Thailand could meet the three criteria of the US Treasury Department's foreign exchange report in the coming periods, possibly putting the country on a monitoring list of currency manipulators, says Siam Commercial Bank's Economic Intelligence Centre (EIC).

Thailand is likely to record a 6.4% current account surplus this year, well above the US's 2% limit, according to the EIC.

The current account surplus was valued at US$29.3 billion on a year-to-date basis as of October, according to Bank of Thailand data. Last year's current account surplus tallied $28.5 billion.

The central bank has intervened to rein in the baht's strength continuously for more than six months during a one-year period, and bought the US dollar for more than 2% of Thailand's GDP, said the EIC.

But the country has not breached the final criteria -- having a trade surplus with the US worth of over $20 billion.

Thailand's year-to-date trade surplus with the US was registered at 350.6 billion baht ($11.6 billion) as of October, according to the Commerce Ministry's International Trade Promotion Department.

In 2018, the US had a trade deficit with Thailand of $19.3 billion, according to the Office of the US Trade Representative.

"There is a possibility the trade surplus figure [between Thailand and the US] will increase, meaning the US could include Thailand on a monitoring list or designate the country as a currency manipulator in the coming periods," said the EIC.

"This would result in additional trade barriers [imposed against Thailand]."

Thailand managed to avoid being placed on the US watch list for currency manipulation when the US Treasury Department issued its semi-annual foreign exchange report to Congress in May.

The nine countries placed on the monitoring list were China, Japan, South Korea, Germany, Italy, Ireland, Singapore, Malaysia and Vietnam.

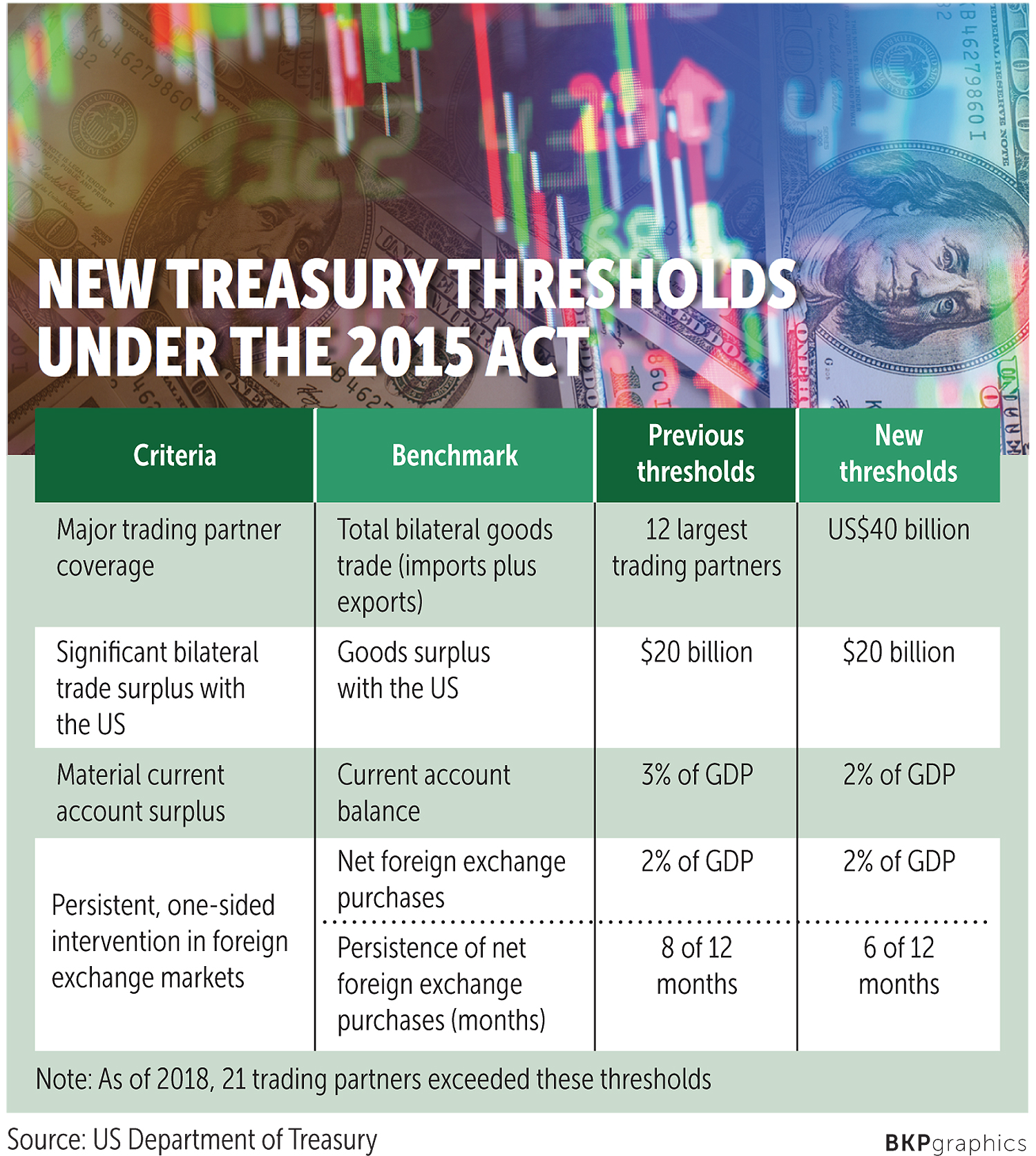

According to the amended criteria, countries with a current account surplus with the US equivalent to 2% of GDP are put on the monitoring list, down from 3%. The other two criteria are persistent one-sided intervention in the foreign exchange market with net purchases of at least 2% of GDP, and a trade surplus of at least $20 billion with the US.

Countries that meet two of the three criteria are put on the monitoring list.

Even though a country labelled as a currency manipulator to gain a trade advantage with the US is not subject to any penalty, financial markets could be rattled and trade sanctions could still be imposed.

US DISCRETION

A different view on the prospects of Thailand being labelled a currency manipulator is offered by a veteran academic.

Despite Thailand's huge current account surplus, the country is not expected to be placed on the monitoring list of currency manipulators because the strong baht has reduced Thailand's trade surplus with the US, said independent academic Somjai Phagaphasvivat.

The baht is Asia's best performing currency this year, rising by more than 7% year-to-date, according to Reuters. Despite subdued economic growth, the baht has appreciated as a result of the country's massive current account surplus, inflows of tourism revenue and near-record foreign reserves.

Ample foreign reserves have made Thailand stand out as a safe haven to park capital, either for actual investment or speculation.

The Bank of Thailand has minimised its foreign exchange intervention effort, with a focus on taming the local currency's strength as opposed to instigating currency devaluation, said Mr Somjai.

"Thailand still does not fall under the [US Treasury's] criteria. However, the US could use a discretional judgement to label Thailand as a currency manipulator as the US has the upper hand in bargaining power," he said.

With the 2020 US presidential election edging closer, the Trump administration has to use foreign policy to demonstrate achievements, said Mr Somjai, citing the US government's suspension of trade privileges under the Generalized System of Preferences for Thailand as having political implications.

Washington's rationale for the move was Thailand's failure to adequately protect worker rights.

But Thailand's decision to ban ractopamine and glyphosate, in addition to its trade deficit with Thailand, could be seen as undermining US shipments, he said.

The US motive for putting political and economic pressure on Thailand could stem from Washington wanting to exert more influence than China in this region, as well as encouraging greater Thai imports of US goods and services, said Mr Somjai.