2020 is the year in which the long-overdue land and building tax takes effect, making landlords and homeowners subject to tax payment based on appraised value if their properties fall under the stipulated conditions.

Starting on New Year's Day, the new property tax regime will replace the house and land tax and the local development tax after years of deliberation and tweaks.

Replacing the soon-to-be-abandoned income-based method, an assessment based on a property's appraised value will be used to improve the clarity of future tax calculations.

Appraised value of property deriving from separate standard prices of land and buildings will also help to minimise officers' discretion in the assessment process, while the different land use purposes will have varying implications for tax treatment, according to Siam Commercial Bank's Economic Intelligence Center.

Tax filing under the measure will be scheduled for August instead of April because of some uncompleted organic laws and to give local administrative organisations time to evaluate asset prices before informing the asset holders of their tax bill.

An assessment based on a property's appraised value will be used to improve the clarity of future tax calculations. Somchai Poomlard

APPRAISED VALUE

Despite rising concern among homeowners of shouldering higher tax bills, a closer observation should soothe their jitters, as 99.96% of properties in Thailand are not valued at over 50 million baht, according to the Fiscal Policy Office, which was responsible for drafting the new law.

The new property tax, which is a means by which the government hopes to reduce income disparity and alleviate the fiscal burden of subsidising local administrative organisations, is applied to residences, farmland, commercial areas and undeveloped land.

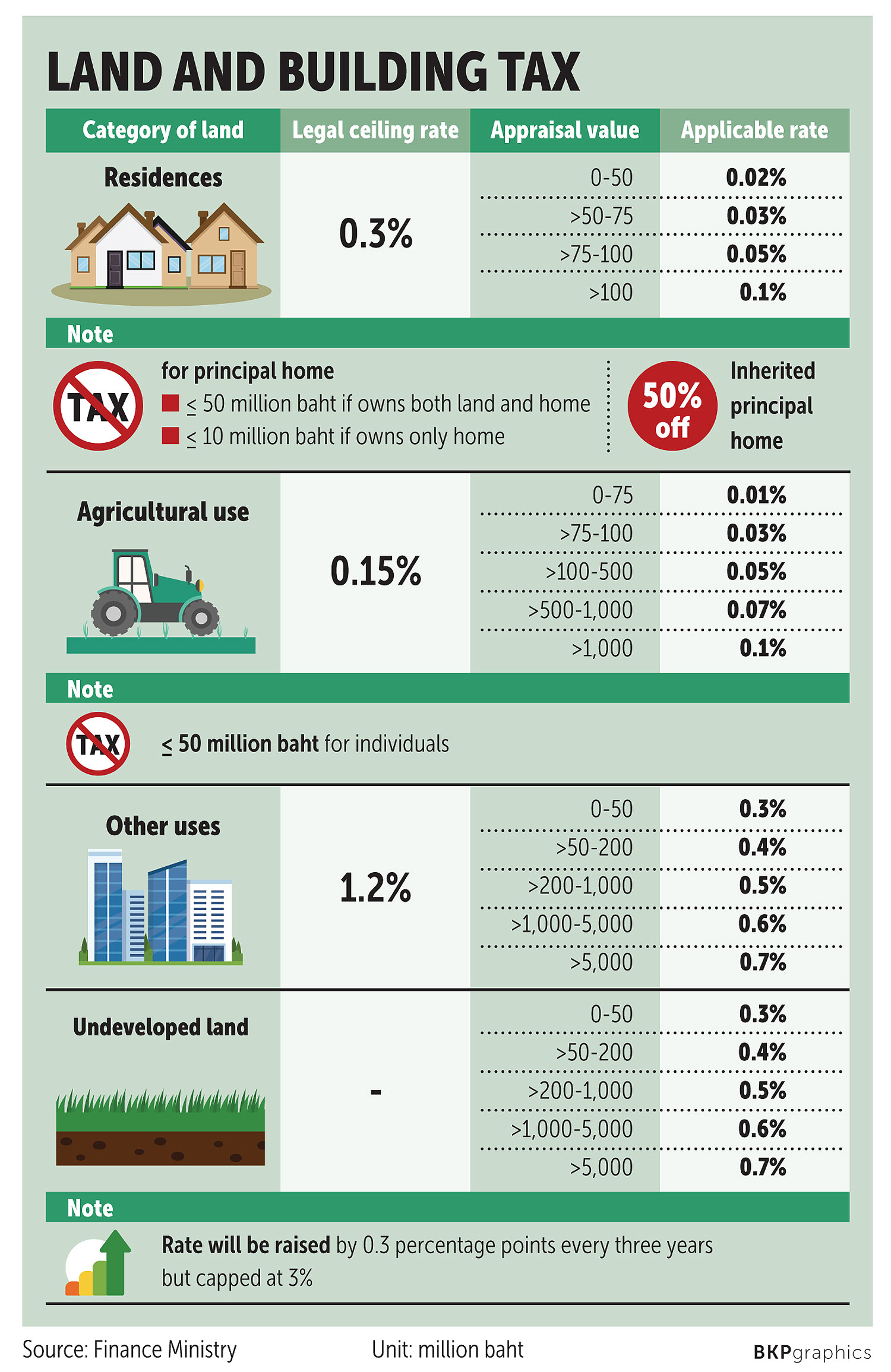

According to the new tax structure, land and buildings used for residences with appraisal prices of up to 50 million baht are tax-exempt for principal homes, while those valued at more than 50-75 million baht are taxed at 0.03% of appraisal prices, more than 75-100 million baht at 0.05% and more than 100 million baht at 0.1%.

