Recap: Global shares plummeted as a bond selloff reflected growing fears that a strong global economic recovery will fan inflation and force interest rates higher. Asian shares led by Tokyo, Hong Kong, Mumbai, Taipei, Sydney and Shanghai all retreated.

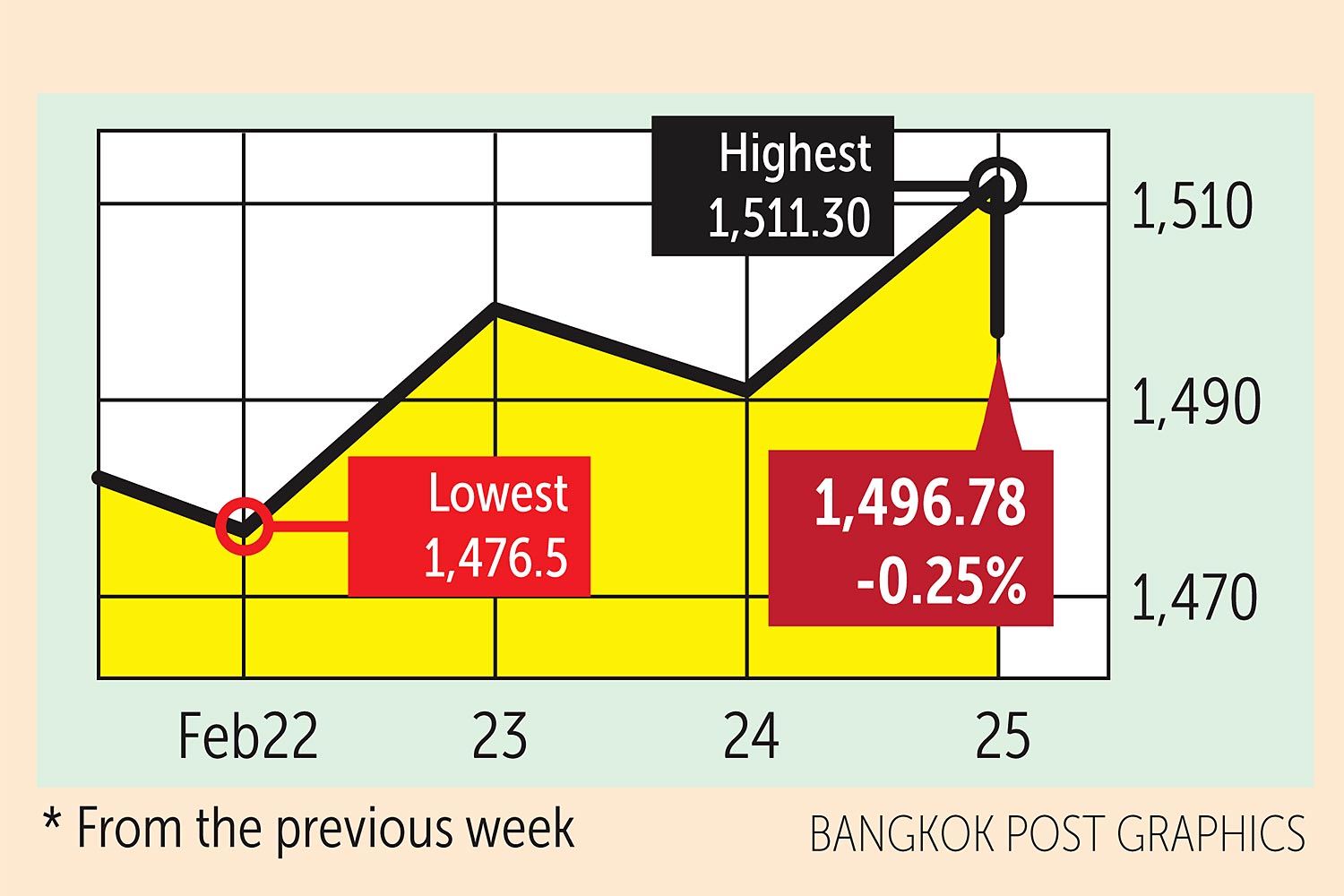

Thailand's market was spared from any immediate fallout as it was closed for a holiday. The SET index moved in a range of 1,476.5 and 1,511.30 points on the week and finished on Thursday at 1,496.78, a decrease of 0.2% from the previous week, in daily turnover averaging 95.83 billion baht.

Retail investors were the only net buyers this week, at 15.09 billion baht. Foreign investors were net sellers of 10.28 billion, institutional investors sold 2.97 billion and brokerage firms offloaded 1.85 billion baht worth of shares.

Newsmakers: Benchmark 10-year Treasury yields on Thursday topped 1.6% and traders are revising their predictions of how soon the Fed will have to tighten policy. A year of emergency stimulus is not only working, but has left some areas of the economy at risk of overheating, say analysts.

