The Stock Exchange of Thailand (SET) has revised the securities trading regulations for triggering a circuit-breaker and the ceiling and floor limits for securities products in a bid to curb a heavy stock plunge.

The revised regulations will take effect from today until June 30.

The mandate comes after Wall Street indices collapsed in their worst day since 1987 on Monday, with the S&P 500 and Nasdaq dropping about 12% and the Dow sinking nearly 13%.

On Monday night, SET executives held an emergency meeting and finalised the new circuit-breaker regulations. They then sought the Securities and Exchange Commission's approval yesterday, according to a source at the SEC.

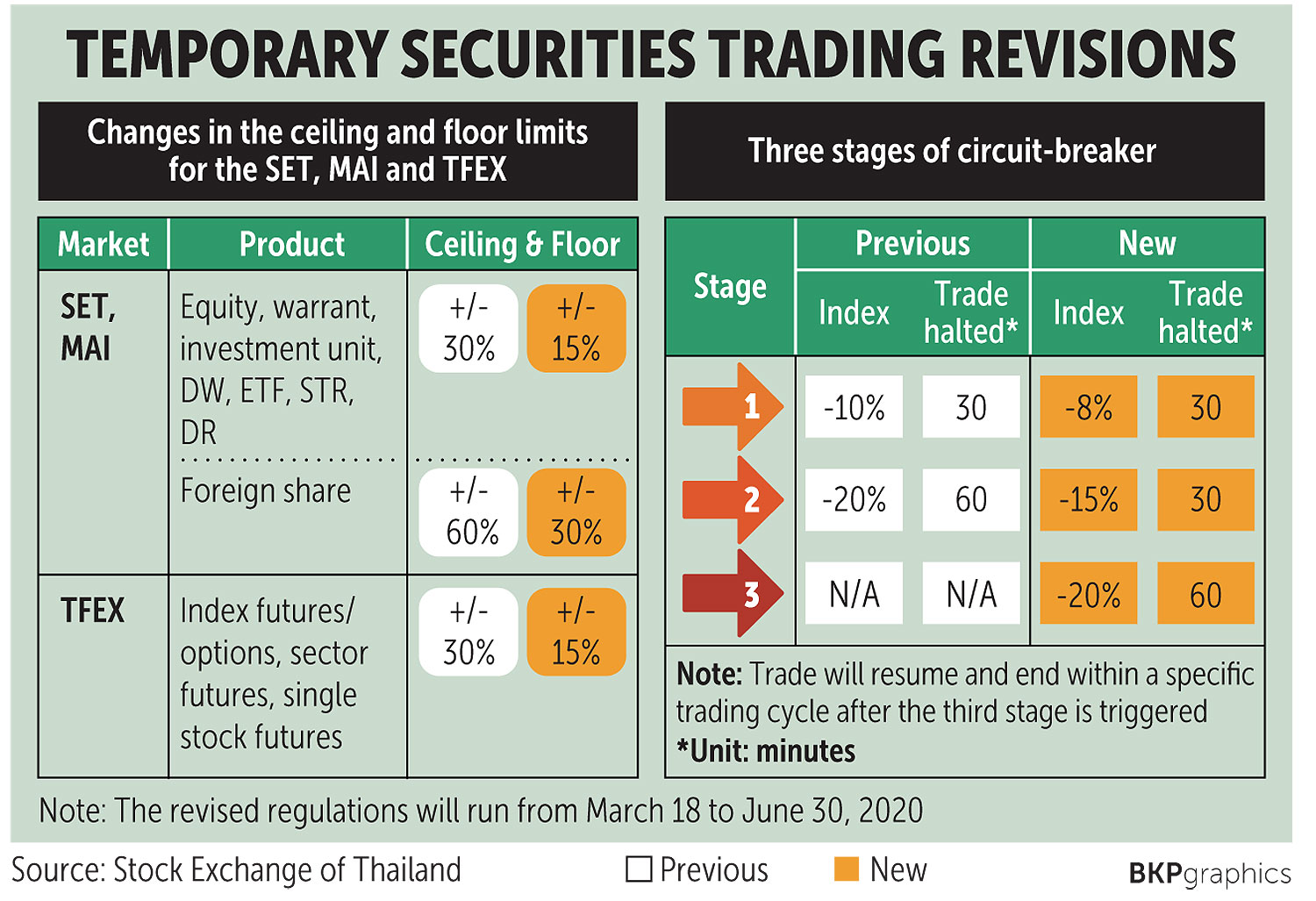

A circuit-breaker will be triggered in three stages. In the first stage, equity trading will be halted for 30 minutes if the SET index falls by 8%, down from the previous 10%. Trading will be halted for an additional 30 minutes if the SET index plunges by 15%, a change from a 60-minute intermission for a 20% decline.

If the SET index continues to plummet by 20%, trading will be halted for 60 minutes in the third stage.

Trade will resume and end within a specific trading cycle after the third stage is triggered.

"There has to be a trade-off between heavy [equity] sell-offs and gradual sell-offs," said SET president Pakorn Peetathawatchai. "What has been happening is not related to internal fundamentals, but rather a global issue that affects our stock market.

"The SET will not shut down the stock market," he said. "We will adhere to our objective to provide trading liquidity for investors."

The ceiling and floor limit for stocks, investment units, warrants, derivative warrants, exchange-traded funds, treasury stocks and depository receipts traded on the SET and the Market for Alternative Investment (MAI) have been revised to plus/minus 15%, curtailed from plus/minus 30% of the previous closing share price.

The ceiling and floor limits for foreign shares traded on the SET and MAI have been revised to plus/minus 30% from plus/minus 60%.

For index futures, options, sector futures and single stock futures traded on the Thailand Futures Exchange, the ceiling and floor limits for these securities have been revised to plus/minus 15% from plus/minus 30%.

Last Friday morning, trading on the SET was halted for a second straight day, as a circuit-breaker was triggered after a 10% plunge.

It was the fifth time in history that a circuit-breaker was activated to curb excessive volatility in Thailand's equity market, coming right after Thursday afternoon, when the pandemic panic and plunging crude prices triggered the fourth-ever halt.

Pattera Dilokrungthirapop, chief executive of DBS Vickers Securities Thailand, said the new measures fit the circumstances, while shutting down the stock market would be a poor option in light of the damage to the bourse's credibility that would result.

Bank of Thailand assistant governor Vachira Arromdee said the central bank last week pumped 35 billion baht into buying short- and long-dated government bonds to blunt volatility and support market participants' transactions.

The central bank also boosted US dollar liquidity in the currency market to keep pace with demand, Ms Vachira said.