Thailand is in the pole position for social commerce in the world, says price-comparing website Priceza, and local merchants should drive towards unique and value-added products to stay competitive in the market.

The country's e-commerce market is expected to continue flourishing, driven by subsidised prices offered by giant e-marketplaces.

"Thailand's e-commerce will continue to grow 20-30% in 2020, similar to in the past few years," said Thanawat Malabuppha, chief executive of Priceza, speaking at yesterday's Priceza E-Commerce Summit 2020. "Strong market competition is pushing e-marketplace players to provide subsidised prices and promotions."

This contrasts with conventional retail business, which is expected to deliver only single-digit growth next year, Mr Thanawat said.

Thailand has become the global leader in social commerce, he said, citing a report titled "Conversational Commerce: The Next Gen of E-com" by Boston Consulting Group.

Up to 40% of Thais say they have shopped through social commercial platforms, the highest proportion in the world, the report said.

Next year, social commerce platforms Facebook, Instagram and Line will provide payment services to accommodate shoppers on their platforms.

According to Mr Thanawat, cross-border products will become more commonplace on e-commerce platforms in 2020.

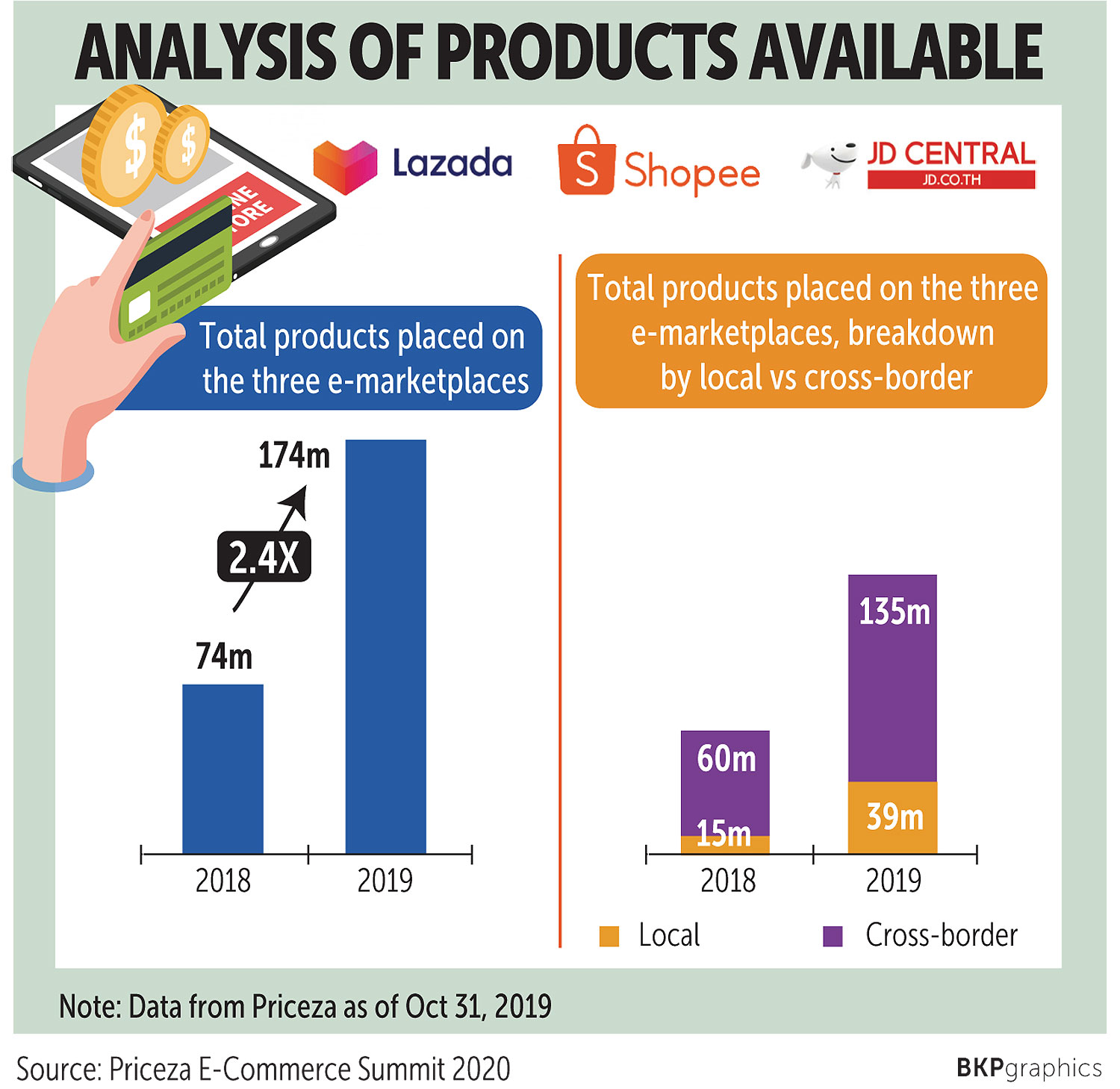

Based on data from three leading e-marketplaces in Thailand -- Lazada, Shopee and JD Central -- 60 million cross-border products were placed on the platforms last year. As of Oct 31 this year, the number had reached 135 million items, accounting for 77% of total products placed on the platforms.

As of Oct 31, local sellers accounted for 86% of product sales on the three platforms. Average order value was 738 baht for local sellers and 350 baht for cross-border sellers.

Mr Thanawat said he is aware of the competition from Chinese goods, as Chinese product delivery now takes just six days, down from 12 days about six months ago.

"The weakening of the yuan also make Chinese products more affordable, while faster delivery is expected in 2020," Mr Thanawat said.

Local vendors need to come up with unique and quality products and offer faster and free delivery, he said, adding that sellers must engage with multichannel sales, ranging from websites to social commerce and e-marketplaces.

Booming social commerce also opens the door for brands to sell products directly to customers under the direct-to-consumer concept.

Another trend on tap for next year is that ride-hailing players like Grab, Get and Line will add same-day delivery for products sold through e-commerce channels.

This service began in Indonesia in 2018, Mr Thanawat said, and "will spark a logistics business war".

Omni-channel or offline-online mixed channels will be another key trend next year and should spur consumer spending.

"We expect in the short future that Amazon and Alibaba will acquire some retailers in Thailand, like what happened in China and the US, to fulfil the omni-channel experience for customers," Mr Thanawat said.

Worawut Oonjai, president of the Thai Retailers Association, said the country's economy could worsen next year as the strong baht takes a toll on exports and farm product prices remain low.

"This could threaten the growth of 3 trillion baht worth of the retail market, which could see single-digit growth," Mr Worawut said.

SMEs need to seek new products to offset declining sales of other items by taking into account consumer insight data, he said.