Those who only own houses, not land, qualify for a tax exemption for the first 10 million baht of their houses' appraisal prices. Residences with appraised value of more than 10-50 million baht are charged at 0.02%, more than 50-75 million baht at 0.03%, more than 75-100 million baht at 0.05%, and more than 100 million baht at 0.1%.

If owners have more than one home, the second and subsequent residences are subject to a 0.02% tax for those with an appraisal price of up to 50 million baht, and the same tax rate as principal homes is applied for those with appraisal prices above 50 million baht.

Land for agricultural purposes with appraisal prices of up to 75 million baht is levied at a rate of 0.01%, more than 75-100 million baht is taxed at 0.03%, more than 100-500 million baht at 0.05%, more than 500 million-1 billion baht at 0.07% and more than 1 billion baht at 0.1%.

Commercial land is charged 0.3% for property with an appraisal price of up to 50 million baht, 0.4% on land worth more than 50-200 million baht, 0.5% for land valued at more than 200 million baht-1 billion baht, 0.6% for land worth more than 1 billion-5 billion baht and 0.7% for land worth more than 5 billion baht.

For vacant land, a tax rate of 0.3% is applied and will increase by 0.3% every three years, up to a cap of 3%.

The first land and building tax payment is scheduled for the end of April 2020, and landowners must pay their tax bills every April.

Farmland, however, is tax-exempt for the first three years to comply with a measure to alleviate the tax burden for low-income rural landowners, while owners of land for other uses who are subject to higher property tax bills are allowed to gradually phase in the increase each year, rising 25% each year over the course of four years.

Land and property owners can appeal local administrative officials' property appraisal value assessment in the event of factual errors.

For instance, if a residential property is appraised as a commercial property, the owner can appeal by providing necessary evidence.

High-rise buildings on Rama IV and Sukhumvit roads near Asok intersection. Patipat Janthong

TAX TIPS

A source at Kasikornbank's K-Expert recommends that homeowners, particularly those who have more than one housing unit, register in the house registration book of homes, where prices are the most expensive, to avoid new property tax bills.

Although the Interior Ministry has postponed the tax filing period for 2020 to August from April, homeowners should complete the registration process by the end of this year, as it remains uncertain as to whether the deadline period of the house registration database to determine tax payment will be postponed, the source said.

In cases of joint ownership, homeowners, especially couples, should manage this by changing to single ownership if possible, the source said, adding that the tax is expected to be charged based on a pro rata basis in co-ownership cases.

For those whose names are not in the house registration book of properties they bought, officials at local administrative organisations will identify the case as either a second home or others, whereby tax rates will be applied differently.

Second houses will be taxed at 0.02% for homes with an appraisal price of up to 50 million baht, or 200 baht for 1 million baht worth of appraised price.

But for homes classified for other uses, owners will be subject to a 0.3% tax rate for up to 50 million baht, or 3,000 baht for 1 million baht worth of appraised price.

The source said homeowners who fall into this category must declare to officials that the home is for living or other purposes, such as rent, but it must be on a factual basis to avert any penalty if examined.

HIGHER COSTS FORESEEN

Housing developers are accelerating sales of remaining unsold units in existing projects to minimise new costs from the land and building tax.

Supattra Paopiamsap, deputy group chief executive of SET-listed developer Pruksa Holding Plc, said all developers will have the land and building tax as a new cost in selling, general and administrative expenses (SG&A) starting from next year.

"We are trying to sell unsold units by offering heavy discounts and promotions to clear our inventory soon, and as many as possible, because there will be higher costs derived from the land and building tax," Mrs Supattra said.

As of the end of September, Pruksa had a total of 30,175 unsold units worth 99.2 billion baht in 192 residential projects in Greater Bangkok and key provinces.

She estimates that a new cost of 20-25 million baht per year will arise from the land and building tax because of the company's unsold inventory.

According to the Land and Building Tax Act, owners of units, lands and properties that remain unsold at low-rise and condo projects, excluding for common areas and utilities, are required to pay tax.

The law, however, will give a tax deduction of up to 90% for no longer than three years from the date that low-rise projects received a land allocation permit or a condominium received a construction permit.

"We need to control costs by all means, as 2020 will be another difficult year to strive for," Mrs Supattra said.

Other developers and landowners, particularly those having large vacant land plots, have also made preparations for the new land and building tax. Among them is BTS Group Holdings Plc.

In November, BTS signed a memorandum of understanding with SET-listed Ananda Development Plc to make a feasibility study on land plots sized at a total of 308 rai in Thana City on Bang Na-Trat Road, tracts that have been left undeveloped for many decades.

Phattarachai Taweewong, associate director in property consultant Colliers International Thailand's research department, said developers will be more selective in buying land plots for development of new projects.

"Developers will no longer buy land plots in advance for many years, but instead will buy and develop immediately, as there will be a cost of landholding," Mr Phattarachai said. "They will also ensure project [feasibility] and demand before buying land."

Some developers with land plots for future development but uncertainty about the market situation will shift to renting out these land plots instead, he said.