's evolving medical needs are a function of its geography and economic development, as countries are affected by infectious tropical diseases, as well as a growing range of chronic ailments.

People are also living longer. Increased life expectancy is an economic development worthy of celebration, but when combined with the prevalence of long-term conditions such as diabetes and Alzheimer's, it creates a heavy burden on the existing health infrastructure.

The region is below the global average in a number of important metrics. Asean's five most populous countries have an average of 0.8 doctors per 1,000 people, which is much lower than the world average of 1.5, and far behind Singapore, which has 2.3 per 1,000. That helps explain why the typical patient experience in many Southeast Asian countries is one of long waiting times and low levels of personal care.

At the same time, Southeast Asian patients are required to contribute more to their healthcare costs than people in other parts of the world. Out-of-pocket costs for five major Asean countries (see graphic) account for 44% of current health expenditure, compared with the global average of 19%.

As the cost of treating chronic conditions is likely to outpace the growth in public healthcare spending, patients will become even more responsible for a larger proportion of their medical bills.

On the plus side, strong economic growth has boosted the size and the wealth of the middle class, putting them in a better position to pay for their own healthcare.

But the existing infrastructure in the region is not prepared for a major shift towards widespread chronic diseases, and the population will be spending more of their own money for treatment. Transformative solutions will be needed.

TECHNOLOGY SOLUTIONS

In the past, investors looking to participate in Southeast Asia's healthcare sector faced limited options -- primarily multinationals or local healthcare groups that operate brick-and-mortar hospitals. The rise of technological solutions has helped make the market more diverse, with healthtech companies proliferating. In 2018, Southeast Asia accounted for just under half the 78 healthtech funding deals in Asia (excluding China and India).

These include artificial intelligence-driven medical imaging, apps promoting a healthy lifestyle, and platforms that allow patients to remotely communicate with doctors. Finding the right investment target can be a challenge.

We see healthcare through the lens of a broader investment philosophy that favours companies capable of rethinking every link of the value chain and packaging it into a single end-to-end solution. Such solutions can address the full range of a customer's needs, allowing a company to capture all the business that traditionally would have gone to multiple vendors.

The full-stack model is highly appropriate in Southeast Asia, where even a simple medical condition can require encounters with several professionals -- visiting a general practitioner (GP) will likely be followed by a trip to a pharmacist. A serious ailment will require a long process comprising many stages -- the referral from GP to specialist, blood tests and other scans, along with multiple trips to a hospital. The existing procedures are a prime target for increased efficiencies.

A successful solution will address the issues faced by different parts of society. Lower-income people are often unable to get access to the kind of care they need. The waiting times are so long a person might have to forgo a day of paid work. The costs of healthcare are so high for a low-income family as to be a serious financial burden.

Middle-class patients face different issues. Many people are concerned enough about the quality of local healthcare to travel abroad for treatment -- not only for serious illnesses but also for routine check-ups.

This has created a sizeable intra-regional medical tourism industry in Southeast Asia, far from optimal. The best situation is where people enjoy a local healthcare system that meets their needs for quality, accessibility and cost.

Southeast Asia is well-placed to adopt digital healthcare strategies because of uniquely high levels of engagement with the internet. The region is home to hundreds of millions of digital natives who expect goods and services to be available on their mobile device.

This all bodes well for the healthcare industry, as businesses can take advantage of technology and data to deliver the same convenience and cost savings found in other parts of the online economy, such as e-commerce. Instead of visiting a clinic, a patient can talk to their doctor via a smartphone app or consult and view the results from an X-ray directly on their device.