- The Bitcoin rally hit a speed bump as the volatile cryptocurrency slumped 20% this week, the most since last March, and was trading below $47,000 yesterday morning in Hong Kong.

- Facebook and Google will be forced to pay for Australian news under legislation passed on Thursday that is being closely watched globally for precedents in the battle between Big Tech and media companies.

- The European Union warned it is considering sanctions against Myanmar while Washington penalised two more generals for links to the military coup, as Western countries sought to pressure the junta to avoid a violent crackdown after weeks of protests.

- Hong Kong hiked stamp duty on stock trades on Wednesday for the first time in almost three decades as it tries to plug a pandemic-induced record budget deficit, sending the local equity market tumbling.

- Vietnam will begin its Covid vaccination programme next week with frontline healthcare staff and the elderly in line for the first doses as the country tackles a new wave of infections.

- The Philippines has approved the Sinovac Covid vaccine for emergency use, but will not give it to healthcare workers at risk of exposure due to its varying levels of efficacy, its Food and Drugs Agency (FDA) said on Monday.

- Three economic stimulus packages -- the co-payment subsidy scheme, We Win financial aid and the Section 33 We Love Each Other programme -- will help shore up the Thai economy and add a combined 1.76 percentage points to growth this year, forecasters say.

- Non-performing loans (NPLs) of small and medium enterprises (SMEs) peaked in last year's final quarter after businesses endured a big impact from the pandemic, especially those associated with the tourism industry, says the Bank of Thailand.

- The Revenue Department expects revenue from the upcoming e-service tax to exceed 5 billion baht per year as the pandemic has led to increased traffic on online platforms.

- Exports rose for a second straight month in January, albeit at a slow pace, edging up by 0.35% from the same month of last year after a 4.7% year-on-year surge in December 2020.

- Although hiring dipped 37% during 2020, 33% of companies in Thailand now say they will increase their workforce in 2021.

- The tourism industry should have a competitiveness enhancement fund to transform businesses in order to avoid a massive collapse in the post-pandemic era, according to the Tourism Authority of Thailand (TAT).

- Thailand may scrap the two-week mandatory quarantine for foreign visitors with proof of Covid-19 vaccination as it seeks to revive the tourism industry.

- Domestic car sales declined 21.3% year-on-year in January to 55,208 units as the second-wave outbreak continues to drag down consumer confidence and purchasing power.

- Bangchak Corporation (BCP), the energy firm majority-owned by the state, is adjusting some of its business strategies, with oil refineries, power generation and electric vehicle (EV) infrastructure development part of its focus. It plans 23 billion baht in capital spending this year to tap into rapid changes in the global energy market.

- PTT Exploration and Production Plc (PTTEP) has found another promising source of high-quality gas in Malaysia, following a discovery at its first exploration well, Dokong-1, in Block SK417 off the coast of Sarawak.

- The Mass Rapid Transit Authority of Thailand (MRTA) on Tuesday signed a contract to jointly invest in designing, constructing and funding an electric rail operating system to provide maintenance services to the Pink Line's 4-billion-baht Si Rat-Muang Thong Thani extension route.

- TOA Venture Holding (TOAVH) expects revenue will grow by 10% this year to 12.8 billion baht as the company continues to look for new business opportunities, including branching out into the Japanese-style Donki Mall in Thailand, under a 540-million-baht investment this year.

Coming up: China will release February NBS manufacturing PMI on Sunday. The US will release February manufacturing PMI and business confidence on Monday, China will release February Caixin manufacturing PMI, and the Italian government will present its fiscal budget.

- Japan and Germany will release January unemployment data on Tuesday, the Reserve Bank of Australia will announce its interest rate decision, and the euro zone will release February inflation data. The UK government will present its 2021 budget on Wednesday.

- Thailand will release February consumer confidence on Thursday, Australia will release January trade figures and Japan will release February consumer confidence. Thailand will release February inflation and foreign reserves data on Friday. Canada and the US will release January trade figures.

Stocks to watch: Country Group Securities recommends short-term investment in stocks of firms likely to be boosted by the economic recovery. Its top picks are BBL, KBANK, SCB, PTTGC, PTT, PTTEP, TOP, CBG, CPF, TFG, TU, BJC and CPALL. For the medium to longer term, the brokerage recommends stocks that have been consistently profitable this year including TQM, DOHOME, MEGA, TU, SCGP, RATCH, PTTGC and KBANK.

- Capital Nomura Securities recommends stocks expected to produce dividend yields of at least 3.7% between March and May. Its picks are MC, AP, KKP, SC, SPCG, THANI, HTC, PTT, SNC and TISCO.

Technical view: DBS Vickers Securities sees support at 1,460 points and resistance at 1,520. Capital Nomura sees support at 1,472 and resistance at 1,510.